OpenText Investor Day Presentation Deck

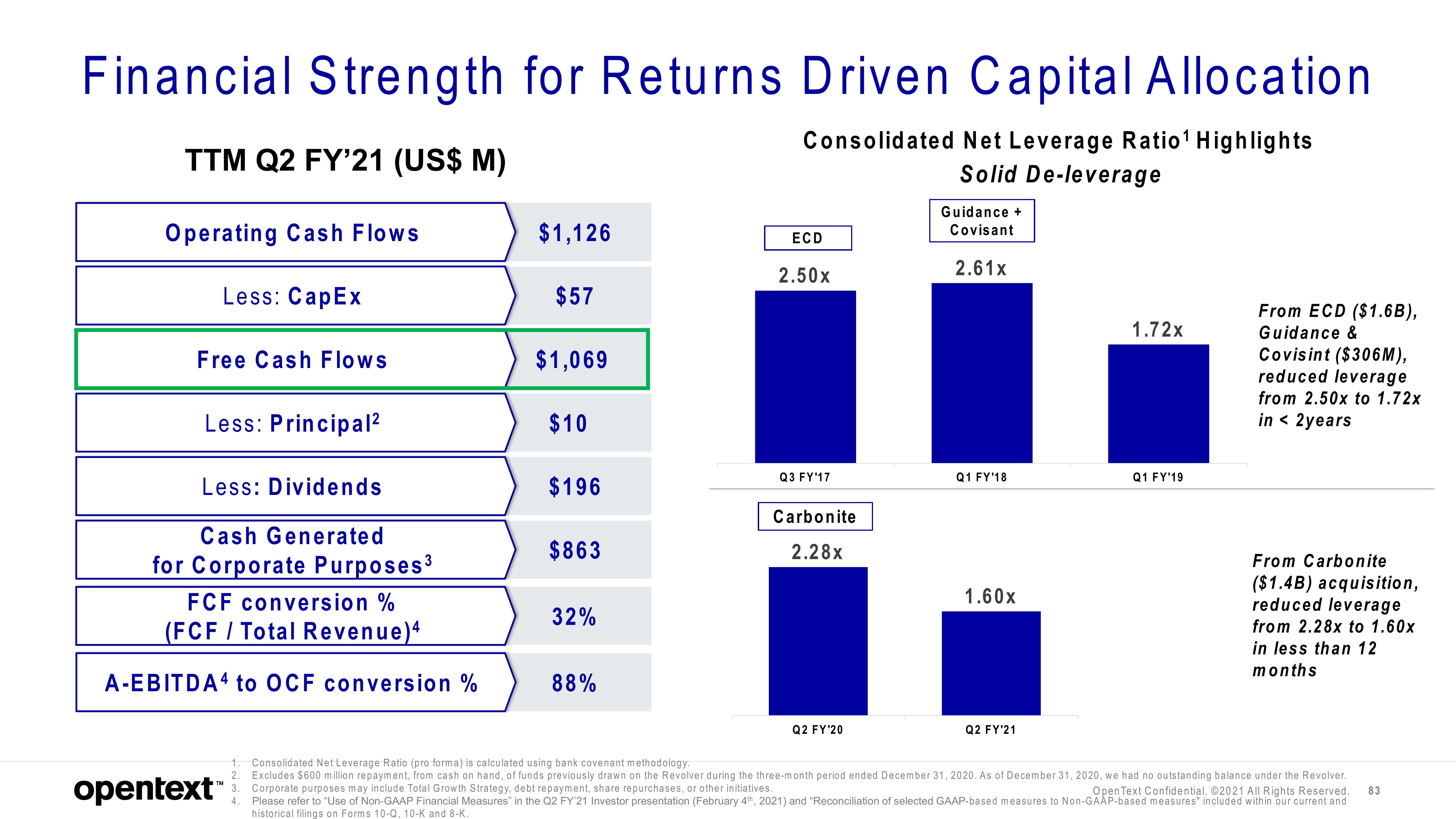

Financial Strength for Returns Driven Capital Allocation

Consolidated Net Leverage Ratio ¹ Highlights

TTM Q2 FY'21 (US$ M)

Solid De-leverage

Operating Cash Flows

Less: CapEx

Free Cash Flows

Less: Principal²

Less: Dividends

Cash Generated

for Corporate Purposes ³

FCF conversion %

(FCF / Total Revenue)4

A-EBITDA4 to OCF conversion%

opentext™

$1,126

$57

$1,069

$10

$196

$863

32%

88%

ECD

2.50x

Q3 FY'17

Carbonite

2.28x

Q2 FY'20

Guidance +

Covisant

2.61x

Q1 FY'18

1.60x

Q2 FY'21

1.72x

Q1 FY'19

From ECD ($1.6B),

Guidance &

Covisint ($306 M),

reduced leverage

from 2.50x to 1.72x

in < 2years

From Carbonite

($1.4B) acquisition,

reduced leverage

from 2.28x to 1.60x

in less than 12

months

1. Consolidated Net Leverage Ratio (pro forma) is calculated using bank covenant methodology.

2. Excludes $600 million repayment, from cash on hand, of funds previously drawn on the Revolver during the three-month period ended December 31, 2020. As of December 31, 2020, we had no outstanding balance under the Revolver.

3. Corporate purposes may include Total Growth Strategy, debt repayment, share repurchases, or other initiatives.

Open Text Confidential. ©2021 All Rights Reserved.

4. Please refer to "Use of Non-GAAP Financial Measures" in the Q2 FY'21 Investor presentation (February 4th, 2021) and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and

historical filings on Forms 10-Q, 10-K and 8-K.

83View entire presentation