Servicing Portfolio Growth Deck

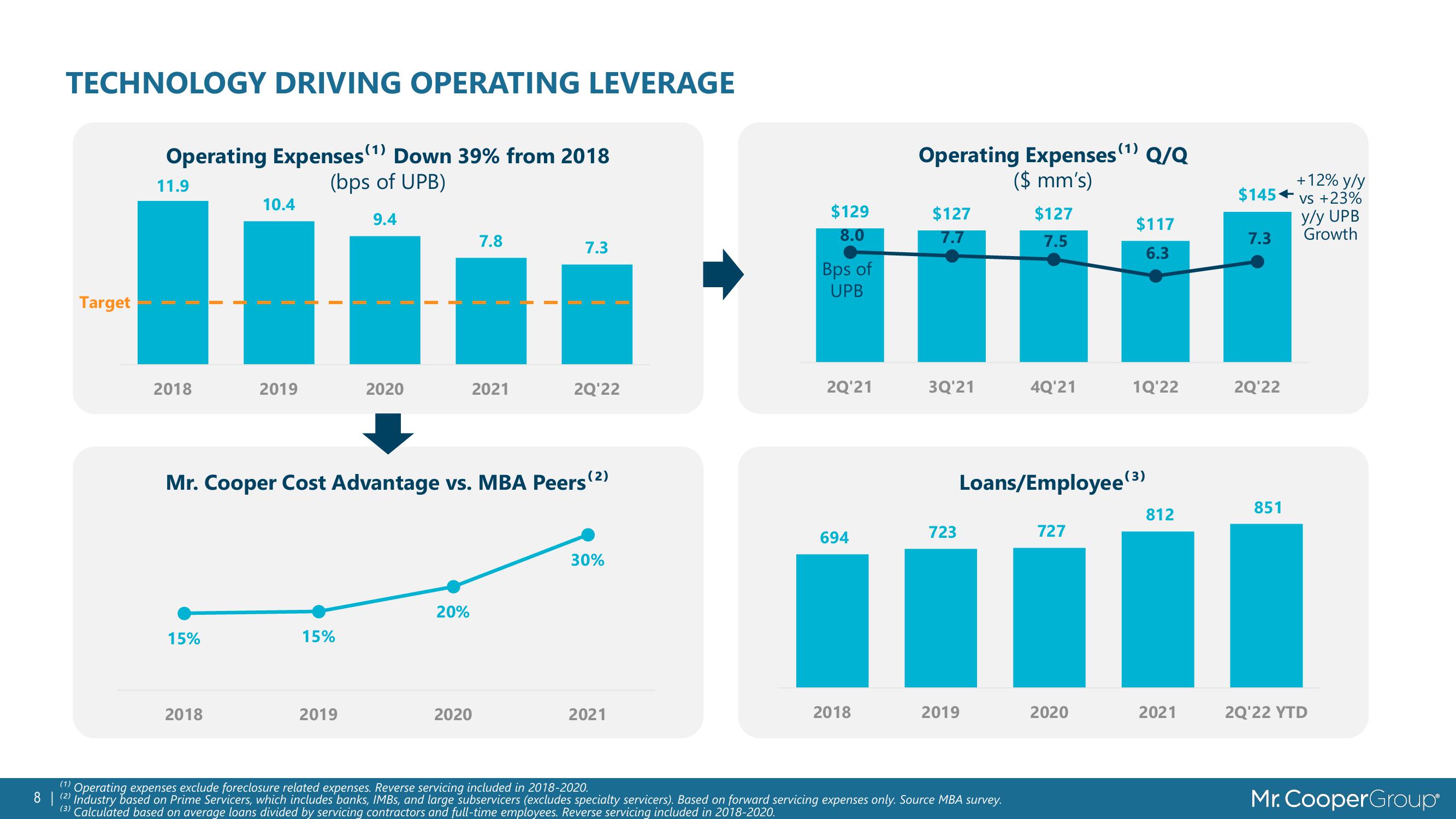

TECHNOLOGY DRIVING OPERATING LEVERAGE

Target

Operating Expenses (¹) Down 39% from 2018

(bps of UPB)

9.4

11.9

2018

15%

10.4

2018

2019

15%

2020

2019

Mr. Cooper Cost Advantage vs. MBA Peers (2)

20%

7.8

2021

2020

7.3

2Q'22

30%

2021

$129

8.0

Bps of

UPB

2Q¹21

694

2018

Operating Expenses (¹) Q/Q

($ mm's)

$127

7.7

3Q'21

723

2019

$127

7.5

(1) Operating expenses exclude foreclosure related expenses. Reverse servicing included in 2018-2020.

8 (2) Industry based on Prime Servicers, which includes banks, IMBS, and large subservicers (excludes specialty servicers). Based on forward servicing expenses only. Source MBA survey.

(3) Calculated based on average loans divided by servicing contractors and full-time employees. Reverse servicing included in 2018-2020.

4Q'21

Loans/Employee (3

727

$117

6.3

2020

1Q'22

812

2021

$145+

7.3

2Q'22

851

+12% y/y

vs +23%

y/y UPB

Growth

2Q'22 YTD

Mr. CooperGroupView entire presentation