Dave Investor Presentation Deck

Reduced Adjusted

EBITDA losses

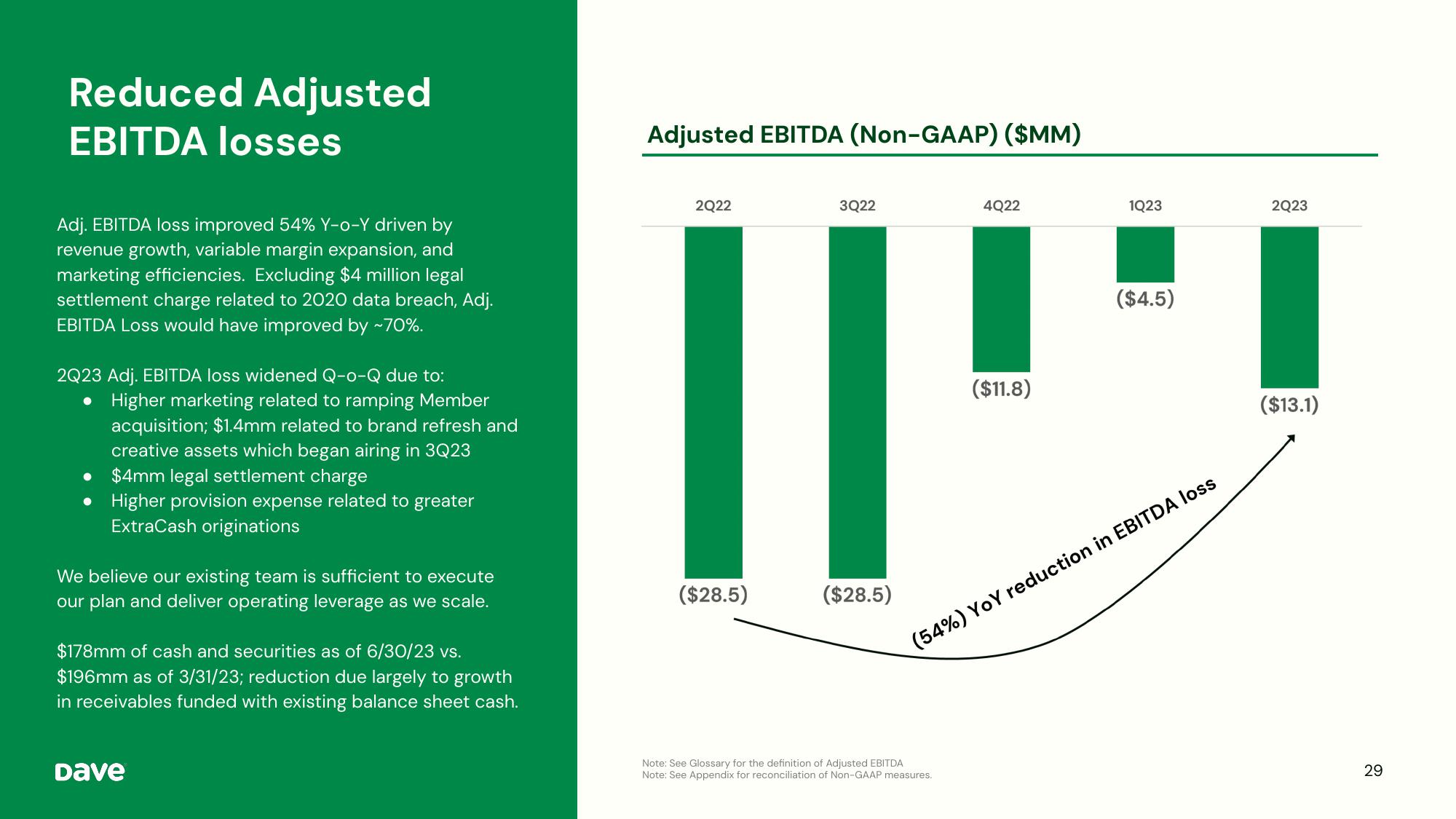

Adj. EBITDA loss improved 54% Y-o-Y driven by

revenue growth, variable margin expansion, and

marketing efficiencies. Excluding $4 million legal

settlement charge related to 2020 data breach, Adj.

EBITDA Loss would have improved by ~70%.

2Q23 Adj. EBITDA loss widened Q-o-Q due to:

Higher marketing related to ramping Member

acquisition; $1.4mm related to brand refresh and

creative assets which began airing in 3Q23

$4mm legal settlement charge

Higher provision expense related to greater

ExtraCash originations

We believe our existing team is sufficient to execute

our plan and deliver operating leverage as we scale.

$178mm of cash and securities as of 6/30/23 vs.

$196mm as of 3/31/23; reduction due largely to growth

in receivables funded with existing balance sheet cash.

Dave

Adjusted EBITDA (Non-GAAP) ($MM)

2Q22

($28.5)

3Q22

($28.5)

4Q22

Note: See Glossary for the definition of Adjusted EBITDA

Note: See Appendix for reconciliation of Non-GAAP measures.

($11.8)

1Q23

($4.5)

(54%) YoY reduction in EBITDA loss

2Q23

($13.1)

29View entire presentation