Waldencast SPAC

OBAGI stand-alone

Milk stand-alone

Li Adjustments for 2021

actuals

Growth

%

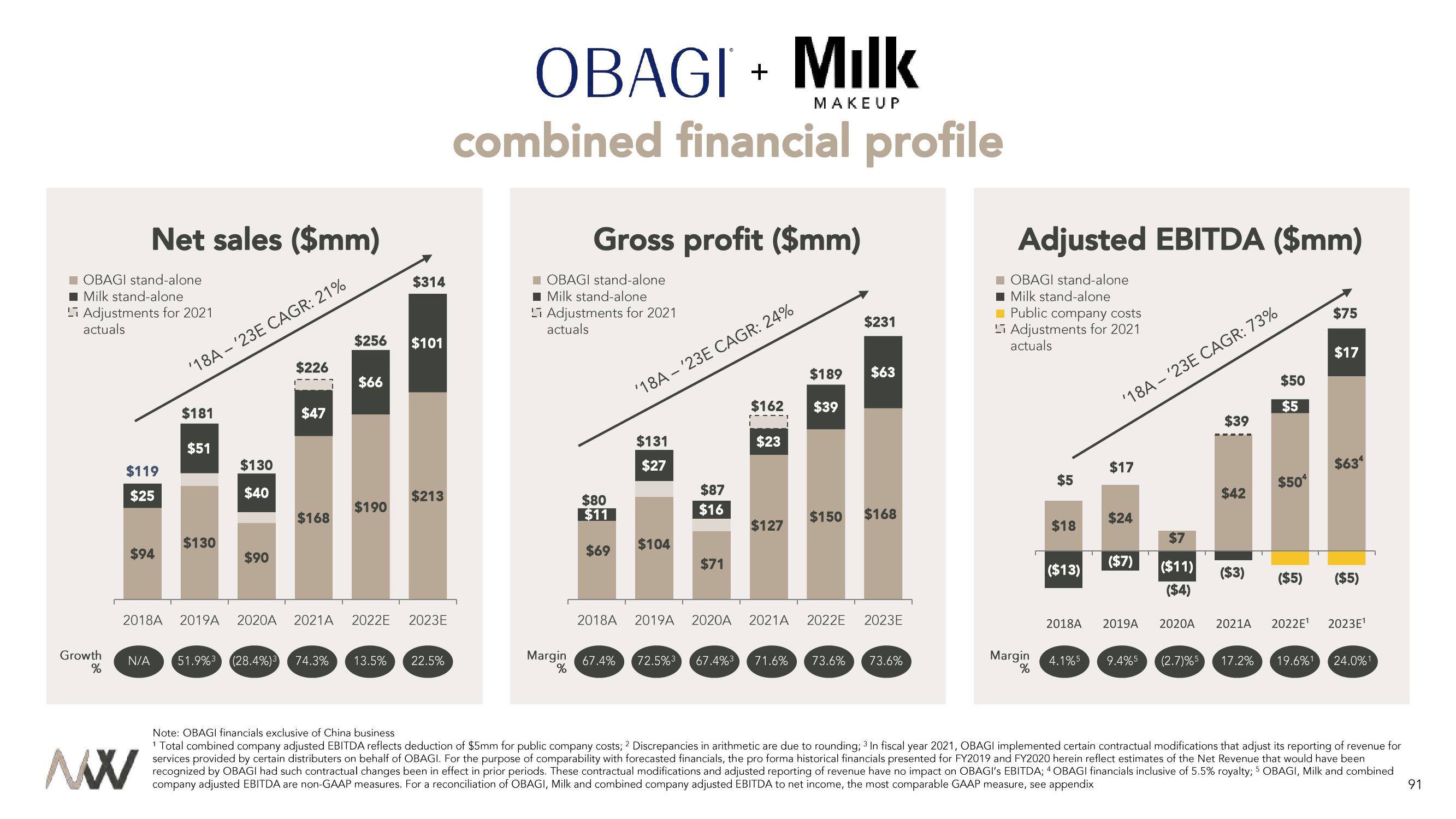

Net sales ($mm)

$119

$25

$94

N/A

'18A - '23E CAGR: 21%

$181

$51

$130

$130

$40

51.9%³

$90

$226

(28.4%)3

$47

$168

$256 $101

$66

$314

$190

2018A 2019A 2020A 2021A 2022E 2023E

$213

74.3% 13.5% 22.5%

OBAGI + Milk

MAKEUP

combined financial profile

Gross profit ($mm)

■OBAGI stand-alone

■ Milk stand-alone

Li Adjustments for 2021

actuals

$80

$11

$69

'18A-'23E CAGR: 24%

$131

$27

$104

$87

$16

$71

$162 $39

$23

$127

$189 $63

$231

$150 $168

2018A 2019A 2020A 2021A 2022E

2023E

Margin 67.4% 72.5%³ 67.4%³ 71.6% 73.6% 73.6%

%

Adjusted EBITDA ($mm)

OBAGI stand-alone

Milk stand-alone

Public company costs

Adjustments for 2021

actuals

Margin

%

$5

$18

($13)

'18A-'23E CAGR: 73%

$17

$24

($7)

$39

$50

$5

$42

$504

$7

($11) ($3) ($5)

($4)

$75

$17

$634

($5)

2018A 2019A 2020A 2021A 2022E¹ 2023E¹

4.1%5 9.4%5 (2.7)%5 17.2% 19.6%1 24.0%1

Note: OBAGI financials exclusive of China business

NX

1 Total combined company adjusted EBITDA reflects deduction of $5mm for public company costs; 2 Discrepancies in arithmetic are due to rounding; 3 In fiscal year 2021, OBAGI implemented certain contractual modifications that adjust its reporting of revenue for

services provided by certain distributers on behalf of OBAGI. For the purpose of comparability with forecasted financials, the pro forma historical financials presented for FY2019 and FY2020 herein reflect estimates of the Net Revenue that would have been

recognized by OBAGI had such contractual changes been in effect in prior periods. These contractual modifications and adjusted reporting of revenue have no impact on OBAGI's EBITDA; 4 OBAGI financials inclusive of 5.5% royalty; 5 OBAGI, Milk and combined

company adjusted EBITDA are non-GAAP measures. For a reconciliation of OBAGI, Milk and combined company adjusted EBITDA to net income, the most comparable GAAP measure, see appendix

91View entire presentation