PropertyGuru SPAC Presentation Deck

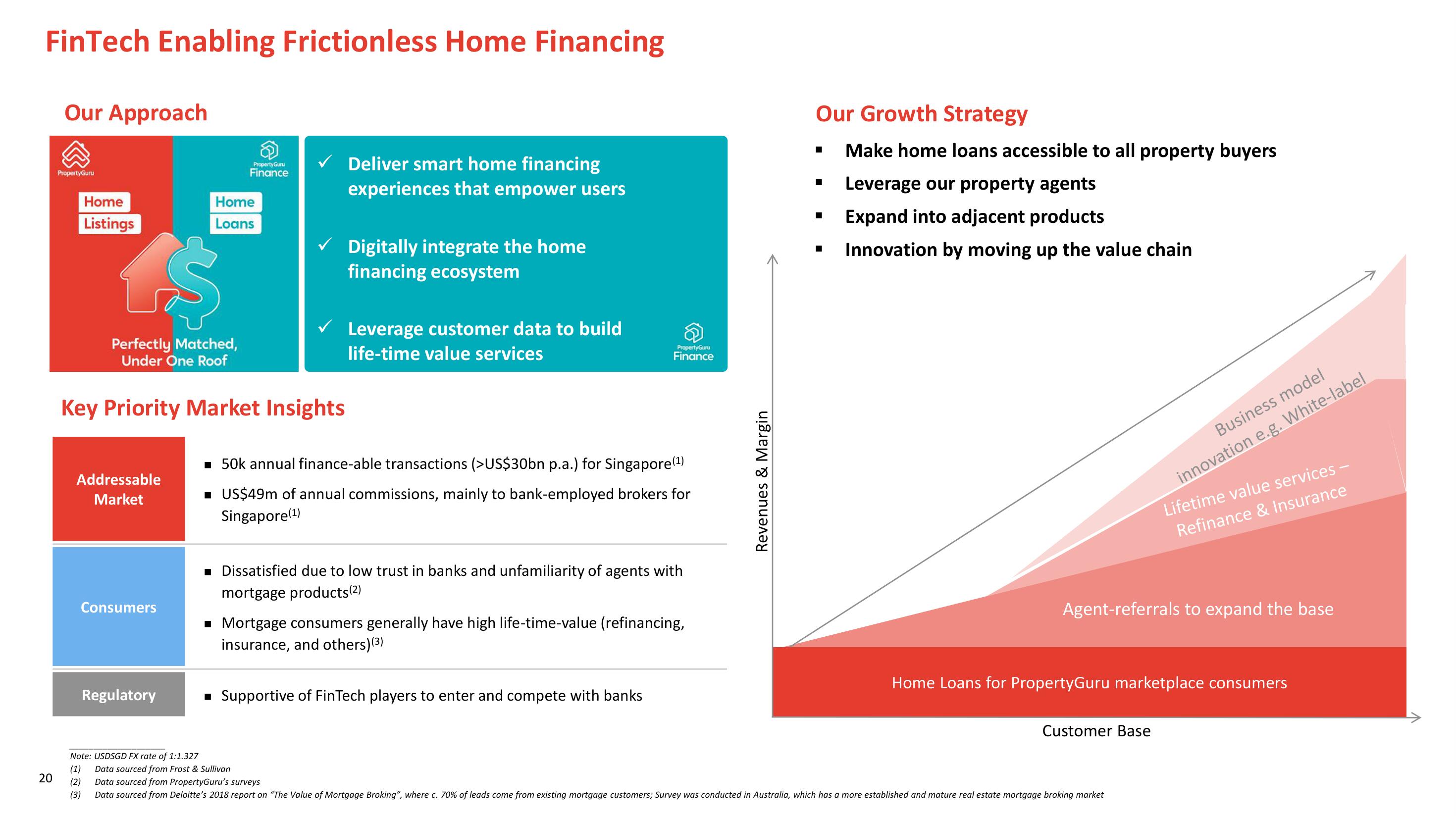

FinTech Enabling Frictionless Home Financing

20

Our Approach

PropertyGuru

Home

Listings

Addressable

Market

Consumers

Regulatory

PropertyGuru

Finance

Home

Loans

L$

Perfectly Matched,

Under One Roof

Key Priority Market Insights

✓ Deliver smart home financing

experiences that empower users

✓ Digitally integrate the home

financing ecosystem

✓ Leverage customer data to build

life-time value services

Note: USDSGD FX rate of 1:1.327

(1) Data sourced from Frost & Sullivan

(2)

(3)

■ 50k annual finance-able transactions (>US$30bn p.a.) for Singapore (¹)

■ US$49m of annual commissions, mainly to bank-employed brokers for

Singapore (¹)

PropertyGuru

Finance

■ Dissatisfied due to low trust in banks and unfamiliarity of agents with

mortgage products(2)

■ Mortgage consumers generally have high life-time-value (refinancing,

insurance, and others)(3)

■ Supportive of FinTech players to enter and compete with banks

& Margin

Revenues

Our Growth Strategy

Make home loans accessible to all property buyers

Leverage our property agents

Expand into adjacent products

Innovation by moving up the value chain

■

I

Business model

innovation e.g. White-label

Agent-referrals to expand the base

Customer Base

Lifetime value services -

Refinance & Insurance

Home Loans for PropertyGuru marketplace consumers

Data sourced from PropertyGuru's surveys

Data sourced from Deloitte's 2018 report on "The Value of Mortgage Broking", where c. 70% of leads come from existing mortgage customers; Survey was conducted in Australia, which has a more established and mature real estate mortgage broking marketView entire presentation