Melrose Mergers and Acquisitions Presentation Deck

Powder Metallurgy: overview

Melrose

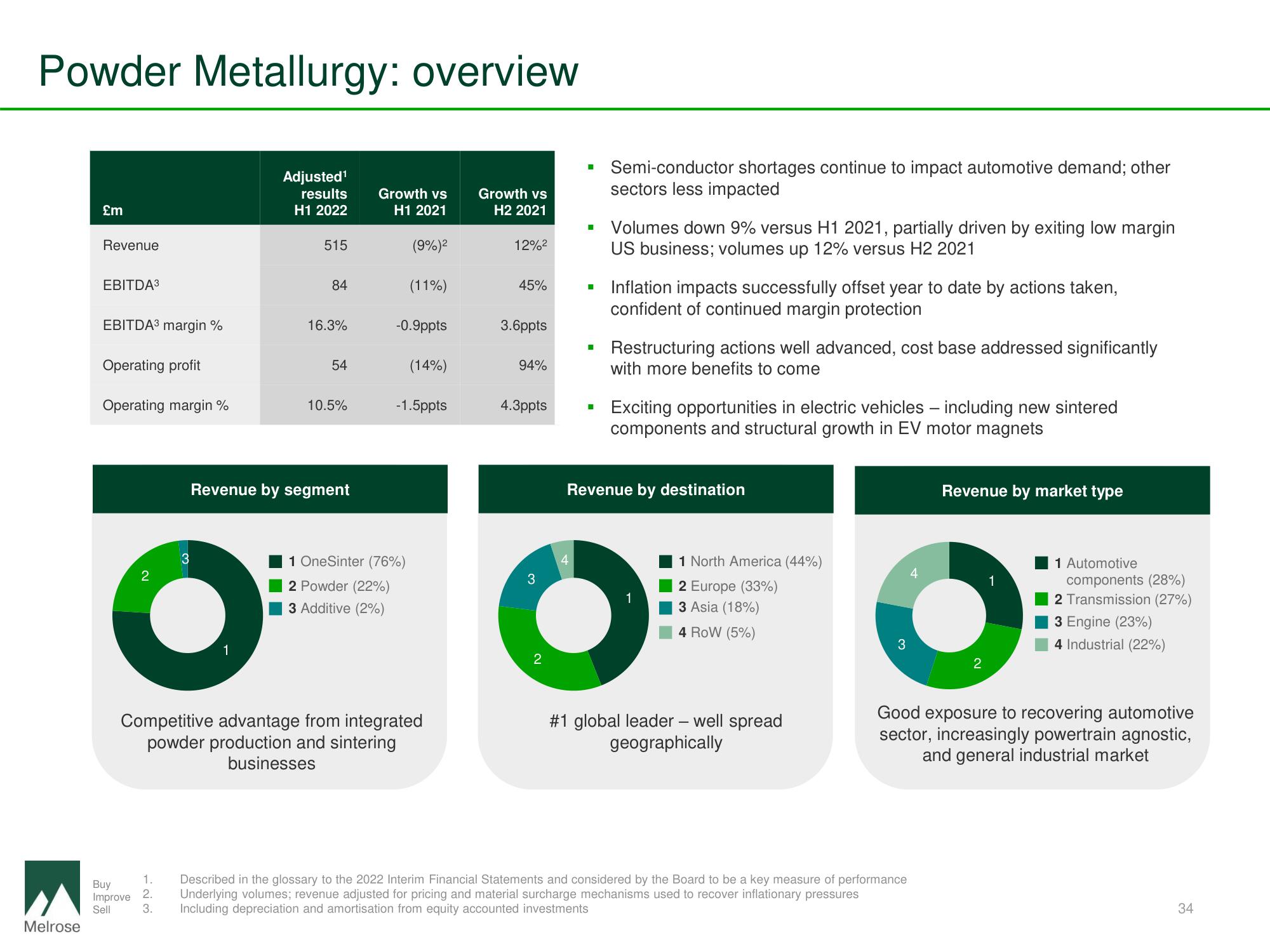

£m

Revenue

EBITDA³

EBITDA3 margin %

Operating profit

Operating margin %

2

3

123

Adjusted¹

results

H1 2022

1

515

84

16.3%

54

10.5%

Revenue by segment

Growth vs

H1 2021

(9%)²

(11%)

-0.9ppts

1 OneSinter (76%)

2 Powder (22%)

3 Additive (2%)

(14%)

-1.5ppts

Competitive advantage from integrated

powder production and sintering

businesses

Growth vs

H2 2021

12%²

45%

3.6ppts

94%

4.3ppts

3

2

■

1

■

■

Semi-conductor shortages continue to impact automotive demand; other

sectors less impacted

Volumes down 9% versus H1 2021, partially driven by exiting low margin

US business; volumes up 12% versus H2 2021

Inflation impacts successfully offset year to date by actions taken,

confident of continued margin protection

Restructuring actions well advanced, cost base addressed significantly

with more benefits to come

Exciting opportunities in electric vehicles - including new sintered

components and structural growth in EV motor magnets

Revenue by destination

1 North America (44%)

2 Europe (33%)

3 Asia (18%)

4 ROW (5%)

#1 global leader - well spread

geographically

Buy

Improve 2.

Sell

1. Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

Underlying volumes; revenue adjusted for pricing and material surcharge mechanisms used to recover inflationary pressures

3. Including depreciation and amortisation from equity accounted investments

Revenue by market type

2

1

1 Automotive

components (28%)

2 Transmission (27%)

3 Engine (23%)

4 Industrial (22%)

Good exposure to recovering automotive

sector, increasingly powertrain agnostic,

and general industrial market

34View entire presentation