First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

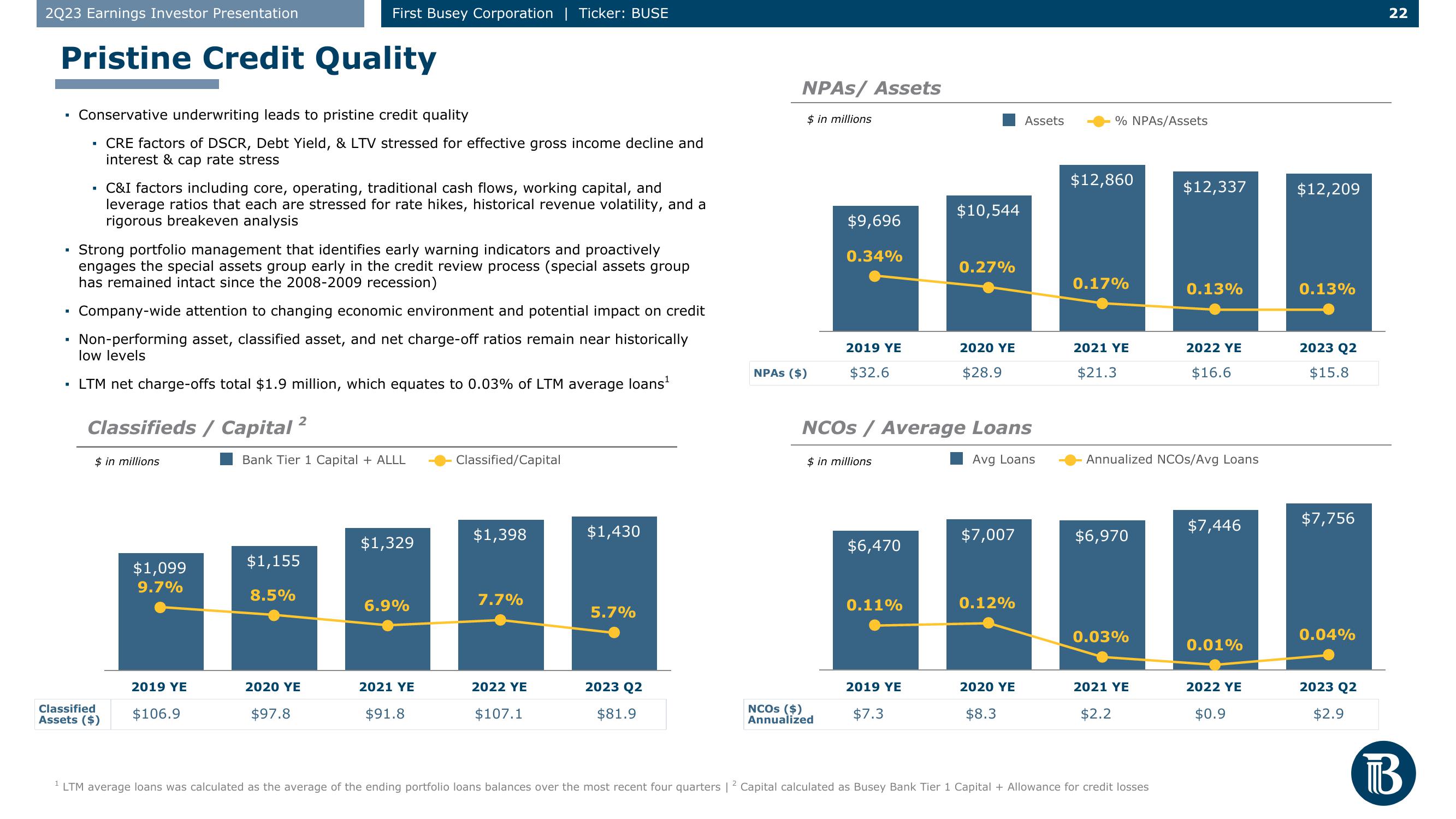

Pristine Credit Quality

■

■

■

■

■

Conservative underwriting leads to pristine credit quality

CRE factors of DSCR, Debt Yield, & LTV stressed for effective gross income decline and

interest & cap rate stress

I

I

C&I factors including core, operating, traditional cash flows, working capital, and

leverage ratios that each are stressed for rate hikes, historical revenue volatility, and a

rigorous breakeven analysis

Strong portfolio management that identifies early warning indicators and proactively

engages the special assets group early in the credit review process (special assets group

has remained intact since the 2008-2009 recession)

Company-wide attention to changing economic environment and potential impact on credit

Non-performing asset, classified asset, and net charge-off ratios remain near historically

low levels

LTM net charge-offs total $1.9 million, which equates to 0.03% of LTM average loans¹

Classifieds / Capital

$ in millions

Classified

Assets ($)

$1,099

9.7%

2019 YE

$106.9

First Busey Corporation | Ticker: BUSE

2

Bank Tier 1 Capital + ALLL

$1,155

8.5%

2020 YE

$97.8

$1,329

6.9%

2021 YE

$91.8

Classified/Capital

$1,398

7.7%

2022 YE

$107.1

$1,430

5.7%

2023 Q2

$81.9

NPAS/ Assets

NPAS ($)

$ in millions

$9,696

0.34%

NCOS ($)

Annualized

2019 YE

$32.6

$ in millions

$6,470

NCOS / Average Loans

Avg Loans

0.11%

2019 YE

$10,544

$7.3

0.27%

2020 YE

$28.9

$7,007

0.12%

2020 YE

Assets

$8.3

% NPAS/Assets

$12,860

0.17%

2021 YE

$21.3

$6,970

0.03%

Annualized NCOS/Avg Loans

2021 YE

$2.2

$12,337

¹ LTM average loans was calculated as the average of the ending portfolio loans balances over the most recent four quarters | 2 Capital calculated as Busey Bank Tier 1 Capital + Allowance for credit losses

0.13%

2022 YE

$16.6

$7,446

0.01%

2022 YE

$0.9

$12,209

0.13%

2023 Q2

$15.8

$7,756

0.04%

2023 Q2

$2.9

22

BView entire presentation