Carlyle Investor Day Presentation Deck

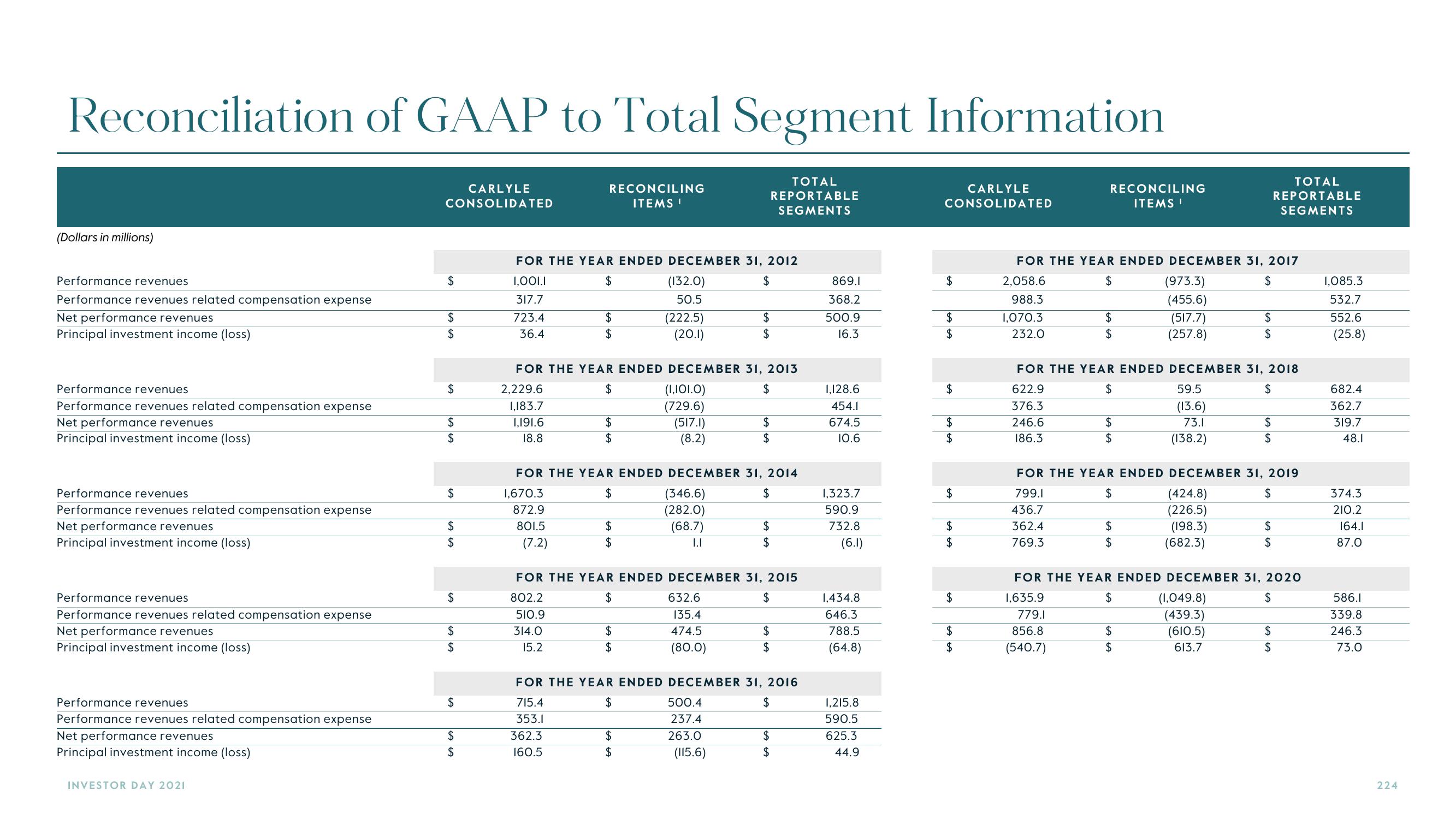

Reconciliation of GAAP to Total Segment Information

(Dollars in millions)

Performance revenues

Performance revenues related compensation expense

Net performance revenues

Principal investment income (loss)

Performance revenues

Performance revenues related compensation expense

Net performance revenues

Principal investment income (loss)

Performance revenues

Performance revenues related compensation expense

Net performance revenues

Principal investment income (loss)

Performance revenues

Performance revenues related compensation expense

Net performance revenues

Principal investment income (loss)

Performance revenues

Performance revenues related compensation expense

Net performance revenues

Principal investment income (loss)

INVESTOR DAY 2021

CARLYLE

CONSOLIDATED

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

RECONCILING

ITEMS!

FOR THE YEAR ENDED DECEMBER 31, 2012

$

$

1,001.1

317.7

723.4

36.4

(7.2)

$

$

FOR THE YEAR ENDED DECEMBER 31, 2013

2,229.6

$

$

1,183.7

1,191.6

18.8

$

$

362.3

160.5

$

$

(132.0)

50.5

(222.5)

(20.1)

FOR THE YEAR ENDED DECEMBER 31, 2014

1,670.3

$

$

872.9

801.5

$

$

(1,101.0)

(729.6)

(517.1)

(8.2)

$

$

(346.6)

(282.0)

(68.7)

I. I

$

$

FOR THE YEAR ENDED DECEMBER 31, 2015

802.2

$

$

510.9

314.0

15.2

632.6

135.4

474.5

(80.0)

$

$

500.4

237.4

263.0

(115.6)

TOTAL

REPORTABLE

SEGMENTS

$

$

FOR THE YEAR ENDED DECEMBER 31, 2016

715.4

$

$

353.1

$

$

$

$

869.1

368.2

500.9

16.3

1,128.6

454.1

674.5

10.6

1,323.7

590.9

732.8

(6.1)

1,434.8

646.3

788.5

(64.8)

1,215.8

590.5

625.3

44.9

CARLYLE

CONSOLIDATED

$

$

$

$

$

$

$

$

$

$

$

$

RECONCILING

ITEMS I

$

FOR THE YEAR ENDED DECEMBER 31, 2017

2,058.6

$

988.3

1,070.3

232.0

$

$

$

$

(973.3)

(455.6)

(517.7)

(257.8)

$

$

FOR THE YEAR ENDED DECEMBER 31, 2018

622.9

376.3

246.6

186.3

$

$

59.5

(13.6)

73.1

(138.2)

$

$

$

$

FOR THE YEAR ENDED DECEMBER 31, 2019

799.1

$

$

436.7

362.4

769.3

(424.8)

(226.5)

(198.3)

(682.3)

$

$

(1,049.8)

(439.3)

(610.5)

613.7

TOTAL

REPORTABLE

SEGMENTS

$

$

FOR THE YEAR ENDED DECEMBER 31, 2020

1,635.9

$

$

779.1

856.8

(540.7)

$

$

1,085.3

532.7

552.6

(25.8)

682.4

362.7

319.7

48.1

374.3

210.2

164.1

87.0

586.1

339.8

246.3

73.0

224View entire presentation