Tudor, Pickering, Holt & Co Investment Banking

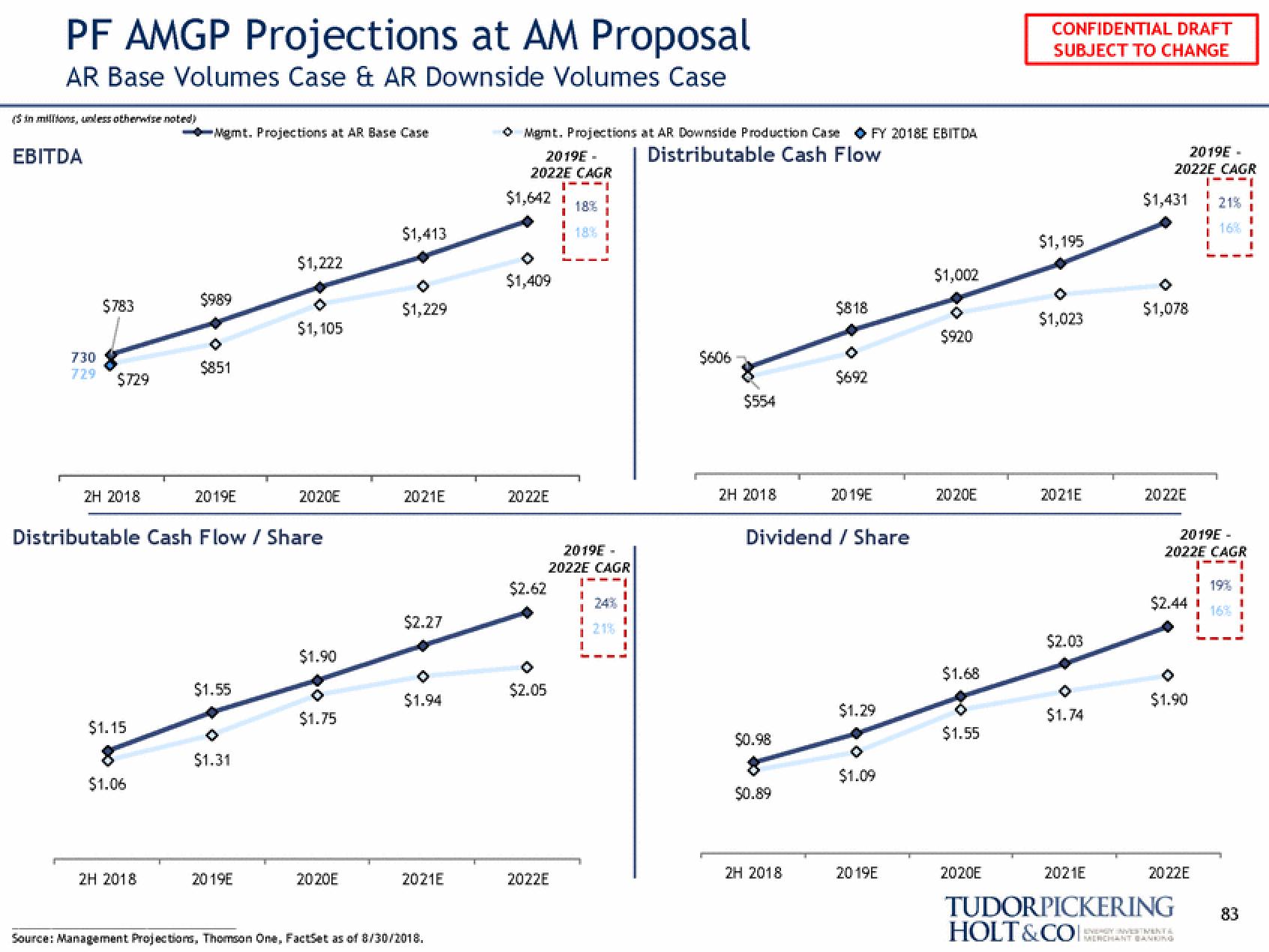

PF AMGP Projections at AM Proposal

AR Base Volumes Case & AR Downside Volumes Case

(in millions, unless otherwise noted)

EBITDA

$783

730

729 $729

2H 2018

$1.15

$1.06

Mgmt. Projections at AR Base Case

2H 2018

$989

$851

2019E

Distributable Cash Flow / Share

$1.55

0

$1.31

$1,222

2019E

$1,105

2020E

$1.90

$1.75

2020E

$1,413

$1,229

2021E

$2.27

O

$1.94

2021E

Source: Management Projections, Thomson One, FactSet as of 8/30/2018.

ⒸMgmt. Projections at AR Downside Production Case FY 2018E EBITDA

Distributable Cash Flow

2019E-

2022E CAGR

1---1

18%

18%

$1,642 i

$1,409

2022E

$2.62

$2.05

I

2019E-

2022E CAGR

2022E

24%

21%

I

$606

$554

2H 2018

$0.98

$0.89

$818

Dividend / Share

2H 2018

$692

2019E

$1.29

$1.09

2019E

$1,002

$920

2020E

$1.68

$1.55

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2020E

$1,195

$1,023

2021E

$2.03

0

$1.74

2019E-

2022E CAGR

1-

$1,431

$1,078

2022E

2019E-

2022E CAGR

1---1

19%

16%

$2.44

$1.90

1

2022E

21%

16%

I

1

I

2021E

TUDORPICKERING 83

HOLT&COCHANT BANKING

1View entire presentation