jetBlue Mergers and Acquisitions Presentation Deck

jetBlue

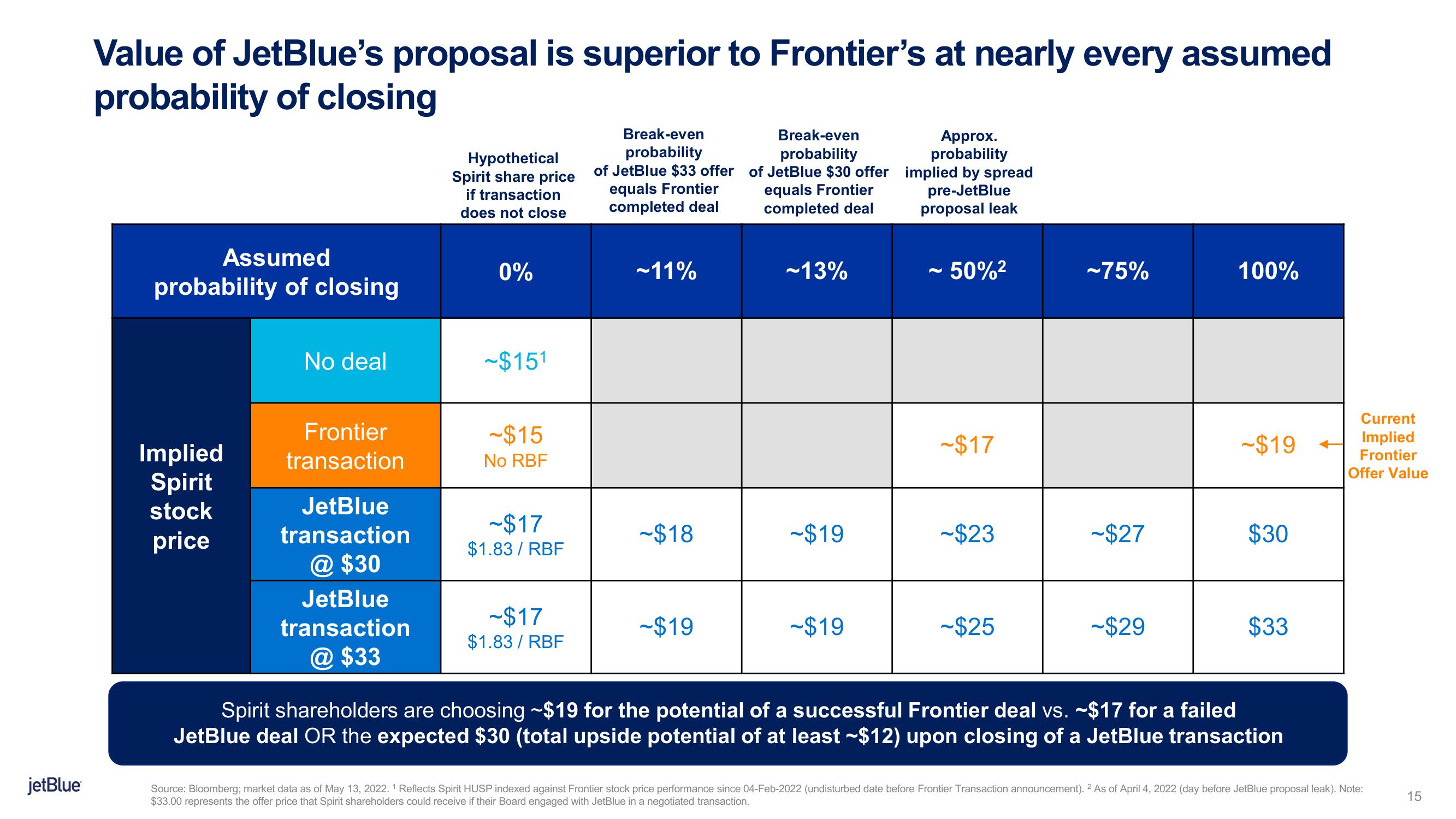

Value of JetBlue's proposal is superior to Frontier's at nearly every assumed

probability of closing

Assumed

probability of closing

Implied

Spirit

stock

price

No deal

Frontier

transaction

JetBlue

transaction

@ $30

JetBlue

transaction

@ $33

Hypothetical

Spirit share price

if transaction

does not close

0%

-$151

-$15

No RBF

-$17

$1.83 / RBF

~$17

$1.83 / RBF

Break-even

probability

of JetBlue $33 offer

equals Frontier

completed deal

~11%

-$18

-$19

Break-even

probability

of JetBlue $30 offer

equals Frontier

completed deal

-13%

-$19

~$19

Approx.

probability

implied by spread

pre-JetBlue

proposal leak

- 50%²

P

-$17

~$23

-$25

-75%

-$27

-$29

100%

-$19

$30

$33

Spirit shareholders are choosing ~$19 for the potential of a successful Frontier deal vs. ~$17 for a failed

JetBlue deal OR the expected $30 (total upside potential of at least ~$12) upon closing of a JetBlue transaction

Current

Implied

Frontier

Offer Value

Source: Bloomberg; market data as of May 13, 2022. 1 Reflects Spirit HUSP indexed against Frontier stock price performance since 04-Feb-2022 (undisturbed date before Frontier Transaction announcement). 2 As of April 4, 2022 (day before JetBlue proposal leak). Note:

$33.00 represents the offer price that Spirit shareholders could receive if their Board engaged with JetBlue in a negotiated transaction.

15View entire presentation