Allwyn Results Presentation Deck

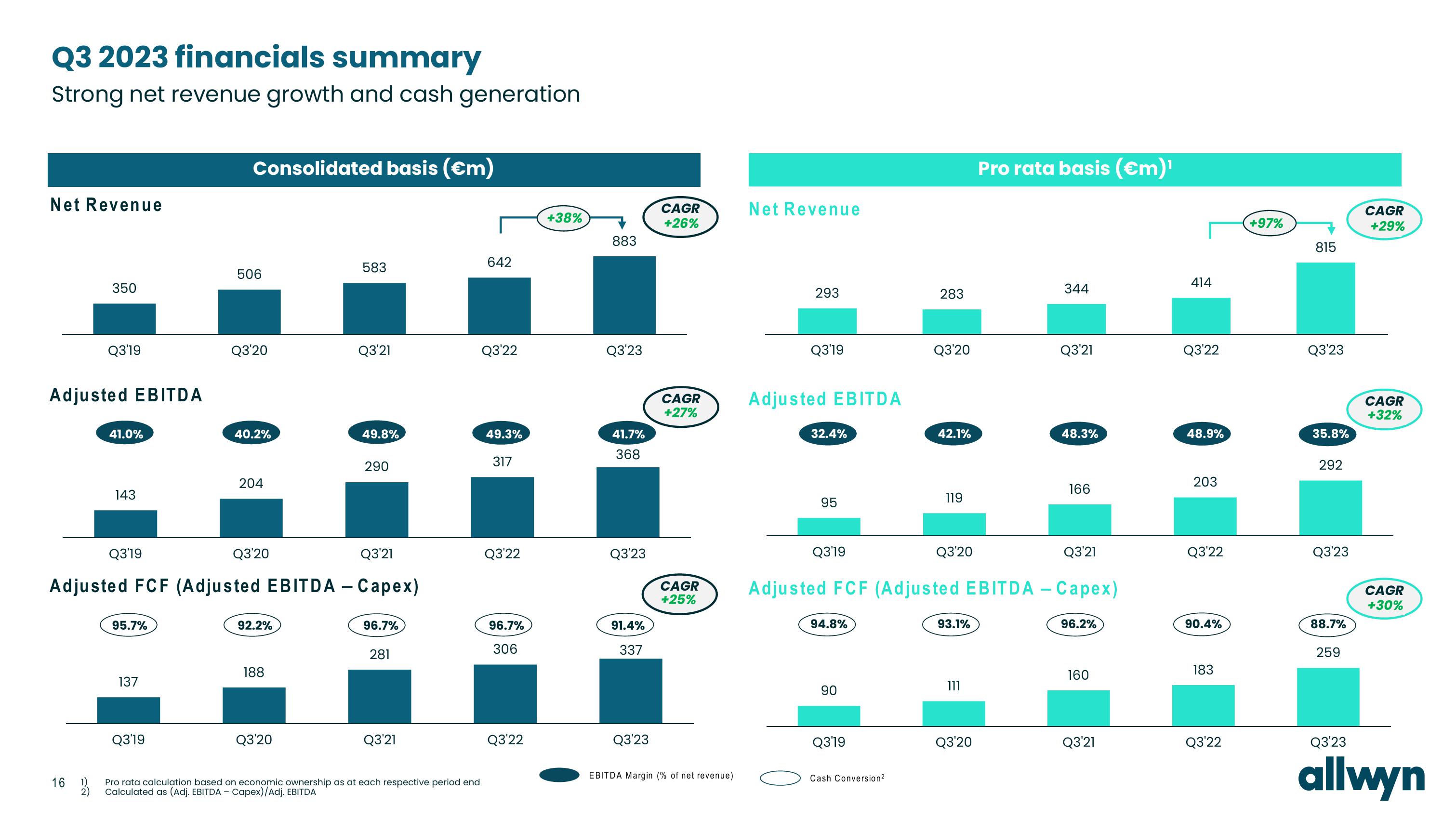

Q3 2023 financials summary

Strong net revenue growth and cash generation

Net Revenue

350

Adjusted EBITDA

16

Q3'19

1)

2)

41.0%

143

Q3'19

95.7%

137

Consolidated basis (€m)

Q3'19

506

Q3'20

40.2%

204

Q3'20

Q3'21

Adjusted FCF (Adjusted EBITDA - Capex)

92.2%

188

583

Q3'20

Q3'21

49.8%

290

96.7%

281

Q3'21

Pro rata calculation based on economic ownership as at each respective period end

Calculated as (Adj. EBITDA - Capex)/Adj. EBITDA

642

Q3'22

49.3%

317

Q3'22

96.7%

306

Q3'22

+38%

883

Q3'23

41.7%

368

Q3'23

91.4%

337

Q3'23

CAGR

+26%

CAGR

+27%

CAGR

+25%

EBITDA Margin (% of net revenue)

Net Revenue

293

Q3'19

Adjusted EBITDA

32.4%

95

Q3'19

94.8%

90

Q3'19

283

Cash Conversion²

Q3'20

42.1%

119

Q3'20

Q3'21

Adjusted FCF (Adjusted EBITDA - Capex)

93.1%

111

Pro rata basis (€m)¹

Q3'20

344

Q3'21

48.3%

166

96.2%

160

Q3'21

414

Q3'22

48.9%

203

Q3'22

90.4%

183

Q3'22

+97%

815

Q3'23

35.8%

292

Q3'23

88.7%

259

CAGR

+29%

CAGR

+32%

CAGR

+30%

Q3'23

allwynView entire presentation