Altus Power Results Presentation Deck

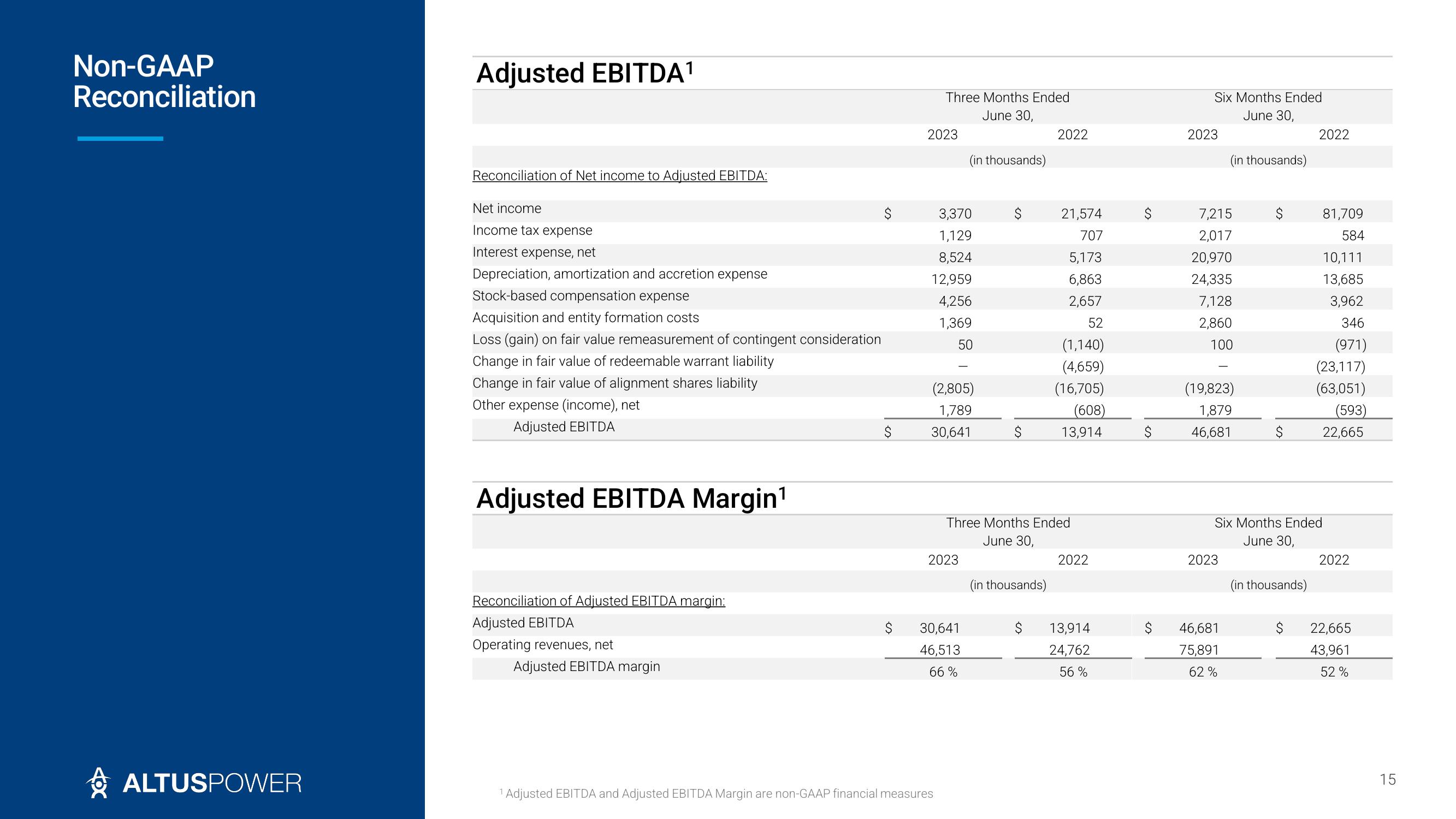

Non-GAAP

Reconciliation

ALTUSPOWER

Adjusted EBITDA¹

Reconciliation of Net income to Adjusted EBITDA:

Net income

Income tax expense

Interest expense, net

Depreciation, amortization and accretion expense

Stock-based compensation expense

Acquisition and entity formation costs

Loss (gain) on fair value remeasurement of contingent consideration

Change in fair value of redeemable warrant liability

Change in fair value of alignment shares liability

Other expense (income), net

Adjusted EBITDA

Adjusted EBITDA Margin¹

Reconciliation of Adjusted EBITDA margin:

Adjusted EBITDA

Operating revenues, net

Adjusted EBITDA margin

Three Months Ended

June 30,

2023

3,370

1,129

8,524

12,959

4,256

1,369

50

(2,805)

1,789

30,641

(in thousands)

2023

1 Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures

30,641

46,513

66%

2022

(in thousands)

21,574

707

5,173

6,863

2,657

Three Months Ended

June 30,

52

(1,140)

(4,659)

(16,705)

(608)

13,914

2022

13,914

24,762

56%

Six Months Ended

June 30,

2023

7,215

2,017

20,970

24,335

7,128

2,860

100

(in thousands)

(19,823)

1,879

46,681

2023

46,681

75,891

62 %

$

Six Months Ended

June 30,

2022

(in thousands)

81,709

584

10,111

13,685

3,962

346

(971)

(23,117)

(63,051)

(593)

22,665

2022

22,665

43,961

52 %

15View entire presentation