Fastly Investor Presentation Deck

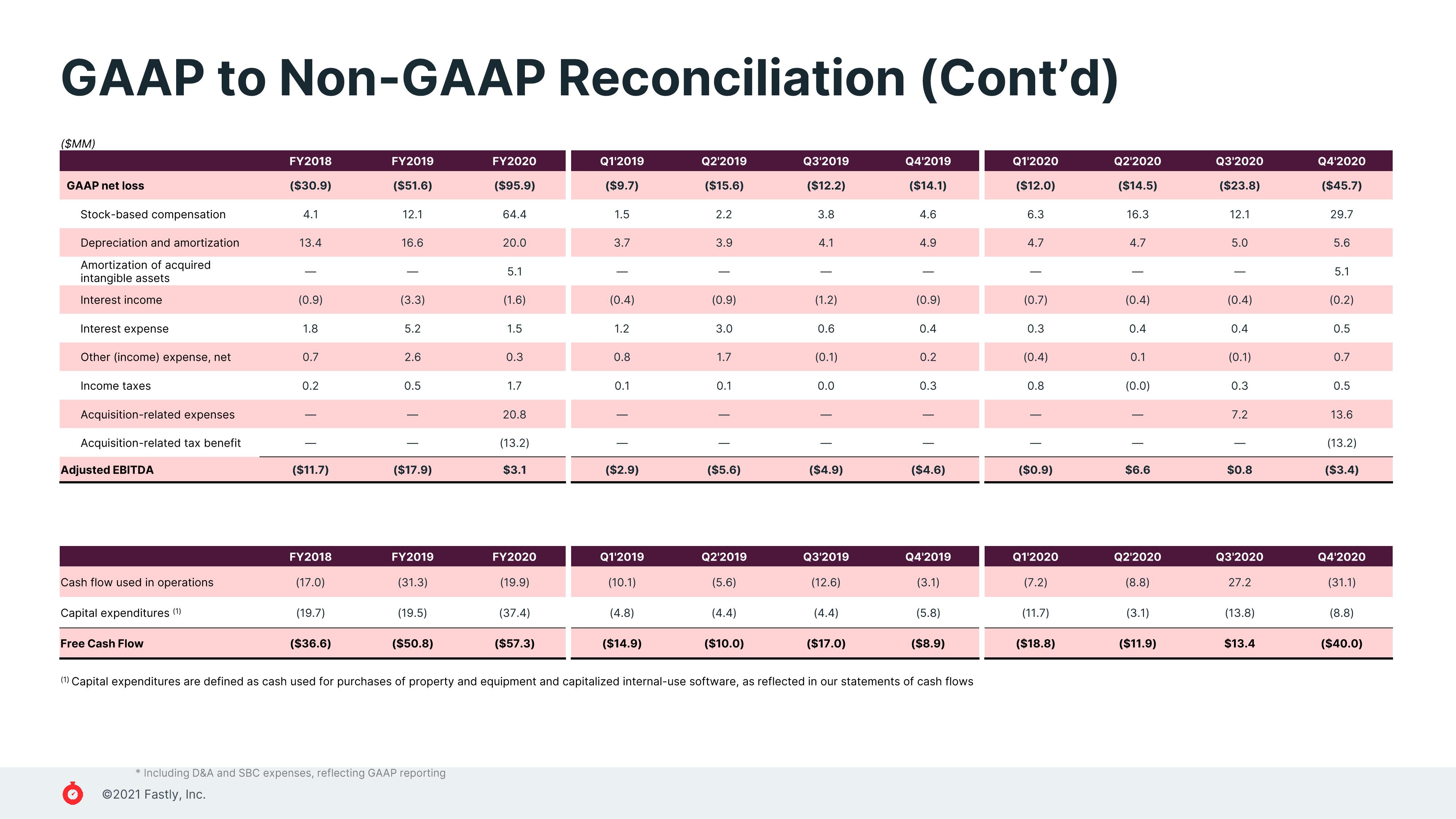

GAAP to Non-GAAP Reconciliation (Cont'd)

FY2019

($51.6)

Q2¹2019

($15.6)

($MM)

GAAP net loss

Stock-based compensation

Depreciation and amortization

Amortization of acquired

intangible assets

Interest income

Interest expense

Other (income) expense, net

Income taxes

Acquisition-related expenses

Acquisition-related tax benefit

Adjusted EBITDA

Cash flow used in operations

Capital expenditures (¹)

Free Cash Flow

FY2018

($30.9)

4.1

Ⓒ2021 Fastly, Inc.

13.4

(0.9)

1.8

0.7

0.2

($11.7)

FY2018

(17.0)

(19.7)

($36.6)

12.1

16.6

(3.3)

5.2

2.6

0.5

($17.9)

FY2019

(31.3)

(19.5)

($50.8)

* Including D&A and SBC expenses, reflecting GAAP reporting

FY2020

($95.9)

64.4

20.0

5.1

(1.6)

1.5

0.3

1.7

20.8

(13.2)

$3.1

FY2020

(19.9)

(37.4)

($57.3)

Q1'2019

($9.7)

1.5

3.7

(0.4)

1.2

0.8

0.1

($2.9)

Q1'2019

(10.1)

(4.8)

($14.9)

2.2

3.9

(0.9)

3.0

1.7

0.1

($5.6)

Q2'2019

(5.6)

(4.4)

($10.0)

Q3'2019

($12.2)

3.8

4.1

(1.2)

0.6

(0.1)

0.0

($4.9)

Q3'2019

(12.6)

(4.4)

($17.0)

Q4¹2019

($14.1)

4.6

4.9

(0.9)

0.4

0.2

0.3

($4.6)

(1) Capital expenditures are defined as cash used for purchases of property and equipment and capitalized internal-use software, as reflected in our statements of cash flows

Q4'2019

(3.1)

(5.8)

($8.9)

Q1¹2020

($12.0)

6.3

4.7

(0.7)

0.3

(0.4)

0.8

($0.9)

Q1'2020

(7.2)

(11.7)

($18.8)

Q2¹2020

($14.5)

16.3

4.7

(0.4)

0.4

0.1

(0.0)

$6.6

Q2¹2020

(8.8)

(3.1)

($11.9)

Q3'2020

($23.8)

12.1

5.0

(0.4)

0.4

(0.1)

0.3

7.2

$0.8

Q3'2020

27.2

(13.8)

$13.4

Q4'2020

($45.7)

29.7

5.6

5.1

(0.2)

0.5

0.7

0.5

13.6

(13.2)

($3.4)

Q4'2020

(31.1)

(8.8)

($40.0)View entire presentation