Mesirow Private Equity

1.

2.

3.

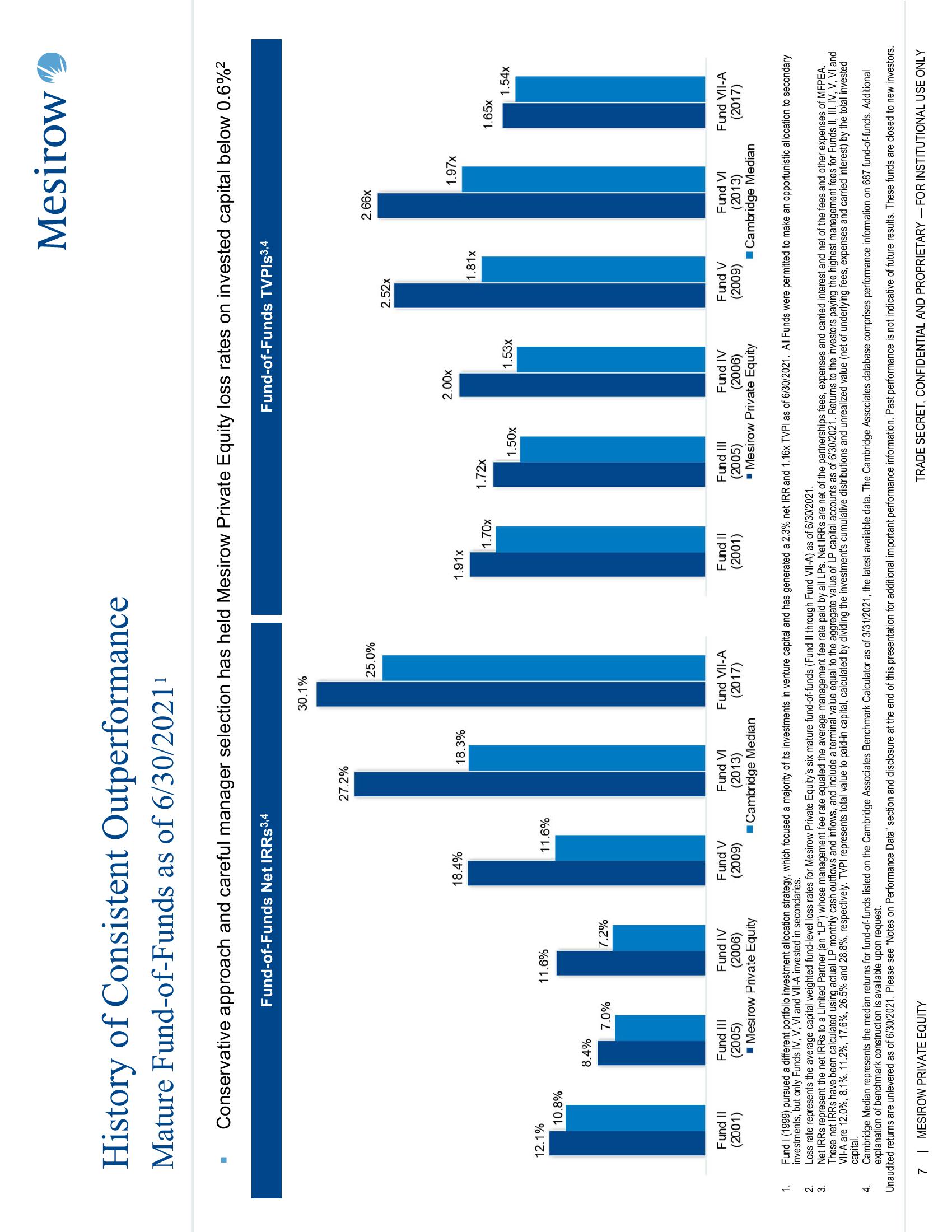

History of Consistent Outperformance

Mature Fund-of-Funds as of 6/30/2021¹

4.

■

Conservative approach and careful manager selection has held Mesirow Private Equity loss rates on invested capital below 0.6%²

12.1%

10.8%

Fund II

(2001)

8.4%

Fund-of-Funds Net IRRs3,4

7.0%

11.6%

7.2%

Fund IV

(2006)

Fund III

(2005)

■ Mesirow Private Equity

18.4%

11.6%

Fund V

(2009)

27.2%

18.3%

Fund VI

(2013)

■Cambridge Median

30.1%

25.0%

Fund VII-A

(2017)

1.91x

1.70x

Fund II

(2001)

1.72x

1.50x

Fund III

(2005)

Fund-of-Funds TVPIS ³,4

2.00x

1.53x

Fund IV

(2006)

▪ Mesirow Private Equity

Mesirow

2.52x

Fund V

(2009)

2.66x

1.97x

1.81x

1.65x

bh

Fund VI

(2013)

Cambridge Median

Fund I (1999) pursued a different portfolio investment allocation strategy, which focused a majority of its investments in venture capital and has generated a 2.3% net IRR and 1.16x TVPI as of 6/30/2021. All Funds were permitted to make an opportunistic allocation to secondary

investments, but only Funds IV, V, VI and VII-A invested in secondaries.

Loss rate represents the average capital weighted fund-level loss rates for Mesirow Private Equity's six mature fund-of-funds (Fund II through Fund VII-A) as of 6/30/2021.

Net IRRs represent the net IRRs to a Limited Partner (an "LP") whose management fee rate equaled the average management fee rate paid by all LPs. Net IRRS are net of the partnerships fees, expenses and carried interest and net of the fees and other expenses of MFPEA.

These net IRRs have been calculated using actual LP monthly cash outflows and inflows, and include a terminal value equal to the aggregate value of LP capital accounts as of 6/30/2021. Returns to the investors paying the highest management fees for Funds II, III, IV, V, VI and

VII-A are 12.0%, 8.1%, 11.2%, 17.6%, 26.5% and 28.8%, respectively. TVPI represents total value to paid-in capital, calculated by dividing the investment's cumulative distributions and unrealized value (net of underlying fees, expenses and carried interest) by the total invested

capital.

Cambridge Median represents the median returns for fund-of-funds listed on the Cambridge Associates Benchmark Calculator as of 3/31/2021, the latest available data. The Cambridge Associates database comprises performance information on 687 fund-of-funds. Additional

explanation of benchmark construction is available upon request.

Unaudited returns are unlevered as of 6/30/2021. Please see "Notes on Performance Data" section and disclosure at the end of this presentation for additional important performance information. Past performance is not indicative of future results. These funds are closed to new investors.

7 | MESIROW PRIVATE EQUITY

1.54x

Fund VII-A

(2017)

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation