Kore SPAC Presentation Deck

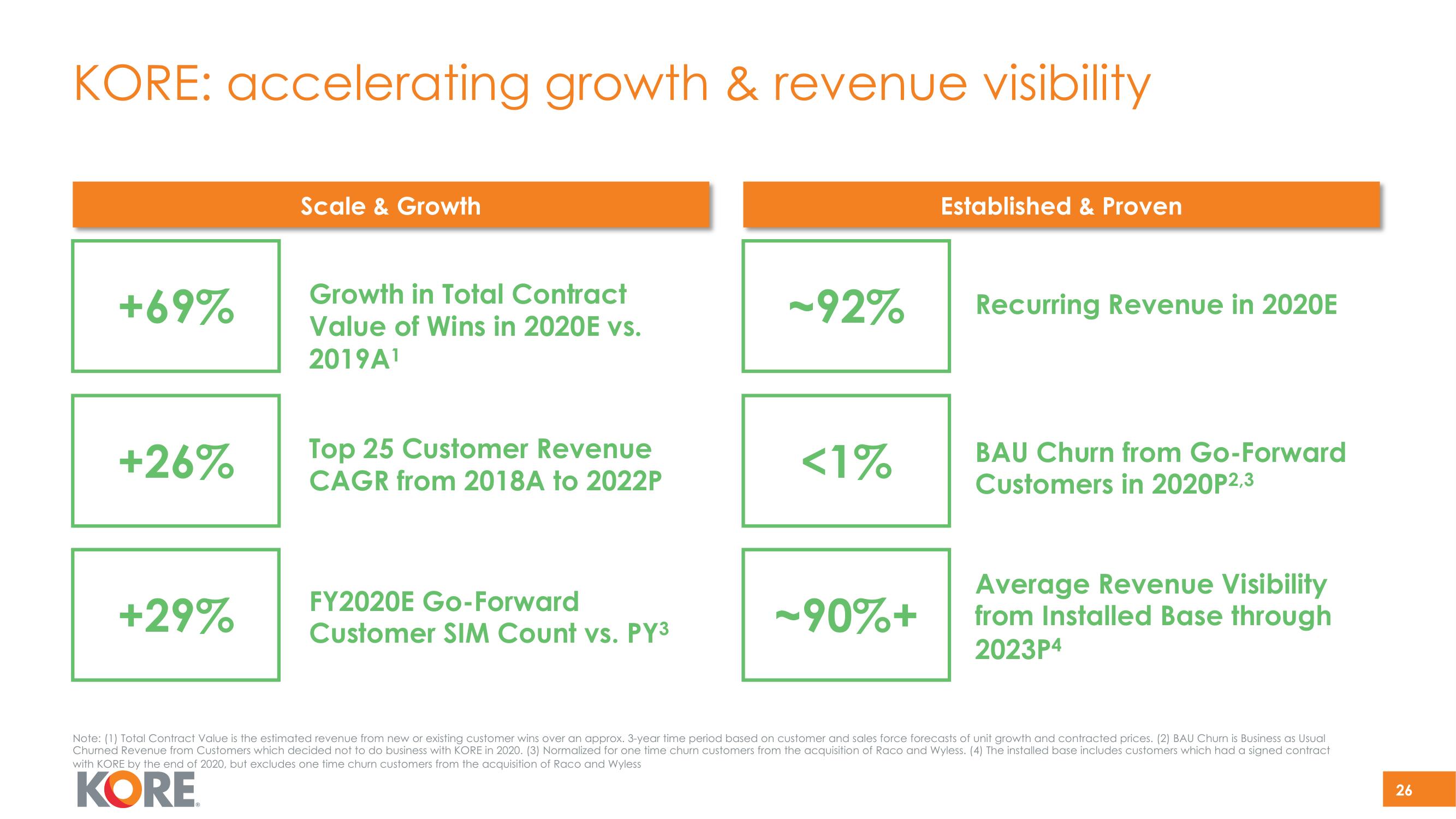

KORE: accelerating growth & revenue visibility

+69%

+26%

+29%

Scale & Growth

Growth in Total Contract

Value of Wins in 2020E vs.

2019A¹

Top 25 Customer Revenue

CAGR from 2018A to 2022P

FY2020E Go-Forward

Customer SIM Count vs. PY³

~92%

<1%

~90%+

Established & Proven

Recurring Revenue in 2020E

BAU Churn from Go-Forward

Customers in 2020P2,3

Average Revenue Visibility

from Installed Base through

2023P4

Note: (1) Total Contract Value is the estimated revenue from new or existing customer wins over an approx. 3-year time period based on customer and sales force forecasts of unit growth and contracted prices. (2) BAU Churn is Business as Usual

Churned Revenue from Customers which decided not to do business with KORE in 2020. (3) Normalized for one time churn customers from the acquisition of Raco and Wyless. (4) The installed base includes customers which had a signed contract

with KORE by the end of 2020, but excludes one time churn customers from the acquisition of Raco and Wyless

KORE

26View entire presentation