Science 37 SPAC

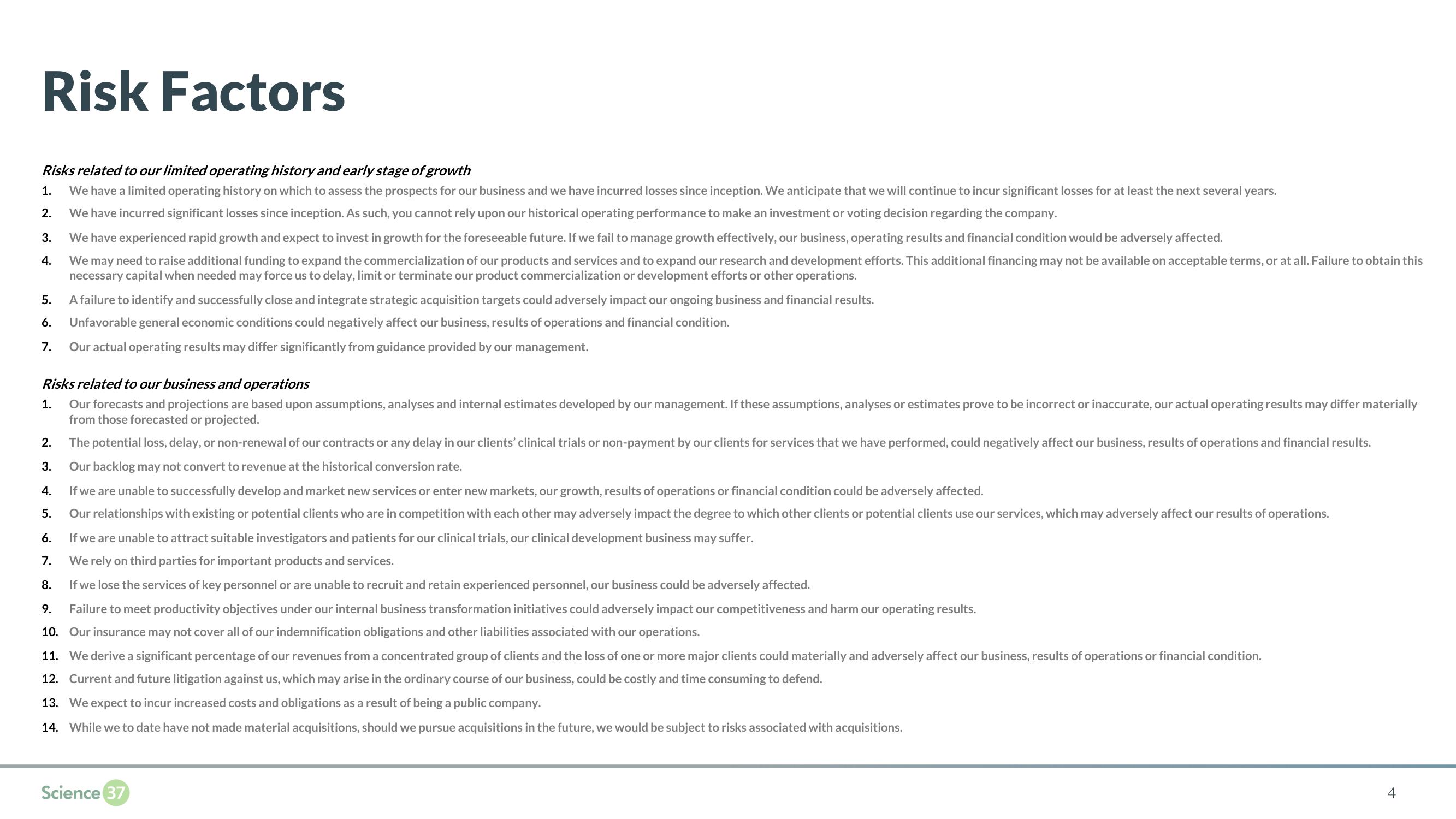

Risk Factors

Risks related to our limited operating history and early stage of growth

1.

We have a limited operating history on which to assess the prospects for our business and we have incurred losses since inception. We anticipate that we will continue to incur significant losses for at least the next several years.

2.

We have incurred significant losses since inception. As such, you cannot rely upon our historical operating performance to make an investment or voting decision regarding the company.

We have experienced rapid growth and expect to invest in growth for the foreseeable future. If we fail to manage growth effectively, our business, operating results and financial condition would be adversely affected.

We may need to raise additional funding to expand the commercialization of our products and services and to expand our research and development efforts. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this

necessary capital when needed may force us to delay, limit or terminate our product commercialization or development efforts or other operations.

3.

4.

5.

6.

7.

A failure to identify and successfully close and integrate strategic acquisition targets could adversely impact our ongoing business and financial results.

Unfavorable general economic conditions could negatively affect our business, results of operations and financial condition.

Our actual operating results may differ significantly from guidance provided by our management.

Risks related to our business and operations

1. Our forecasts and projections are based upon assumptions, analyses and internal estimates developed by our management. If these assumptions, analyses or estimates prove to be incorrect or inaccurate, our actual operating results may differ materially

from those forecasted or projected.

The potential loss, delay, or non-renewal of our contracts or any delay in our clients' clinical trials or non-payment by our clients for services that we have performed, could negatively affect our business, results of operations and financial results.

Our backlog may not convert to revenue at the historical conversion rate.

If we are unable to successfully develop and market new services or enter new markets, our growth, results of operations or financial condition could be adversely affected.

Our relationships with existing or potential clients who are in competition with each other may adversely impact the degree to which other clients or potential clients use our services, which may adversely affect our results of operations.

2.

3.

4.

5.

6.

If we are unable to attract suitable investigators and patients for our clinical trials, our clinical development business may suffer.

7.

We rely on third parties for important products and services.

8.

If we lose the services of key personnel or are unable to recruit and retain experienced personnel, our business could be adversely affected.

9. Failure to meet productivity objectives under our internal business transformation initiatives could adversely impact our competitiveness and harm our operating results.

10. Our insurance may not cover all of our indemnification obligations and other liabilities associated with our operations.

11. We derive a significant percentage of our revenues from a concentrated group of clients and the loss of one or more major clients could materially and adversely affect our business, results of operations or financial condition.

12. Current and future litigation against us, which may arise in the ordinary course of our business, could be costly and time consuming to defend.

13. We expect to incur increased costs and obligations as a result of being a public company.

14. While we to date have not made material acquisitions, should we pursue acquisitions in the future, we would be subject to risks associated with acquisitions.

Science 37

4View entire presentation