Evercore Investment Banking Pitch Book

Why Evercore?

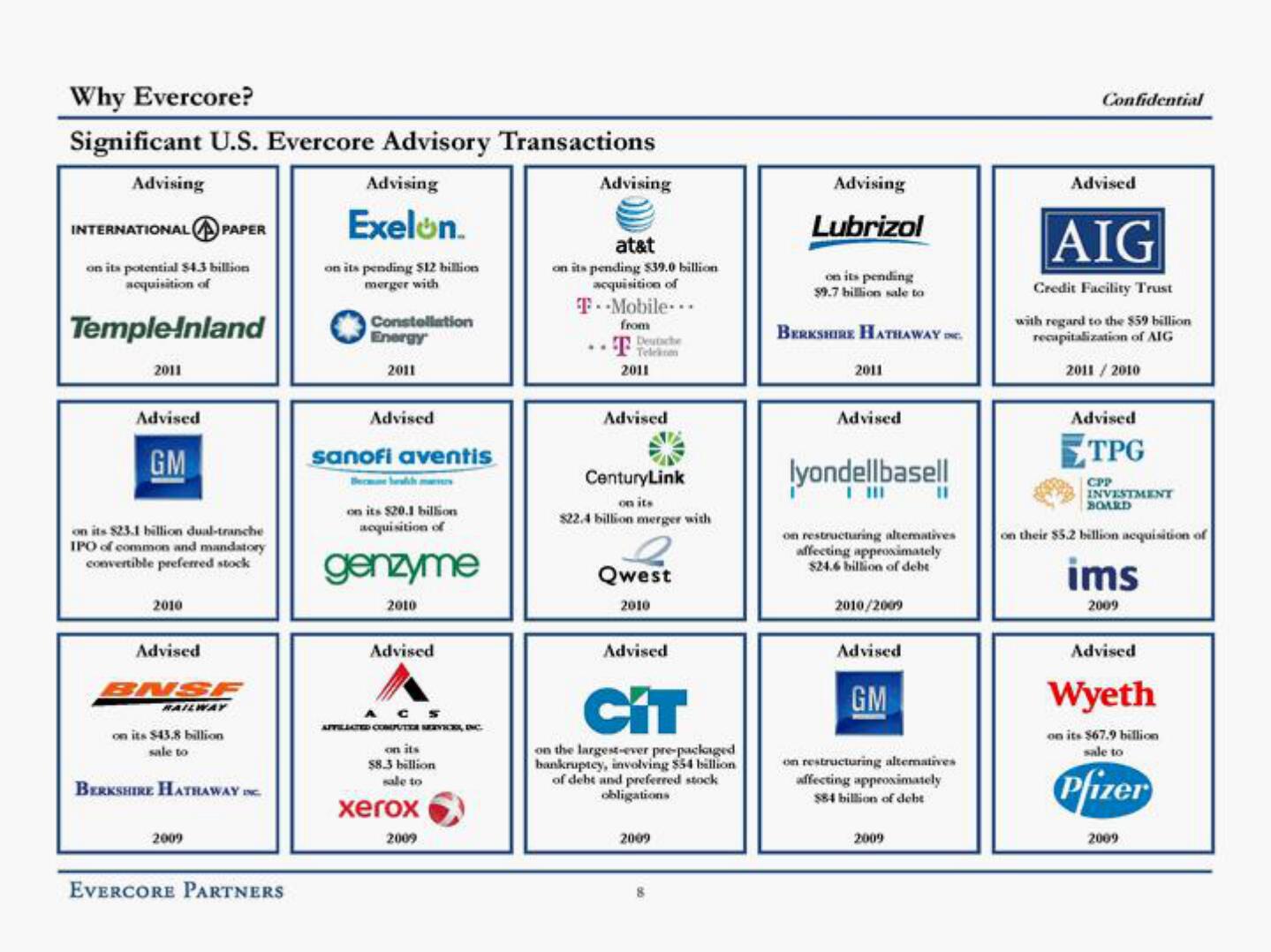

Significant U.S. Evercore Advisory Transactions

Advising

Advising

Exelon.

INTERNATIONAL PAPER

on its potential $4.3 billion

acquisition of

Temple-Inland

2011

Advised

GM

on its $23.1 billion dual-tranche

IPO of common and mandatory

convertible preferred stock

2010

Advised

BNSF

RAILWAY

on its $43.8 billion

sale to

BERKSHIRE HATHAWAY INC.

2009

EVERCORE PARTNERS

on its pending $12 billion

merger with

Constellation

Energy

2011

Advised

sanofi aventis

on its $20.1 billion

acquisition of

genzyme

2010

Advised

AFFILIATED COMPUTER SERVICES, INC.

on its

$8.3 billion

sale to

xerox

2009

Advising

at&t

on its pending $39.0 billion

acquisition of

T-Mobile...

from

The

Telekom

2011

Advised

CenturyLink

on its

$22.4 billion merger with

Qwest

2010

Advised

CIT

on the largest-ever pre-packaged

bankruptcy, involving $54 billion

of debt and preferred stock

obligations

2009

Advising

Lubrizol

on its pending

$9.7 billion sale to

BERKSHIRE HATHAWAY ™C.

2011

Advised

lyondellbasell

III

on restructuring alteratives

affecting approximately

$24.6 billion of debt

2010/2009

Advised

GM

11

on restructuring alternatives

affecting approximately

$84 billion of debt

2009

Confidential

Advised

AIG

Credit Facility Trust

with regard to the $59 billion

recapitalization of AIG

2011/2010

Advised

ETPG

CPP

INVESTMENT

BOARD

on their $5.2 billion acquisition of

ims

2009

Advised

Wyeth

on its $67.9 billion

sale to

Pfizer

2009View entire presentation