AT&T Results Presentation Deck

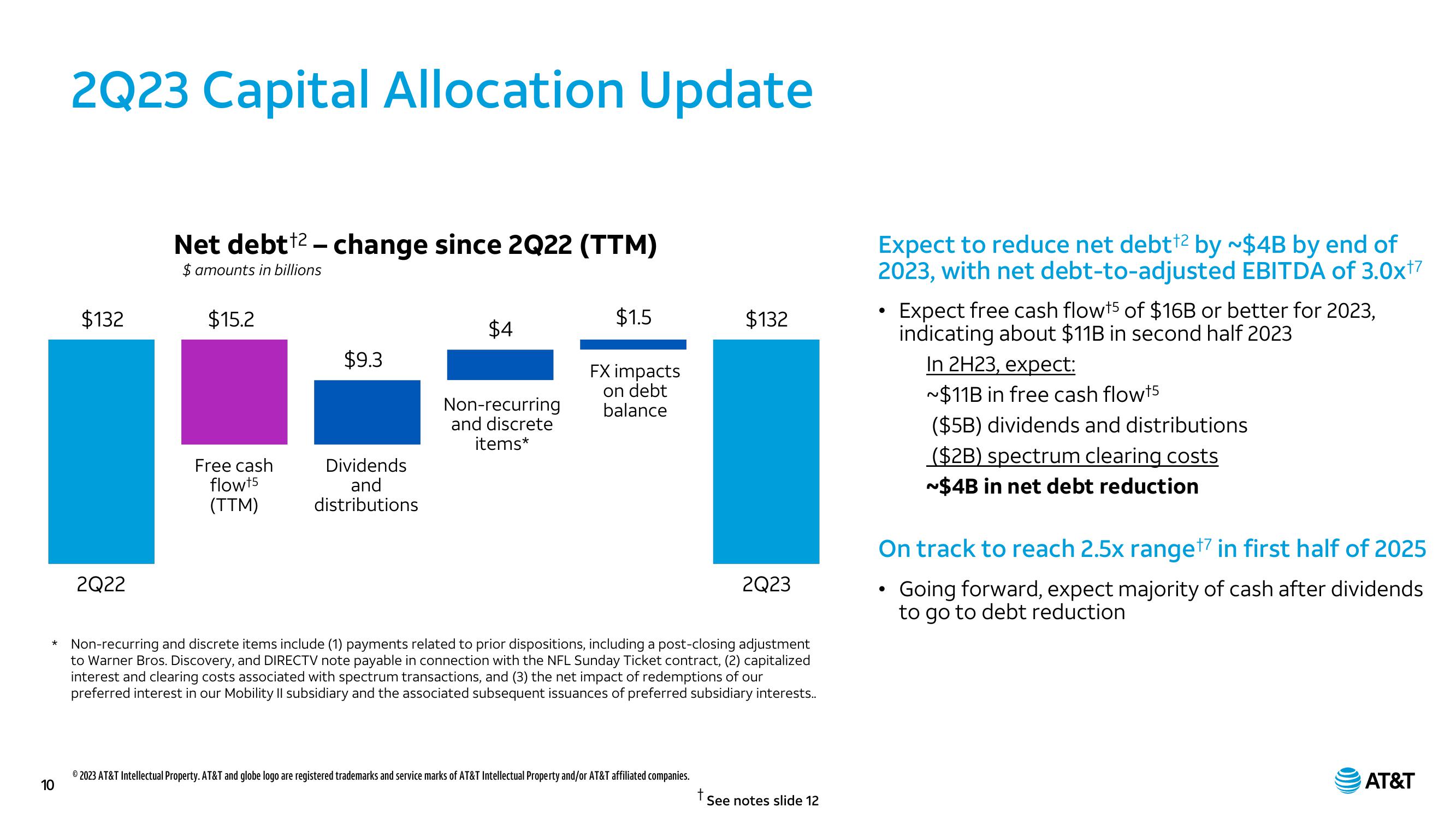

2Q23 Capital Allocation Update

$132

2Q22

Net debt ¹²-change since 2Q22 (TTM)

$ amounts in billions

$15.2

Free cash

flowt5

(TTM)

$9.3

Dividends

and

distributions

$4

Non-recurring

and discrete

items*

$1.5

FX impacts

on debt

balance

$132

© 2023 AT&T Intellectual Property. AT&T and globe logo are registered trademarks and service marks of AT&T Intellectual Property and/or AT&T affiliated companies.

10

2Q23

* Non-recurring and discrete items include (1) payments related to prior dispositions, including a post-closing adjustment

to Warner Bros. Discovery, and DIRECTV note payable in connection with the NFL Sunday Ticket contract, (2) capitalized

interest and clearing costs associated with spectrum transactions, and (3) the net impact of redemptions of our

preferred interest in our Mobility II subsidiary and the associated subsequent issuances of preferred subsidiary interests..

t

See notes slide 12

Expect to reduce net debtt² by ~$4B by end of

2023, with net debt-to-adjusted EBITDA of 3.0x¹7

●

Expect free cash flowt5 of $16B or better for 2023,

indicating about $11B in second half 2023

In 2H23, expect:

~$11B in free cash flowt5

($5B) dividends and distributions

($2B) spectrum clearing costs

~$4B in net debt reduction

On track to reach 2.5x range¹7 in first half of 2025

Going forward, expect majority of cash after dividends

to go to debt reduction

●

AT&TView entire presentation