First Merchants Results Presentation Deck

Business Highlights

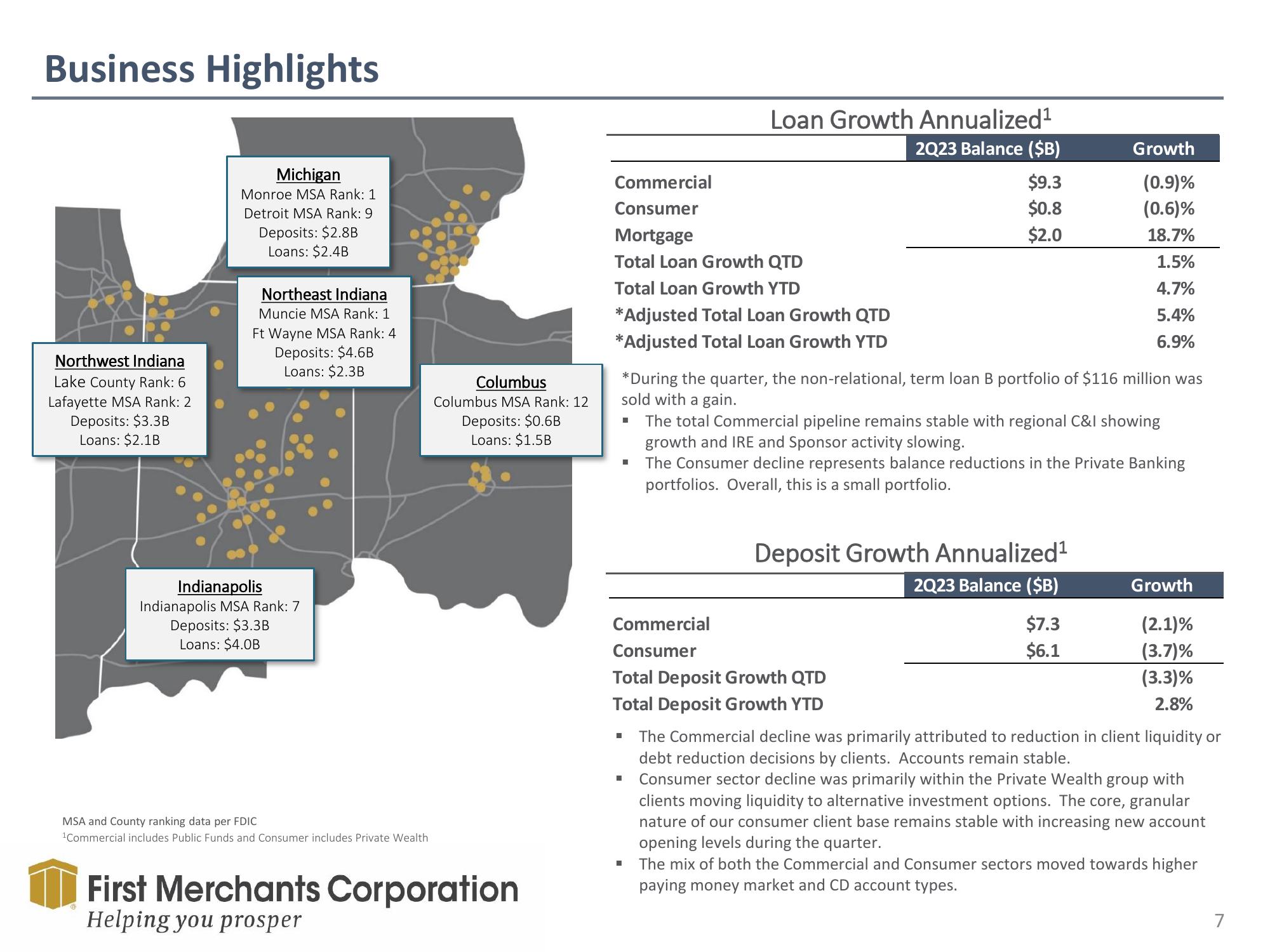

Northwest Indiana

Lake County Rank: 6

Lafayette MSA Rank: 2

Deposits: $3.3B

Loans: $2.1B

Michigan

Monroe MSA Rank: 1

Detroit MSA Rank: 9

Deposits: $2.8B

Loans: $2.4B

Northeast Indiana

Muncie MSA Rank: 1

Ft Wayne MSA Rank: 4

Deposits: $4.6B

Loans: $2.3B

Indianapolis

Indianapolis MSA Rank: 7

Deposits: $3.3B

Loans: $4.0B

MSA and County ranking data per FDIC

¹Commercial includes Public Funds and Consumer includes Private Wealth

Columbus

Columbus MSA Rank: 12

Deposits: $0.6B

Loans: $1.5B

First Merchants Corporation

Helping you prosper

Commercial

Consumer

Mortgage

Total Loan Growth QTD

Total Loan Growth YTD

*Adjusted Total Loan Growth QTD

*Adjusted Total Loan Growth YTD

■

I

Loan Growth Annualized¹

2Q23 Balance ($B)

*During the quarter, the non-relational, term loan B portfolio of $116 million was

sold with a gain.

The total Commercial pipeline remains stable with regional C&I showing

growth and IRE and Sponsor activity slowing.

The Consumer decline represents balance reductions in the Private Banking

portfolios. Overall, this is a small portfolio.

Commercial

Consumer

Total Deposit Growth QTD

Total Deposit Growth YTD

■

$9.3

$0.8

$2.0

■

Deposit Growth Annualized¹

2Q23 Balance ($B)

Growth

(0.9)%

(0.6)%

18.7%

1.5%

4.7%

5.4%

6.9%

$7.3

$6.1

The Commercial decline was primarily attributed to reduction in client liquidity or

debt reduction decisions by clients. Accounts remain stable.

Consumer sector decline was primarily within the Private Wealth group with

clients moving liquidity to alternative investment options. The core, granular

nature of our consumer client base remains stable with increasing new account

opening levels during the quarter.

■ The mix of both the Commercial and Consumer sectors moved towards higher

paying money market and CD account types.

Growth

(2.1)%

(3.7)%

(3.3)%

2.8%

7View entire presentation