Main Street Capital Investor Day Presentation Deck

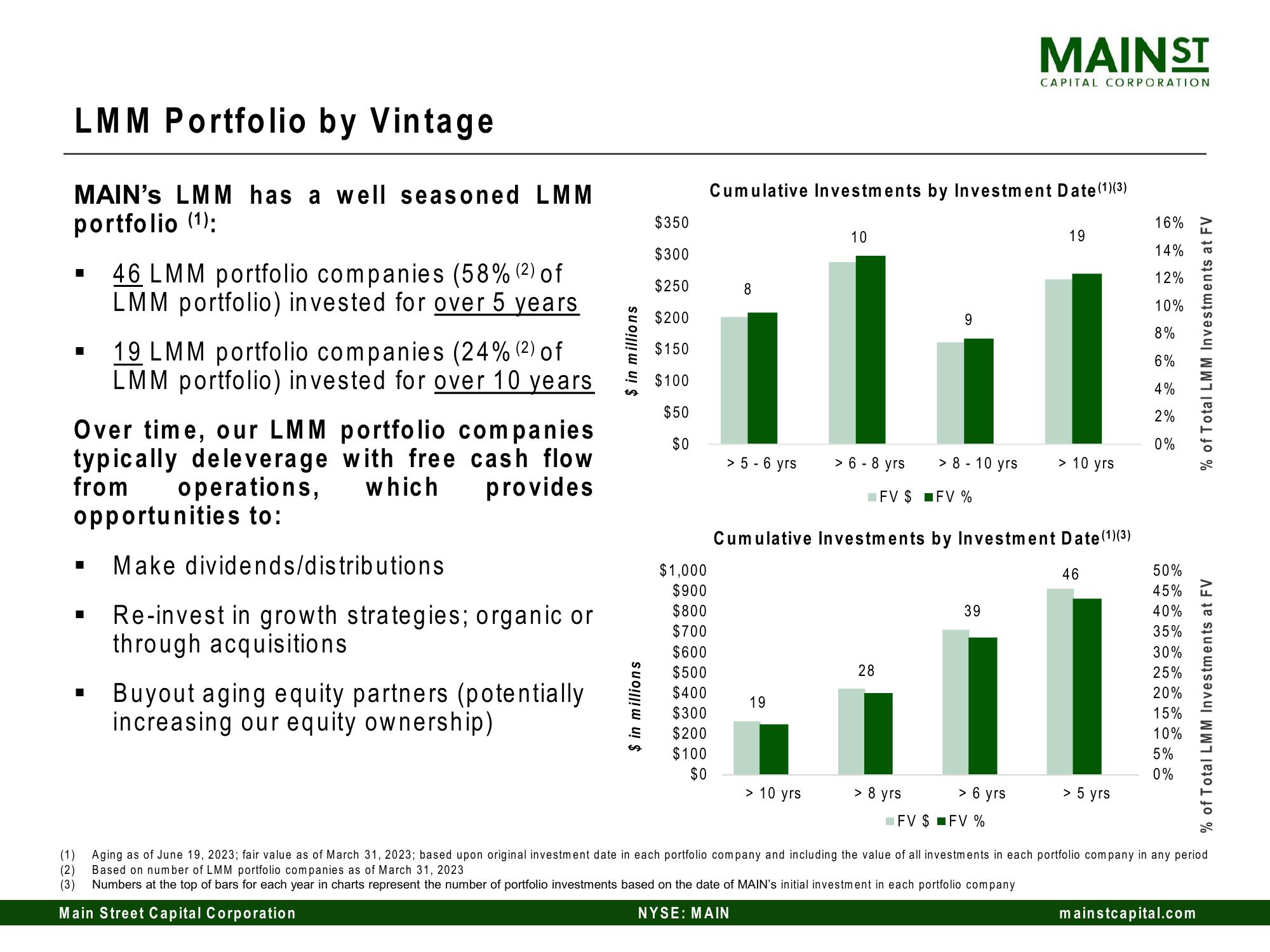

LMM Portfolio by Vintage

MAIN'S LMM has a well seasoned LMM

portfolio (1):

I

■

■

Over time, our LMM portfolio companies

typically deleverage with free cash flow

from operations, which provides

opportunities to:

Make dividends/distributions

■

46 LMM portfolio companies (58% (²) of

LMM portfolio) invested for over 5 years

■

19 LMM portfolio companies (24% (2) of

LMM portfolio) invested for over 10 years

Re-invest in growth strategies; organic or

through acquisitions

Buyout aging equity partners (potentially

increasing our equity ownership)

$ in millions

$ in millions

$350

$300

$250

$200

$150

$100

$50

$0

$1,000

$900

$800

$700

$600

$500

$400

$300

$200

$100

$0

8

Cumulative Investments by Investment Date (1)(3)

> 5-6 yrs

19

10

9

I I

> 6-8 yrs

FV $

> 10 yrs

28

> 8 yrs

> 8-10 yrs

FV%

Cumulative Investments by Investment Date (1)(3)

46

FV $

39

MAIN ST

> 6 yrs

CAPITAL CORPORATION

FV %

19

> 10 yrs

> 5 yrs

16%

14%

12%

10%

8%

6%

4%

2%

0%

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

% of Total LMM Investments at FV

mainstcapital.com

% of Total LMM Investments at FV

(1) Aging as of June 19, 2023; fair value as of March 31, 2023; based upon original investment date in each portfolio company and including the value of all investments in each portfolio company in any period

(2) Based on number of LMM portfolio companies as of March 31, 2023

(3) Numbers at the top of bars for each year in charts represent the number of portfolio investments based on the date of MAIN's initial investment in each portfolio company

Main Street Capital Corporation

NYSE: MAINView entire presentation