AMC Mergers and Acquisitions Presentation Deck

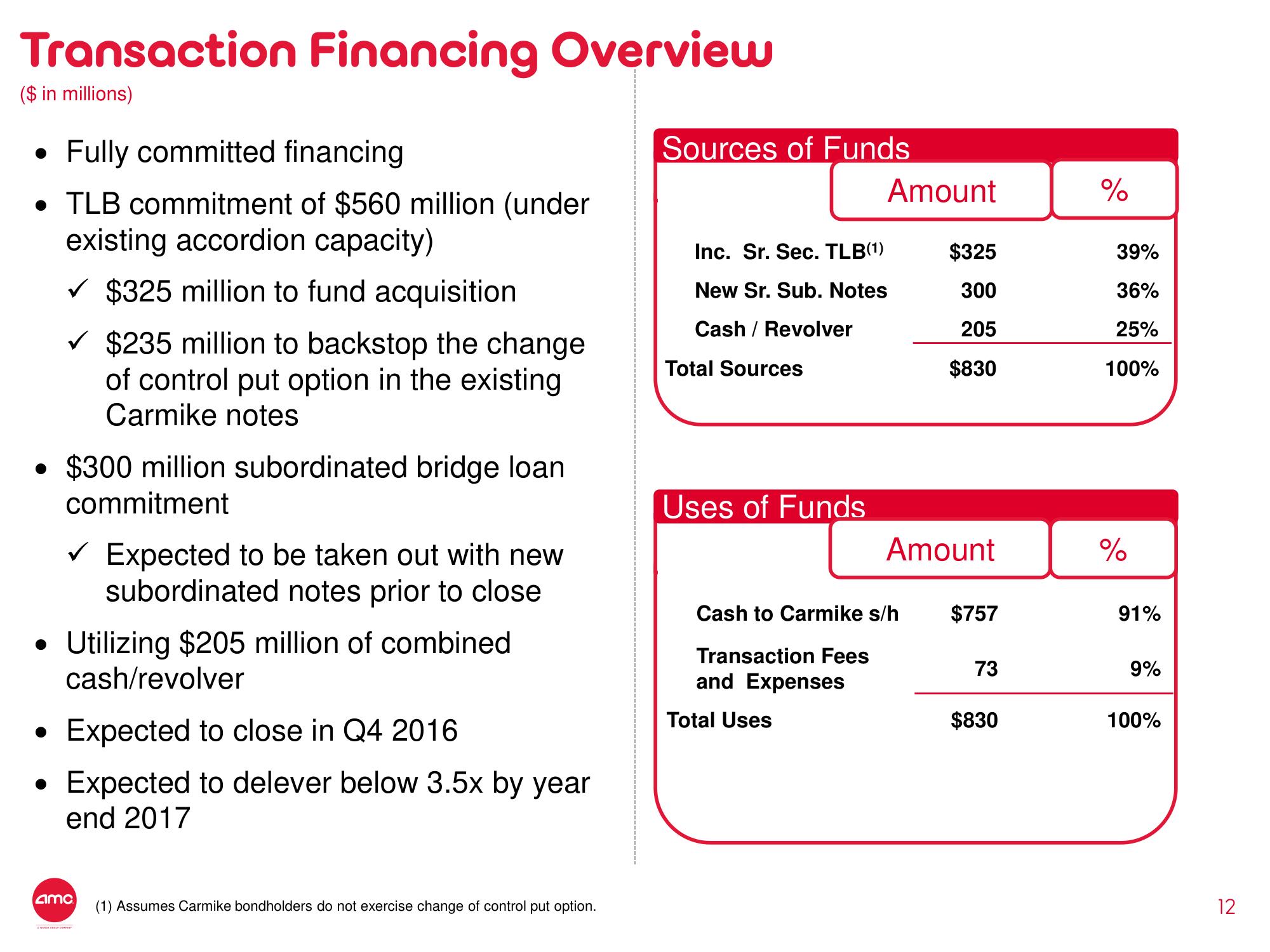

Transaction Financing Overview

($ in millions)

Fully committed financing

• TLB commitment of $560 million (under

existing accordion capacity)

✓ $325 million to fund acquisition

✓ $235 million to backstop the change

of control put option in the existing

Carmike notes

●

●

●

●

$300 million subordinated bridge loan

commitment

✓ Expected to be taken out with new

subordinated notes prior to close

Utilizing $205 million of combined

cash/revolver

Expected to close in Q4 2016

Expected to delever below 3.5x by year

end 2017

4mc

(1) Assumes Carmike bondholders do not exercise change of control put option.

Sources of Funds

Inc. Sr. Sec. TLB(1)

New Sr. Sub. Notes

Cash/Revolver

Total Sources

Uses of Funds

Amount

Total Uses

Cash to Carmike s/h

Transaction Fees

and Expenses

$325

300

205

$830

Amount

$757

73

$830

%

39%

36%

25%

100%

%

91%

9%

100%

12View entire presentation