Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

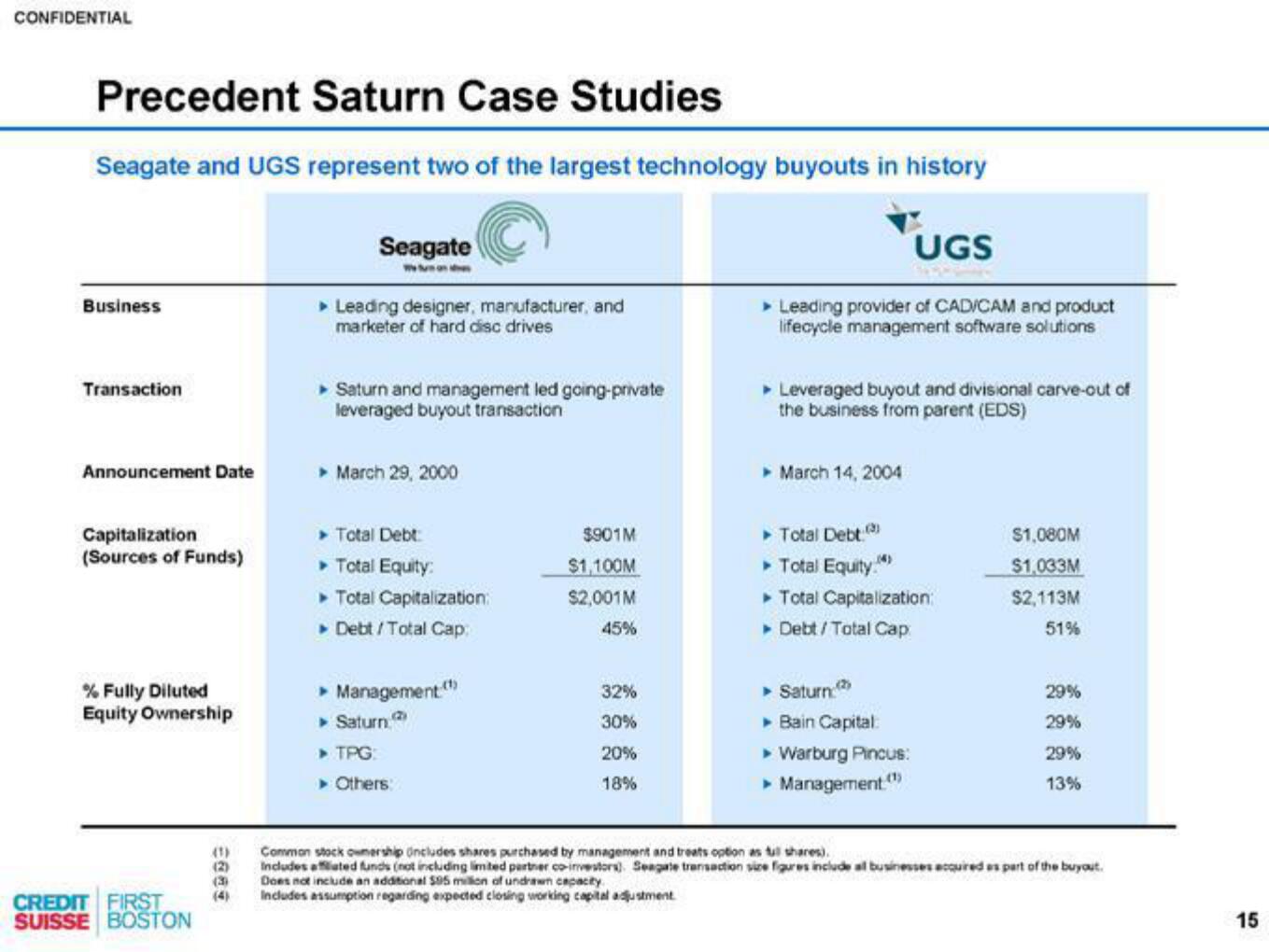

Precedent Saturn Case Studies

Seagate and UGS represent two of the largest technology buyouts in history

Business

Transaction

Announcement Date

Capitalization

(Sources of Funds)

% Fully Diluted

Equity Ownership

CREDIT FIRST

SUISSE BOSTON

(1)

(2)

(3)

Seagate

Wunde

▸ Leading designer, manufacturer, and

marketer of hard disc drives

▸ Saturn and management led going-private

leveraged buyout transaction

► March 29, 2000

Total Debt:

▸ Total Equity:

▸ Total Capitalization:

► Debt/Total Cap:

▸ Management (¹)

▸ Saturn.

▶ TPG:

▸ Others:

$901M

$1,100M

$2,001M

45%

32%

30%

20%

18%

UGS

> Leading provider of CAD/CAM and product

lifecycle management software solutions

▸ Leveraged buyout and divisional carve-out of

the business from parent (EDS)

► March 14, 2004

▸ Total Debt.(3)

▸ Total Equity.

Total Capitalization:

► Debt/Total Cap

▸ Saturn:

▸ Bain Capital:

▸ Warburg Pincus:

▸ Management (¹)

$1,080M

$1,033M

$2,113M

51%

29%

29%

29%

13%

Common stock ownership includes shares purchased by management and treats option as tul shares).

Includes affiated funds (not including limited partner co-investors). Seagate transaction size figures include all businesses acquired as part of the buyout.

Does not include an additional $95 million of undrawn capacity

Includes assumption regarding expected closing working capital adjustment.

15View entire presentation