First Foundation Investor Presentation Deck

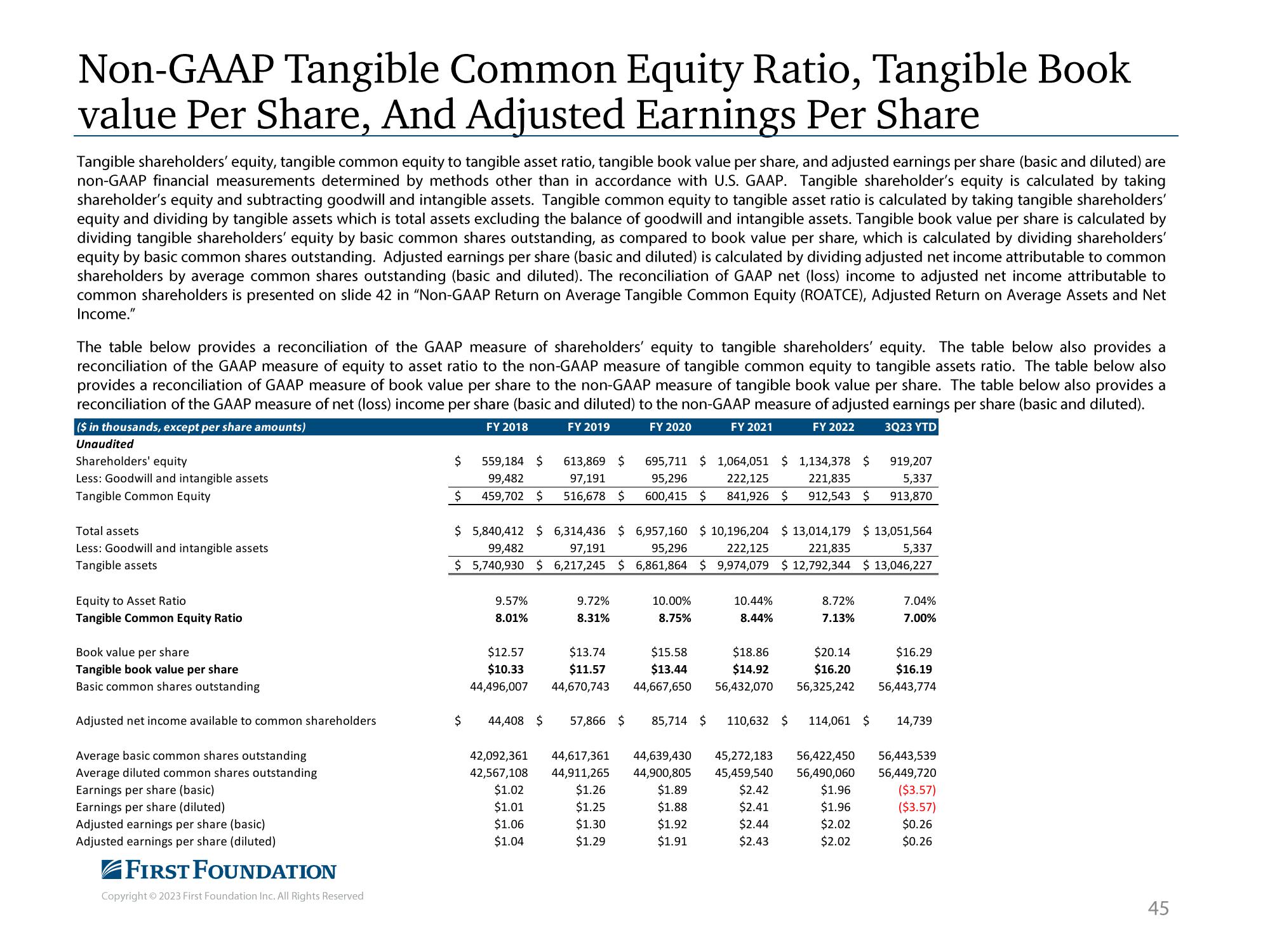

Non-GAAP Tangible Common Equity Ratio, Tangible Book

value Per Share, And Adjusted Earnings Per Share

Tangible shareholders' equity, tangible common equity to tangible asset ratio, tangible book value per share, and adjusted earnings per share (basic and diluted) are

non-GAAP financial measurements determined by methods other than in accordance with U.S. GAAP. Tangible shareholder's equity is calculated by taking

shareholder's equity and subtracting goodwill and intangible assets. Tangible common equity to tangible asset ratio is calculated by taking tangible shareholders'

equity and dividing by tangible assets which is total assets excluding the balance of goodwill and intangible assets. Tangible book value per share is calculated by

dividing tangible shareholders' equity by basic common shares outstanding, as compared to book value per share, which is calculated by dividing shareholders'

equity by basic common shares outstanding. Adjusted earnings per share (basic and diluted) is calculated by dividing adjusted net income attributable to common

shareholders by average common shares outstanding (basic and diluted). The reconciliation of GAAP net (loss) income to adjusted net income attributable to

common shareholders is presented on slide 42 in "Non-GAAP Return on Average Tangible Common Equity (ROATCE), Adjusted Return on Average Assets and Net

Income."

The table below provides a reconciliation of the GAAP measure of shareholders' equity to tangible shareholders' equity. The table below also provides a

reconciliation of the GAAP measure of equity to asset ratio to the non-GAAP measure of tangible common equity to tangible assets ratio. The table below also

provides a reconciliation of GAAP measure of book value per share to the non-GAAP measure of tangible book value per share. The table below also provides a

reconciliation of the GAAP measure of net (loss) income per share (basic and diluted) to the non-GAAP measure of adjusted earnings per share (basic and diluted).

($ in thousands, except per share amounts)

FY 2018

FY 2019

FY 2020

FY 2022

3Q23 YTD

Unaudited

Shareholders' equity

Less: Goodwill and intangible assets

Tangible Common Equity

Total assets

Less: Goodwill and intangible assets

Tangible assets

Equity to Asset Ratio

Tangible Common Equity Ratio

Book value per share

Tangible book value per share

Basic common shares outstanding

Adjusted net income available to common shareholders

Average basic common shares outstanding

Average diluted common shares outstanding

Earnings per share (basic)

Earnings per share (diluted)

Adjusted earnings per share (basic)

Adjusted earnings per share (diluted)

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

$

$

559,184 $

99,482

459,702 $

9.57%

8.01%

$12.57

$10.33

613,869 $

97,191

516,678 $

$ 5,840,412 $ 6,314,436 $

99,482

97,191

6,957,160 $ 10,196,204 $13,014,179 $13,051,564

95,296

222,125

221,835

5,337

$ 5,740,930 $ 6,217,245 $ 6,861,864 $ 9,974,079 $ 12,792,344 $ 13,046,227

9.72%

8.31%

$13.74

$11.57

44,496,007 44,670,743

42,092,361

42,567,108

$1.02

$1.01

$1.06

$1.04

695,711 $ 1,064,051 $ 1,134,378 $

95,296

222,125 221,835

600,415 $ 841,926 $ 912,543 $

10.00%

8.75%

$15.58

$13.44

44,667,650

FY 2021

$ 44,408 $ 57,866 $ 85,714 $

$1.89

$1.88

$1.92

$1.91

10.44%

8.44%

$18.86

$20.14

$14.92

$16.20

56,432,070 56,325,242

110,632 $ 114,061 $ 14,739

44,617,361 44,639,430 45,272,183 56,422,450 56,443,539

44,911,265 44,900,805 45,459,540 56,490,060 56,449,720

$1.26

$2.42

$1.96

$1.25

$2.41

$1.96

$1.30

$2.44

$2.02

$1.29

$2.43

$2.02

919,207

5,337

913,870

8.72%

7.13%

7.04%

7.00%

$16.29

$16.19

56,443,774

($3.57)

($3.57)

$0.26

$0.26

45View entire presentation