Allego SPAC Presentation Deck

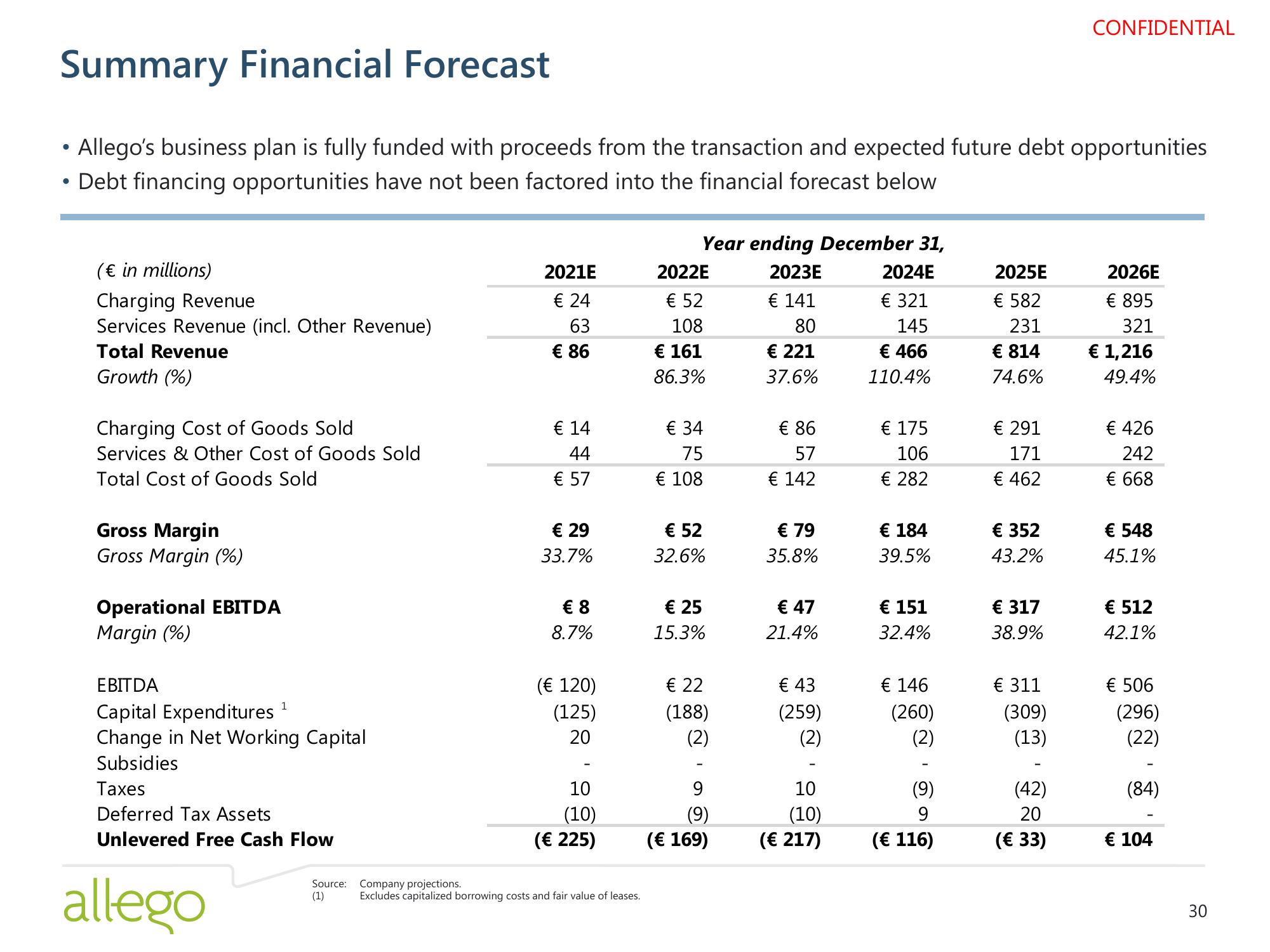

Summary Financial Forecast

• Allego's business plan is fully funded with proceeds from the transaction and expected future debt opportunities

Debt financing opportunities have not been factored into the financial forecast below

●

(€ in millions)

Charging Revenue

Services Revenue (incl. Other Revenue)

Total Revenue

Growth (%)

Charging Cost of Goods Sold

Services & Other Cost of Goods Sold

Total Cost of Goods Sold

Gross Margin

Gross Margin (%)

Operational EBITDA

Margin (%)

EBITDA

Capital Expenditures

Change in Net Working Capital

Subsidies

Taxes

Deferred Tax Assets

Unlevered Free Cash Flow

allego

1

Source:

(1)

2021E

€ 24

63

€ 86

€ 14

44

€ 57

€ 29

33.7%

€ 8

8.7%

(€ 120)

(125)

20

10

(10)

(€ 225)

Company projections.

Excludes capitalized borrowing costs and fair value of leases.

Year ending December 31,

2023E

€ 141

80

€ 221

37.6%

2022E

€ 52

108

€ 161

86.3%

€ 34

75

€ 108

€ 52

32.6%

€ 25

15.3%

€ 22

(188)

(2)

9

(9)

(€ 169)

€ 86

57

€ 142

€ 79

35.8%

€ 47

21.4%

€ 43

(259)

(2)

10

(10)

(€ 217)

2024E

€ 321

145

€ 466

110.4%

€ 175

106

€ 282

€ 184

39.5%

€ 151

32.4%

€ 146

(260)

(2)

(9)

9

(€ 116)

2025E

€ 582

231

€ 814

74.6%

€ 291

171

€ 462

€ 352

43.2%

€ 317

38.9%

€ 311

(309)

(13)

CONFIDENTIAL

(42)

20

(€ 33)

2026E

€ 895

321

€ 1,216

49.4%

€ 426

242

€ 668

€ 548

45.1%

€ 512

42.1%

€ 506

(296)

(22)

(84)

€ 104

30View entire presentation