Affirm Results Presentation Deck

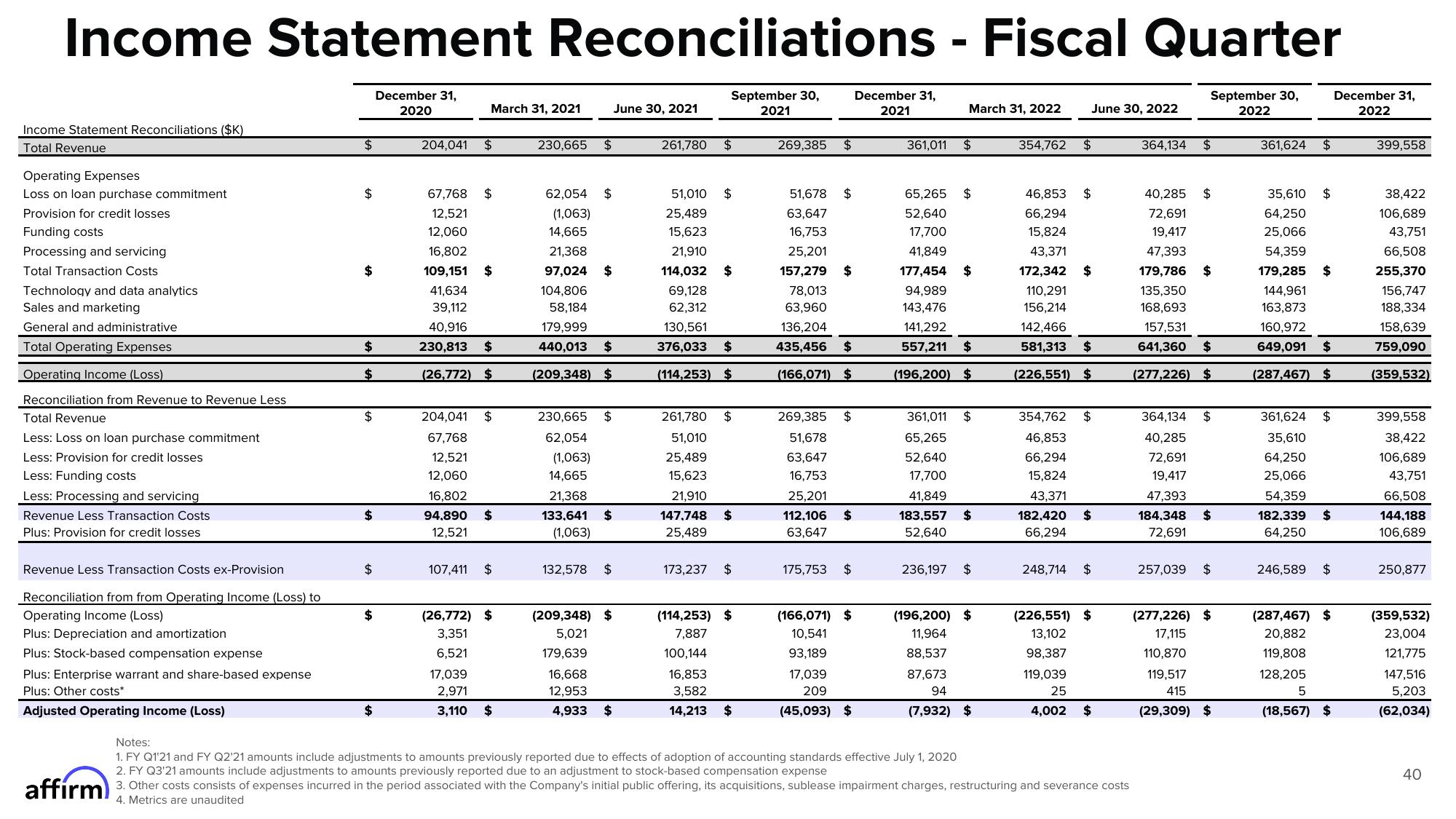

Income Statement Reconciliations

December 31,

2020

September 30,

2021

Income Statement Reconciliations ($K)

Total Revenue

Operating Expenses

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Total Operating Expenses

Operating Income (Loss)

Reconciliation from Revenue to Revenue Less

Total Revenue

Less: Loss on loan purchase commitment

Less: Provision for credit losses

Less: Funding costs

Less: Processing and servicing

Revenue Less Transaction Costs

Plus: Provision for credit losses

Revenue Less Transaction Costs ex-Provision

Reconciliation from from Operating Income (Loss) to

Operating Income (Loss)

Plus: Depreciation and amortization

Plus: Stock-based compensation expense

Plus: Enterprise warrant and share-based expense

Plus: Other costs*

Adjusted Operating Income (Loss)

$

$

$

$

$

$

$

$

$

March 31, 2021

204,041 $

67,768

12,521

12,060

16,802

109,151 $

41,634

39,112

40,916

230,813

$

(26,772) $

$

204,041 $

67,768

12,521

12,060

16,802

94,890 $

12,521

107,411 $

(26,772) $

3,351

6,521

17,039

2,971

3,110 $

230,665

$

62,054

(1,063)

14,665

21,368

97,024

104,806

58,184

179,999

440,013 $

(209,348) $

$

June 30, 2021

$

230,665 $

62,054

(1,063)

14,665

21,368

133,641 $

(1,063)

132,578 $

(209,348) $

5,021

179,639

16,668

12,953

4,933 $

261,780 $

$

51,010

25,489

15,623

21,910

114,032

69,128

62,312

130,561

376,033 $

(114,253) $

$

261,780 $

51,010

25,489

15,623

21,910

147,748 $

25,489

173,237 $

(114,253) $

7,887

100,144

16.853

3,582

14,213 $

269,385

$

51,678 $

63,647

16,753

25,201

157,279

78,013

63,960

136,204

435,456 $

(166,071) $

$

269,385 $

51,678

63,647

16,753

25,201

112,106 $

63,647

175,753 $

(166,071) $

10,541

93,189

17,039

209

(45,093) $

December 31,

2021

361,011

-

361,011

65,265

52,640

17,700

March 31, 2022

$

65,265

52,640

17,700

41,849

177,454 $

94,989

143,476

141,292

557,211 $

(196,200) $

$

$

41,849

183,557 $

52,640

236,197 $

Fiscal Quarter

September 30,

2022

(196,200) $

11,964

88,537

87,673

94

(7,932) $

June 30, 2022

354,762 $

46,853 $

66,294

15,824

43,371

172,342

110,291

156,214

142,466

581,313 $

(226,551) $

$

354,762 $

46,853

66,294

15,824

248,714

43,371

182,420 $

66,294

$

(226,551) $

13,102

98,387

119,039

25

4,002

$

Notes:

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020

2. FY Q3'21 amounts include adjustments to amounts previously reported due to an adjustment to stock-based compensation expense

affirm) 3. Other costs consists of expenses incurred in the period associated with the Company's initial public offering, its acquisitions, sublease impairment charges, restructuring and severance costs

4. Metrics are unaudited

364,134

$

40,285 $

72,691

19,417

47,393

179,786

135,350

168,693

157,531

641,360 $

(277,226) $

$

364,134 $

40,285

72,691

19,417

47,393

184,348 $

72,691

257,039 $

(277,226) $

17,115

110,870

119,517

415

(29,309) $

361,624

$

35,610

64,250

25,066

54,359

179,285

144,961

163,873

160,972

649,091

$

(287,467) $

$

$

361,624 $

35,610

64,250

25,066

54,359

182,339 $

64,250

246,589 $

(287,467) $

20,882

119,808

128,205

5

(18,567) $

December 31,

2022

399,558

38,422

106,689

43,751

66,508

255,370

156,747

188,334

158,639

759,090

(359,532)

399,558

38,422

106,689

43,751

66,508

144,188

106,689

250,877

(359,532)

23,004

121,775

147,516

5,203

(62,034)

40View entire presentation