Altus Power SPAC Presentation Deck

CBRE

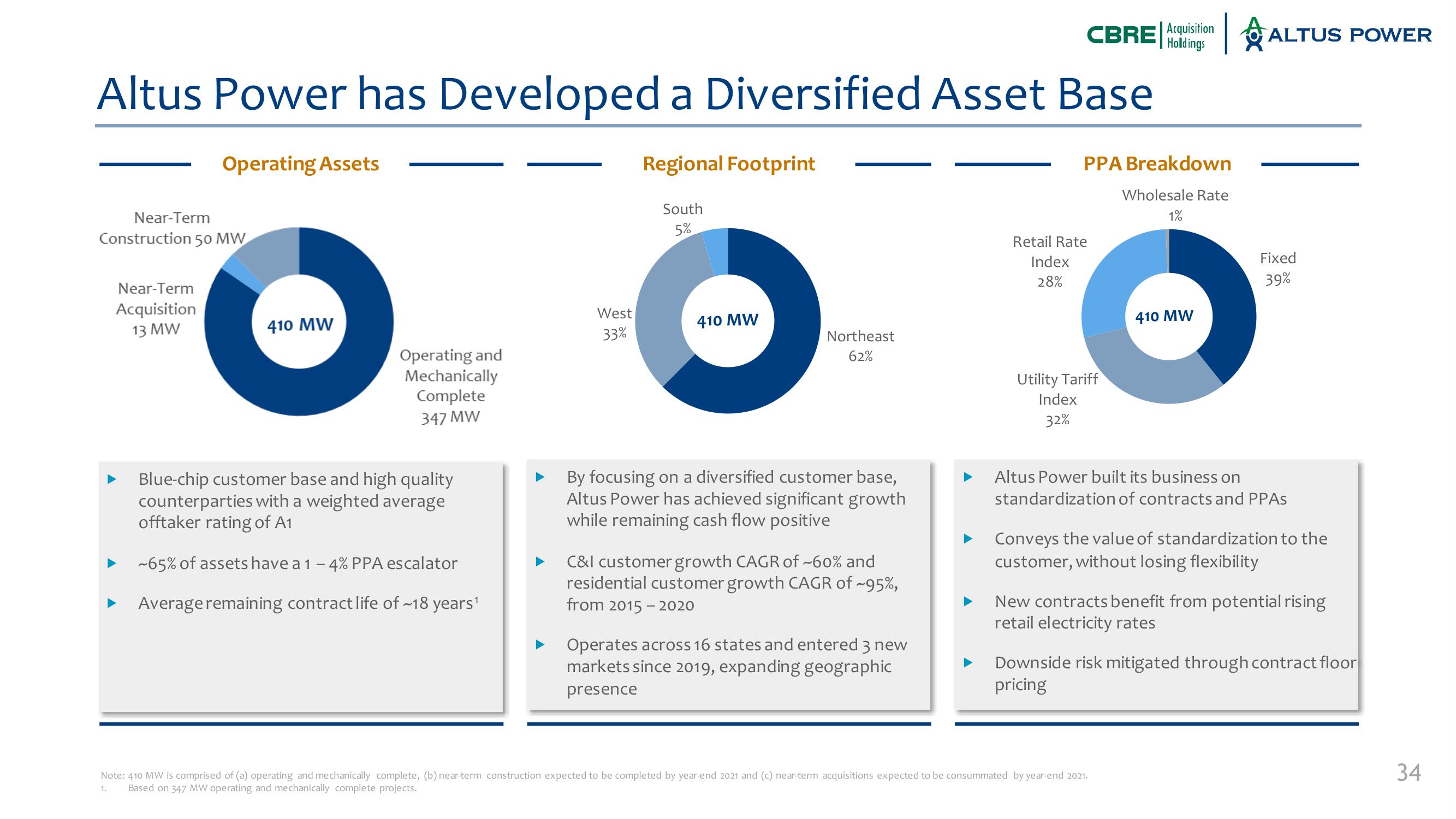

Altus Power has Developed a Diversified Asset Base

Operating Assets

Near-Term

Construction 50 MW

Near-Term

Acquisition

13 MW

410 MW

Operating and

Mechanically

Complete

347 MW

Blue-chip customer base and high quality

counterparties with a weighted average

offtaker rating of A1

~65% of assets have a 1 - 4% PPA escalator

Average remaining contract life of ~18 years¹

West

33%

Regional Footprint

South

5%

410 MW

Northeast

62%

By focusing on a diversified customer base,

Altus Power has achieved significant growth

while remaining cash flow positive

C&I customer growth CAGR of ~60% and

residential customer growth CAGR of ~95%,

from 2015-2020

Operates across 16 states and entered 3 new

markets since 2019, expanding geographic

presence

PPA Breakdown

Wholesale Rate

1%

Retail Rate

Index

28%

Utility Tariff

Index

32%

Acquisition

Holdings

410 MW

ALTUS POWER

Fixed

39%

Altus Power built its business on

standardization of contracts and PPAs

Note: 410 MW is comprised of (a) operating and mechanically complete, (b) near-term construction expected to be completed by year-end 2021 and (c) near-term acquisitions expected to be consummated by year-end 2021.

Based on 347 MW operating and mechanically complete projects.

1.

Conveys the value of standardization to the

customer, without losing flexibility

New contracts benefit from potential rising

retail electricity rates

▶ Downside risk mitigated through contract floor

pricing

34View entire presentation