Kinnevik Results Presentation Deck

OUR CAPITAL ALLOCATION EXPECTATIONS REMAIN UNCHANGED,

WITH KEY ALLOCATION RISKS RELATING TO MISSED UPSIDE OPPORTUNITIES

■

Capital Reallocation

2023 Expectations

Our 2023 expectations remain unchanged - around SEK 5bn in total

investments split 50/50 between new investments and follow-on

investments in the existing portfolio

Our assessments of investee runways also remain largely unchanged,

with the key development being extensions of runways through

funding rounds in the quarter

■

Around 6% of our private investees by value have runway not lasting longer

than to end of 2023 (from 10% in Q4 2022)

Of our currently forecasted follow-on investments, around 70% of

capital is expected to be deployed into high-conviction businesses

where we are either instigating transactions or willingly accreting

ownership (as in Spring Health)

Two main factors could affect our expectations -

1. an inability to deploy as much capital as we would like into our existing

high-conviction businesses (pushing the SEK 5bn and the % share of follow-

on investments downward)

2. not finding enough attractive opportunities to invest in new businesses due

to companies not coming to market (pushing the SEK 5bn and the % share

of new investments downward)

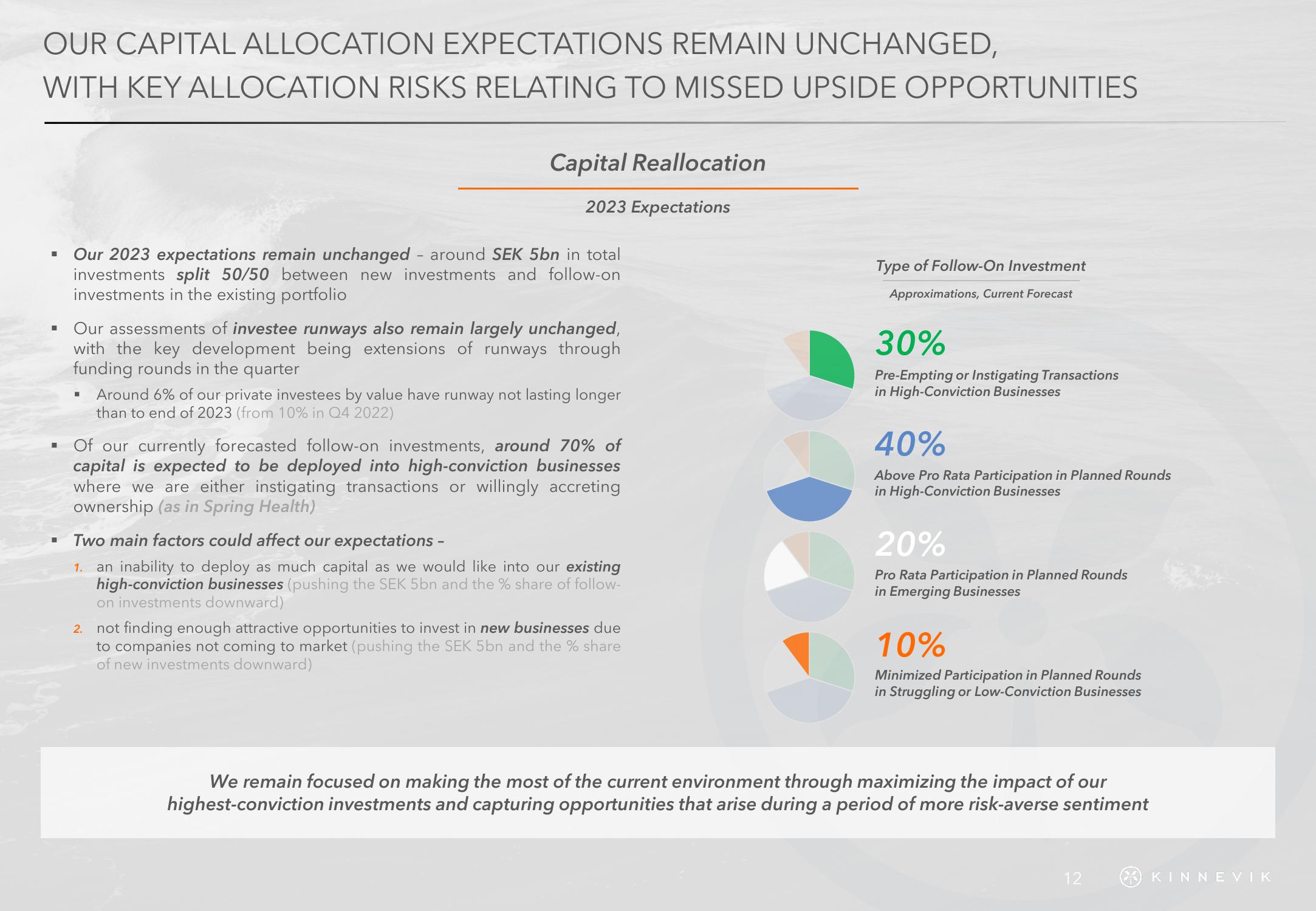

Type of Follow-On Investment

Approximations, Current Forecast

30%

Pre-Empting or Instigating Transactions

in High-Conviction Businesses

40%

Above Pro Rata Participation in Planned Rounds

in High-Conviction Businesses

20%

Pro Rata Participation in Planned Rounds

in Emerging Businesses

10%

Minimized Participation in Planned Rounds

in Struggling or Low-Conviction Businesses

We remain focused on making the most of the current environment through maximizing the impact of our

highest-conviction investments and capturing opportunities that arise during a period of more risk-averse sentiment

12

KINNEVIKView entire presentation