Goldman Sachs Results Presentation Deck

Assets Under Supervision

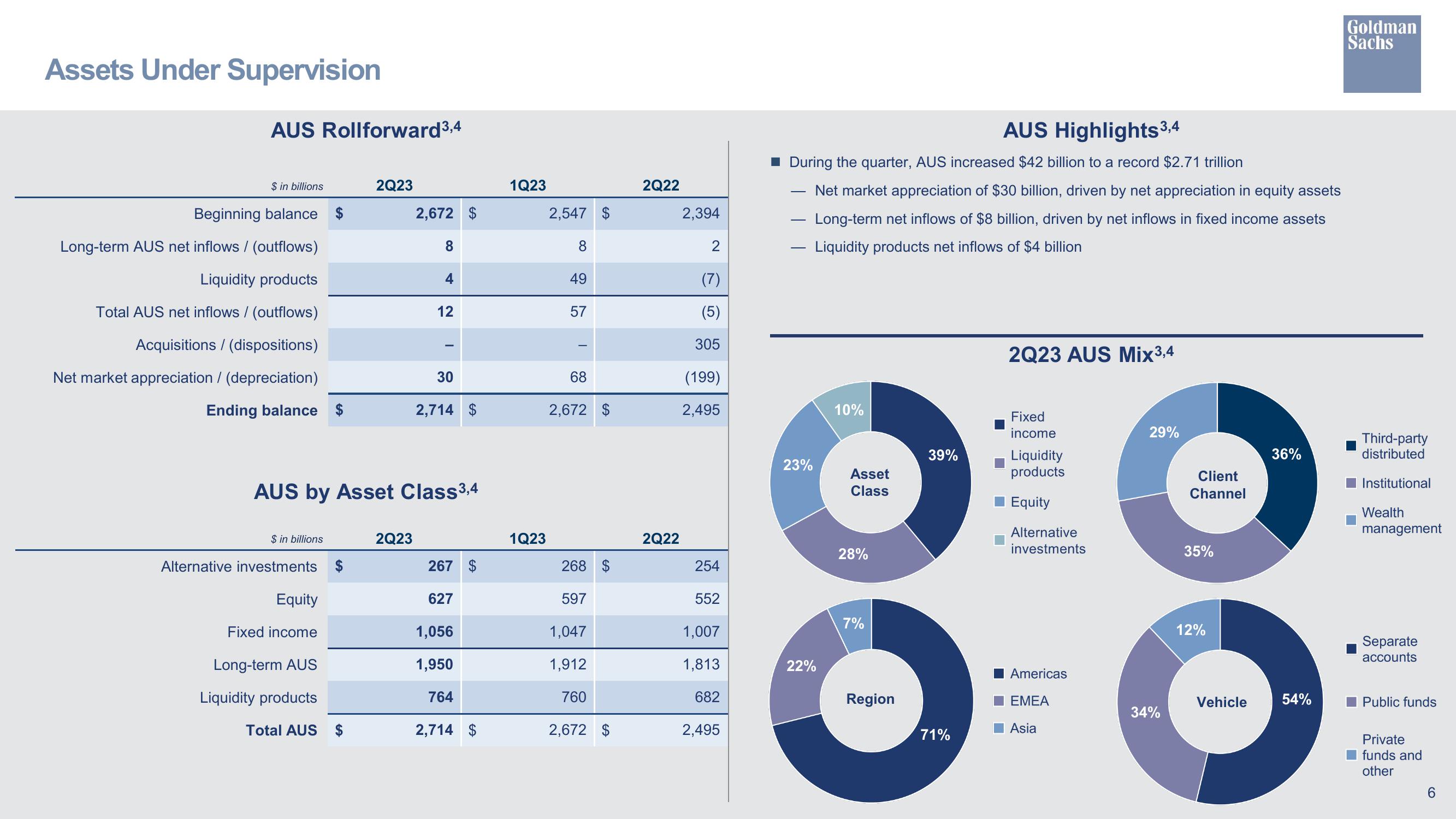

AUS Rollforward³,4

$ in billions

Beginning balance

Long-term AUS net inflows / (outflows)

Liquidity products

Total AUS net inflows / (outflows)

Acquisitions / (dispositions)

Net market appreciation / (depreciation)

Ending balance

$ in billions

Alternative investments

Equity

Fixed income

Long-term AUS

Liquidity products

2Q23

Total AUS

2,672 $

2Q23

8

AUS by Asset Class 3,4

4

12

30

2,714 $

267 $

627

1,056

1,950

764

2,714 $

1Q23

1Q23

2,547 $

8

49

57

68

2,672 $

268 $

597

1,047

1,912

760

2,672 $

2Q22

2Q22

2,394

2

(7)

305

(199)

2,495

254

552

1,007

1,813

682

2,495

AUS Highlights 3,4

During the quarter, AUS increased $42 billion to a record $2.71 trillion

Net market appreciation of $30 billion, driven by net appreciation in equity assets

Long-term net inflows of $8 billion, driven by net inflows in fixed income assets

Liquidity products net inflows of $4 billion

23%

22%

10%

Asset

Class

28%

7%

Region

39%

71%

2Q23 AUS Mix3,4

Fixed

income

Liquidity

products

Equity

Alternative

investments

Americas

EMEA

Asia

29%

34%

Client

Channel

35%

12%

Vehicle

36%

54%

Goldman

Sachs

Third-party

distributed

Institutional

Wealth

management

Separate

accounts

Public funds

Private

funds and

other

6View entire presentation