Crocs Results Presentation Deck

APPENDIX

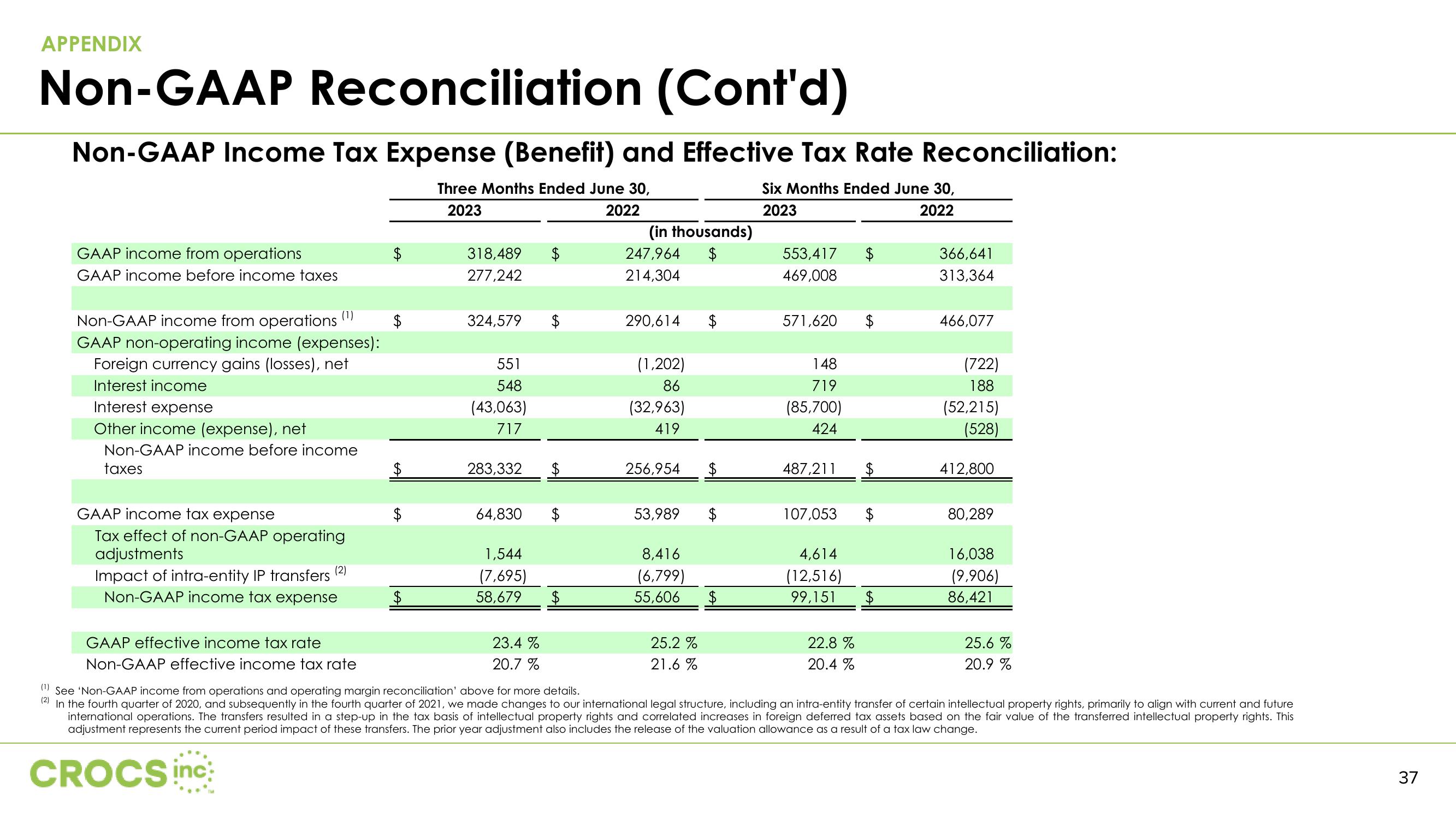

Non-GAAP Reconciliation (Cont'd)

Non-GAAP Income Tax Expense (Benefit) and Effective Tax Rate Reconciliation:

Three Months Ended June 30,

2023

Six Months Ended June 30,

2023

2022

2022

GAAP income from operations

GAAP income before income taxes

(1)

Non-GAAP income from operations

GAAP non-operating income (expenses):

Foreign currency gains (losses), net

Interest income

Interest expense

Other income (expense), net

Non-GAAP income before income

taxes

GAAP income tax expense

Tax effect of non-GAAP operating

adjustments

Impact of intra-entity IP transfers (²)

Non-GAAP income tax expense

GAAP effective income tax rate

Non-GAAP effective income tax rate

318,489

277,242

324,579

551

548

(43,063)

717

283,332

64,830

1,544

(7,695)

58,679

23.4%

20.7 %

(in thousands)

247,964 $

214,304

290,614

(1,202)

86

(32,963)

419

256,954

53,989

8,416

(6,799)

55,606 $

25.2 %

21.6%

553,417

469,008

571,620

148

719

(85,700)

424

487,211

107,053

4,614

(12,516)

99,151

22.8 %

20.4 %

$

366,641

313,364

466,077

(722)

188

(52,215)

(528)

412,800

80,289

16,038

(9,906)

86,421

25.6 %

20.9 %

(2)

(!)See 'Non-GAAP income from operations and operating margin reconciliation' above for more details.

In the fourth quarter of 2020, and subsequently in the fourth quarter of 2021, we made changes to our international legal structure, including an intra-entity transfer of certain intellectual property rights, primarily to align with current and future

international operations. The transfers resulted in a step-up in the tax basis of intellectual property rights and correlated increases in foreign deferred tax assets based on the fair value of the transferred intellectual property rights. This

adjustment represents the current period impact of these transfers. The prior year adjustment also includes the release of the valuation allowance as a result of a tax law change.

CROCS inc

37View entire presentation