Coppersmith Presentation to Alere Inc Stockholders

PAGE 15 |

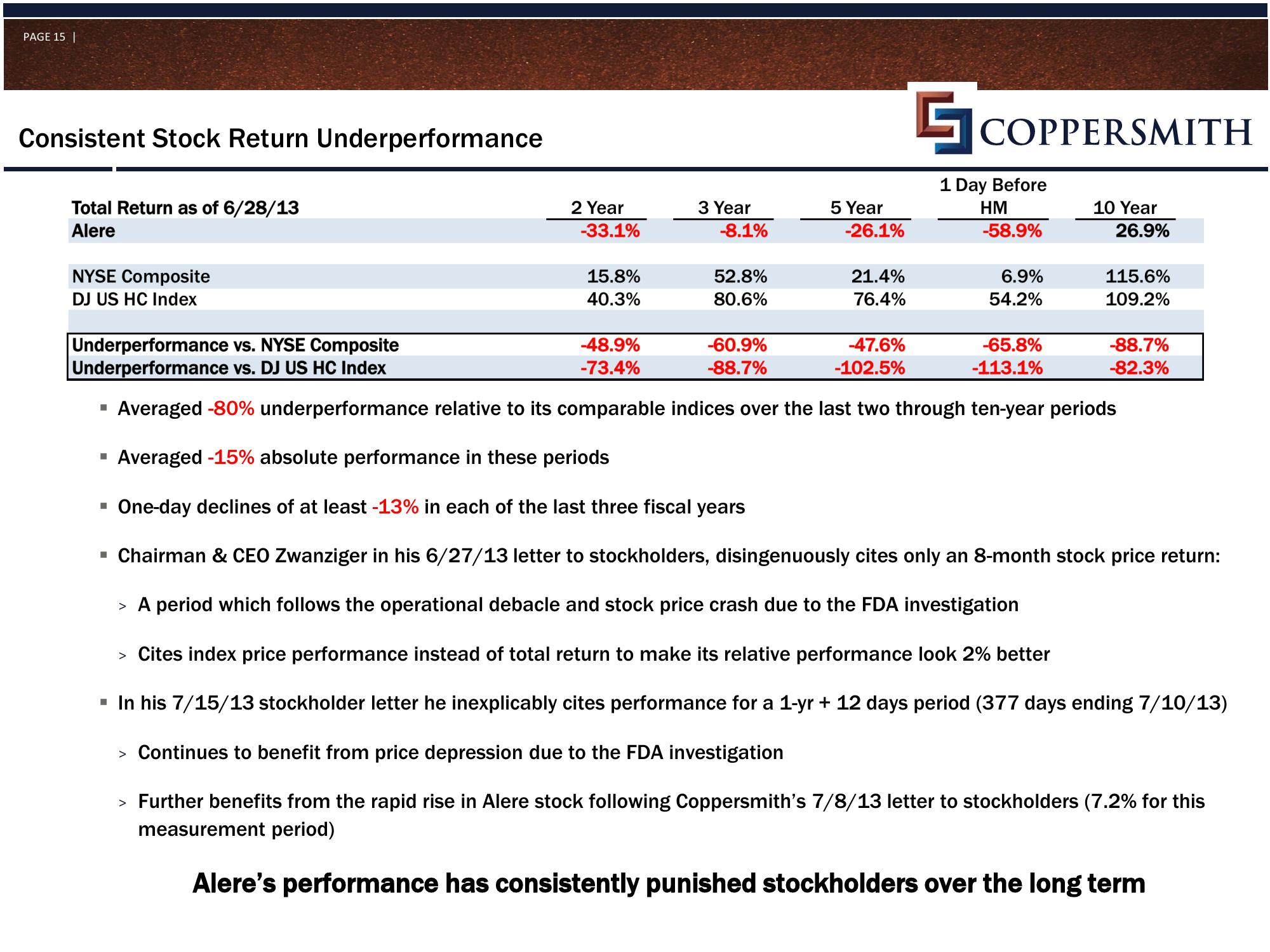

Consistent Stock Return Underperformance

Total Return as of 6/28/13

Alere

NYSE Composite

DJ US HC Index

■

■

2 Year

-33.1%

■

15.8%

40.3%

3 Year

-8.1%

-48.9%

-73.4%

52.8%

80.6%

-60.9%

-88.7%

5 Year

-26.1%

21.4%

76.4%

COPPERSMITH

Underperformance vs. NYSE Composite

Underperformance vs. DJ US HC Index

Averaged -80% underperformance relative to its comparable indices over the last two through ten-year periods

Averaged -15% absolute performance in these periods

▪ One-day declines of at least -13% in each of the last three fiscal years

nairman & CEO Zwanziger in his 6/27/13 letter to stockholders, disingenuously cites only an 8-month stock price return:

> A period which follows the operational debacle and stock price crash due to the FDA investigation

Cites index price performance instead of total return to make its relative performance look 2% better

▪ In his 7/15/13 stockholder letter he inexplicably cites performance for a 1-yr + 12 days period (377 days ending 7/10/13)

> Continues to benefit from price depression due to the FDA investigation

> Further benefits from the rapid rise in Alere stock following Coppersmith's 7/8/13 letter to stockholders (7.2% for this

measurement period)

Alere's performance has consistently punished stockholders over the long term

-47.6%

-102.5%

1 Day Before

HM

-58.9%

6.9%

54.2%

10 Year

-65.8%

-113.1%

26.9%

115.6%

109.2%

-88.7%

-82.3%View entire presentation