Bakkt Results Presentation Deck

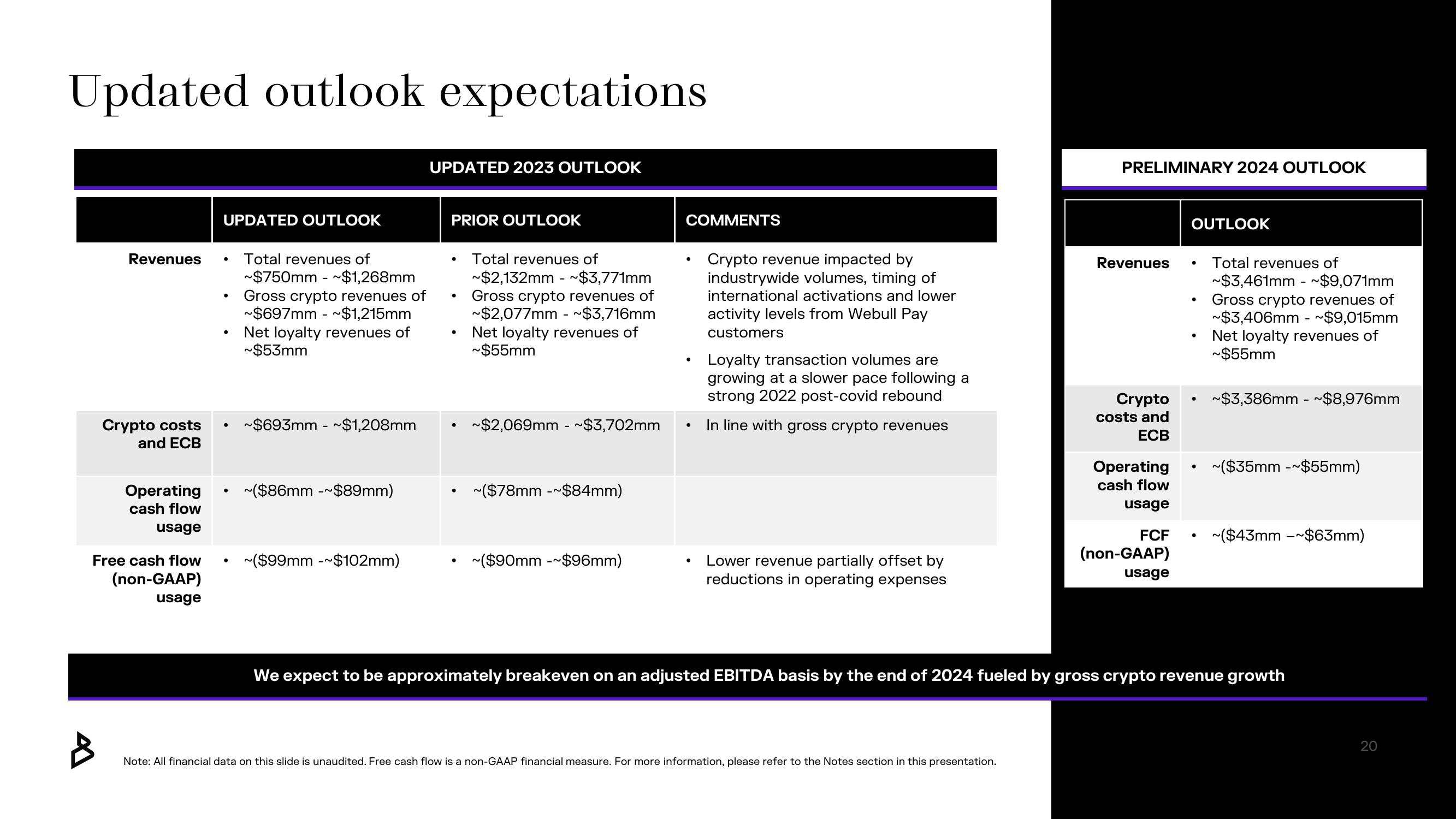

Updated outlook expectations

Revenues

Crypto costs

and ECB

Operating

cash flow

usage

Free cash flow

(non-GAAP)

usage

UPDATED OUTLOOK

●

●

Total revenues of

~$750mm - ~$1,268mm

Gross crypto revenues of

~$697mm - ~$1,215mm

Net loyalty revenues of

~$53mm

~$693mm - ~$1,208mm

~($86mm -~$89mm)

~($99mm -~$102mm)

UPDATED 2023 OUTLOOK

PRIOR OUTLOOK

●

●

●

Total revenues of

~$2,132mm - ~$3,771mm

Gross crypto revenues of

~$2,077mm - ~$3,716mm

Net loyalty revenues of

~$55mm

~$2,069mm - ~$3,702mm

~($78mm -~$84mm)

~($90mm -~$96mm)

COMMENTS

●

●

Crypto revenue impacted by

industrywide volumes, timing of

international activations and lower

activity levels from Webull Pay

customers

Loyalty transaction volumes are

growing at a slower pace following a

strong 2022 post-covid rebound

In line with gross crypto revenues

Lower revenue partially offset by

reductions in operating expenses

PRELIMINARY 2024 OUTLOOK

Note: All financial data on this slide is unaudited. Free cash flow is a non-GAAP financial measure. For more information, please refer to the Notes section in this presentation.

Revenues

Crypto

costs and

ECB

Operating

cash flow

usage

FCF

(non-GAAP)

usage

OUTLOOK

●

●

●

●

Total revenues of

~$3,461mm - ~$9,071mm

Gross crypto revenues of

~$3,406mm - ~$9,015mm

Net loyalty revenues of

~$55mm

~$3,386mm - ~$8,976mm

~($35mm -~$55mm)

~($43mm -~$63mm)

We expect to be approximately breakeven on an adjusted EBITDA basis by the end of 2024 fueled by gross crypto revenue growth

20View entire presentation