WeWork Restructuring Presentation Deck

Transaction Term Sheet (Cont'd)

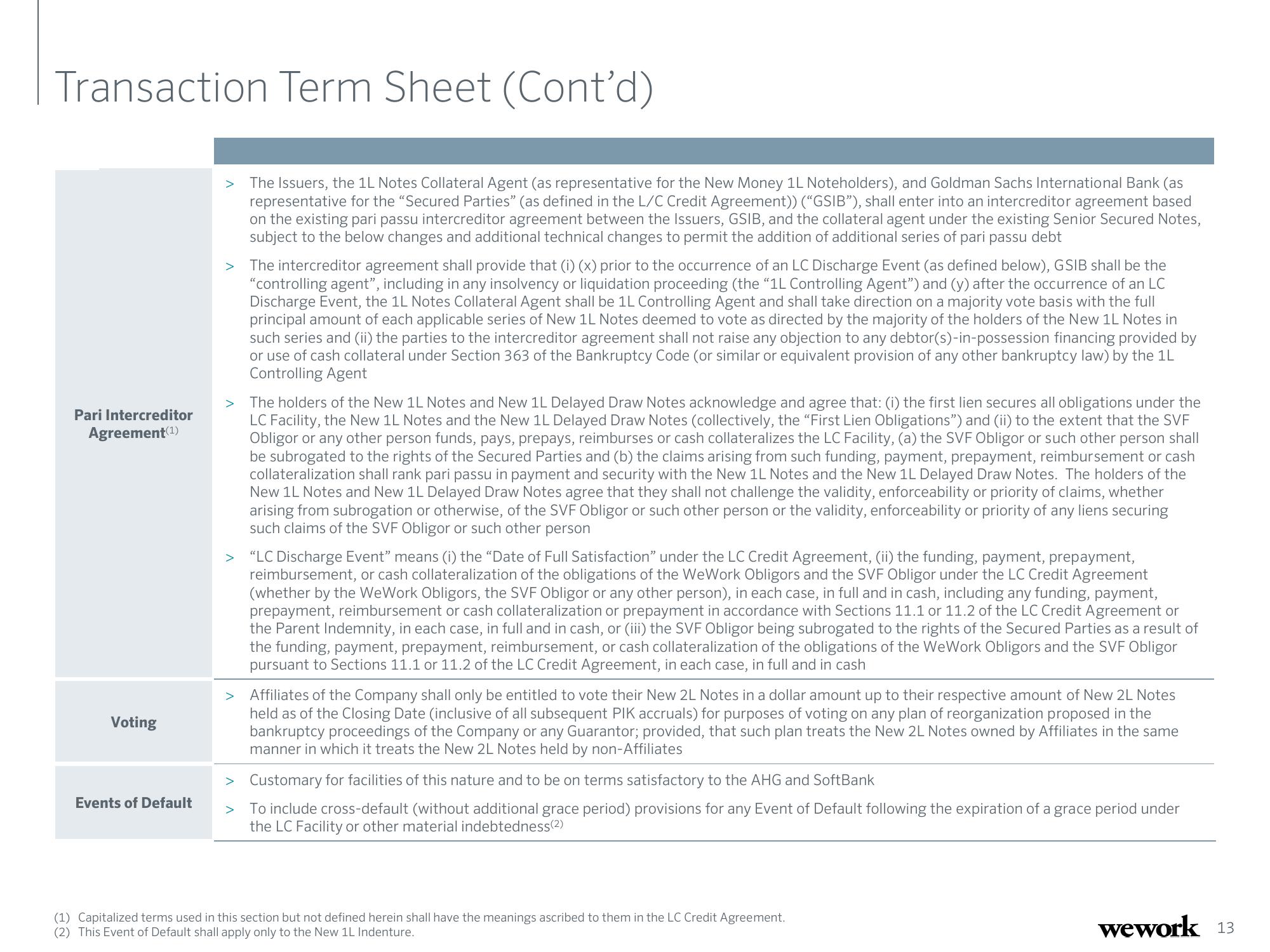

Pari Intercreditor

Agreement (¹)

Voting

Events of Default

The Issuers, the 1L Notes Collateral Agent (as representative for the New Money 1L Noteholders), and Goldman Sachs International Bank (as

representative for the "Secured Parties" (as defined in the L/C Credit Agreement)) ("GSIB"), shall enter into an intercreditor agreement based

on the existing pari passu intercreditor agreement between the Issuers, GSIB, and the collateral agent under the existing Senior Secured Notes,

subject to the below changes and additional technical changes to permit the addition of additional series of pari passu debt

> The intercreditor agreement shall provide that (i) (x) prior to the occurrence of an LC Discharge Event (as defined below), GSIB shall be the

"controlling agent", including in any insolvency or liquidation proceeding (the "1L Controlling Agent") and (y) after the occurrence of an LC

Discharge Event, the 1L Notes Collateral Agent shall be 1L Controlling Agent and shall take direction on a majority vote basis with the full

principal amount of each applicable series of New 1L Notes deemed to vote as directed by the majority of the holders of the New 1L Notes in

such series and (ii) the parties to the intercreditor agreement shall not raise any objection to any debtor(s)-in-possession financing provided by

or use of cash collateral under Section 363 of the Bankruptcy Code (or similar or equivalent provision of any other bankruptcy law) by the 1L

Controlling Agent

The holders of the New 1L Notes and New 1L Delayed Draw Notes acknowledge and agree that: (i) the first lien secures all obligations under the

LC Facility, the New 1L Notes and the New 1L Delayed Draw Notes (collectively, the "First Lien Obligations") and (ii) to the extent that the SVF

Obligor or any other person funds, pays, prepays, reimburses or cash collateralizes the LC Facility, (a) the SVF Obligor or such other person shall

be subrogated to the rights of the Secured Parties and (b) the claims arising from such funding, payment, prepayment, reimbursement or cash

collateralization shall rank pari passu in payment and security with the New 1L Notes and the New 1L Delayed Draw Notes. The holders of the

New 1L Notes and New 1L Delayed Draw Notes agree that they shall not challenge the validity, enforceability or priority of claims, whether

arising from subrogation or otherwise, of the SVF Obligor or such other person or the validity, enforceability or priority of any liens securing

such claims of the SVF Obligor or such other person

> "LC Discharge Event" means (i) the "Date of Full Satisfaction" under the LC Credit Agreement, (ii) the funding, payment, prepayment,

reimbursement, or cash collateralization of the obligations of the WeWork Obligors and the SVF Obligor under the LC Credit Agreement

(whether by the WeWork Obligors, the SVF Obligor or any other person), in each case, in full and in cash, including any funding, payment,

prepayment, reimbursement or cash collateralization or prepayment in accordance with Sections 11.1 or 11.2 of the LC Credit Agreement or

the Parent Indemnity, in each case, in full and in cash, or (iii) the SVF Obligor being subrogated to the rights of the Secured Parties as a result of

the funding, payment, prepayment, reimbursement, or cash collateralization of the obligations of the WeWork Obligors and the SVF Obligor

pursuant to Sections 11.1 or 11.2 of the LC Credit Agreement, in each case, in full and in cash

Affiliates of the Company shall only be entitled to vote their New 2L Notes in a dollar amount up to their respective amount of New 2L Notes

held as of the Closing Date (inclusive of all subsequent PIK accruals) for purposes of voting on any plan of reorganization proposed in the

bankruptcy proceedings of the Company or any Guarantor; provided, that such plan treats the New 2L Notes owned by Affiliates in the same

manner in which it treats the New 2L Notes held by non-Affiliates

> Customary for facilities of this nature and to be on terms satisfactory to the AHG and SoftBank

>

To include cross-default (without additional grace period) provisions for any Event of Default following the expiration of a grace period under

the LC Facility or other material indebtedness (2)

(1) Capitalized terms used in this section but not defined herein shall have the meanings ascribed to them in the LC Credit Agreement.

(2) This Event of Default shall apply only to the New 1L Indenture.

wework 13View entire presentation