BlackRock Results Presentation Deck

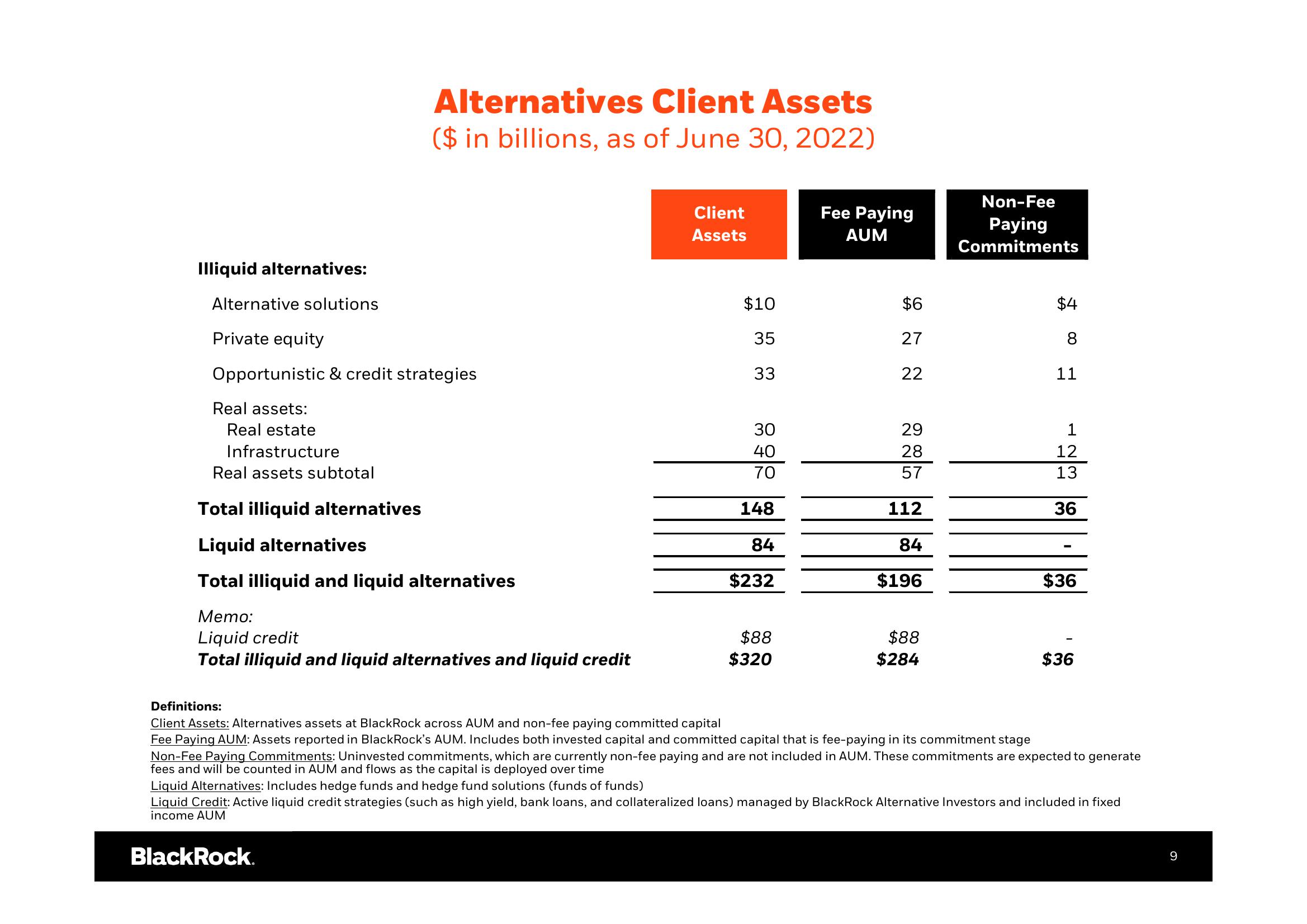

Illiquid alternatives:

Alternative solutions

Private equity

Alternatives Client Assets

($ in billions, as of June 30, 2022)

Opportunistic & credit strategies

Real assets:

Real estate

Infrastructure

Real assets subtotal

Total illiquid alternatives

Liquid alternatives

Total illiquid and liquid alternatives

Memo:

Liquid credit

Total illiquid and liquid alternatives and liquid credit

Client

Assets

$10

35

33

30

40

70

148

84

$232

$88

$320

Fee Paying

AUM

$6

27

22

29

28

57

112

84

$196

$88

$284

Non-Fee

Paying

Commitments

$4

8

00

11

1

12

13

36

$36

$36

Definitions:

Client Assets: Alternatives assets at BlackRock across AUM and non-fee paying committed capital

Fee Paying AUM: Assets reported in BlackRock's AUM. Includes both invested capital and committed capital that is fee-paying in its commitment stage

Non-Fee Paying Commitments: Uninvested commitments, which are currently non-fee paying and are not included in AUM. These commitments are expected to generate

fees and will be counted in AUM and flows as the capital is deployed over time

Liquid Alternatives: Includes hedge funds and hedge fund solutions (funds of funds)

Liquid Credit: Active liquid credit strategies (such as high yield, bank loans, and collateralized loans) managed by BlackRock Alternative Investors and included in fixed

income AUM

BlackRock.

9View entire presentation