HHR Investor Presentation Deck

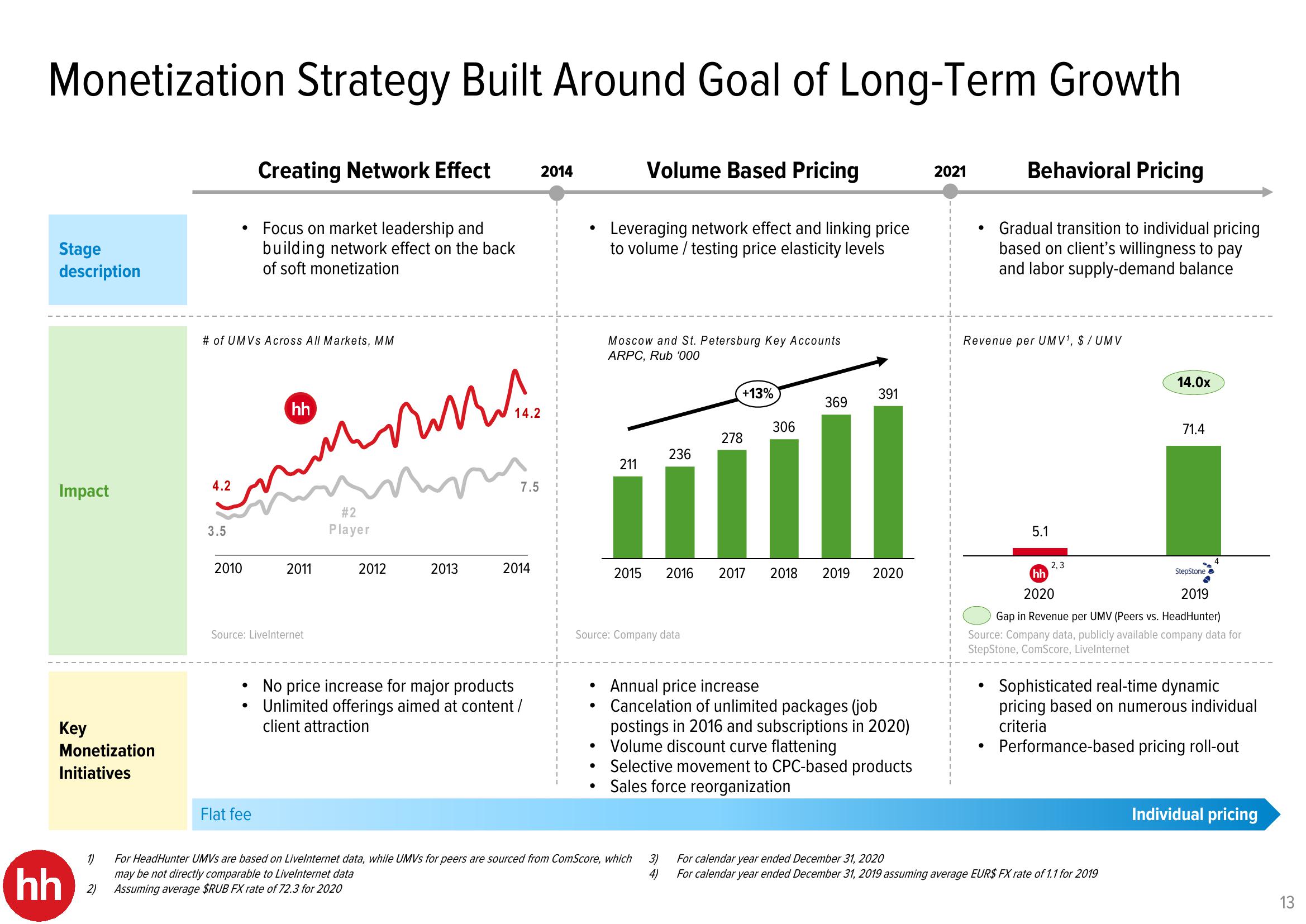

Monetization Strategy Built Around Goal of Long-Term Growth

Stage

description

Impact

Key

Monetization

Initiatives

hh

1)

2)

4.2

●

3.5

# of UMVS Across All Markets, MM

2010

●

Creating Network Effect 2014

●

Focus on market leadership and

building network effect on the back

of soft monetization

Flat fee

hh

Source: LiveInternet

wwww...

2011

#2

Player

2012

14.2

2013

7.5

2014

No price increase for major products

Unlimited offerings aimed at content/

client attraction

●

●

●

●

•

Source: Company data

●

Leveraging network effect and linking price

to volume / testing price elasticity levels

Volume Based Pricing

Moscow and St. Petersburg Key Accounts

ARPC, Rub '000

211

For HeadHunter UMVS are based on Livelnternet data, while UMVS for peers are sourced from ComScore, which

may be not directly comparable to Livelnternet data

Assuming average $RUB FX rate of 72.3 for 2020

+13%

278

236

1

2015 2016 2017 2018 2019 2020

3)

4)

306

369

391

Annual price increase

Cancelation of unlimited packages (job

postings in 2016 and subscriptions in 2020)

Volume discount curve flattening

Selective movement to CPC-based products

Sales force reorganization

2021

Behavioral Pricing

Gradual transition to individual pricing

based on client's willingness to pay

and labor supply-demand balance

Revenue per UMV¹, $/UMV

5.1

2,3

hh

2020

14.0x

71.4

For calendar year ended December 31, 2020

For calendar year ended December 31, 2019 assuming average EUR$ FX rate of 1.1 for 2019

StepStone ►

2019

Gap in Revenue per UMV (Peers vs. HeadHunter)

Source: Company data, publicly available company data for

StepStone, ComScore, Livelnternet

Sophisticated real-time dynamic

pricing based on numerous individual

criteria

• Performance-based pricing roll-out

Individual pricing

13View entire presentation