Bank of America Investment Banking Pitch Book

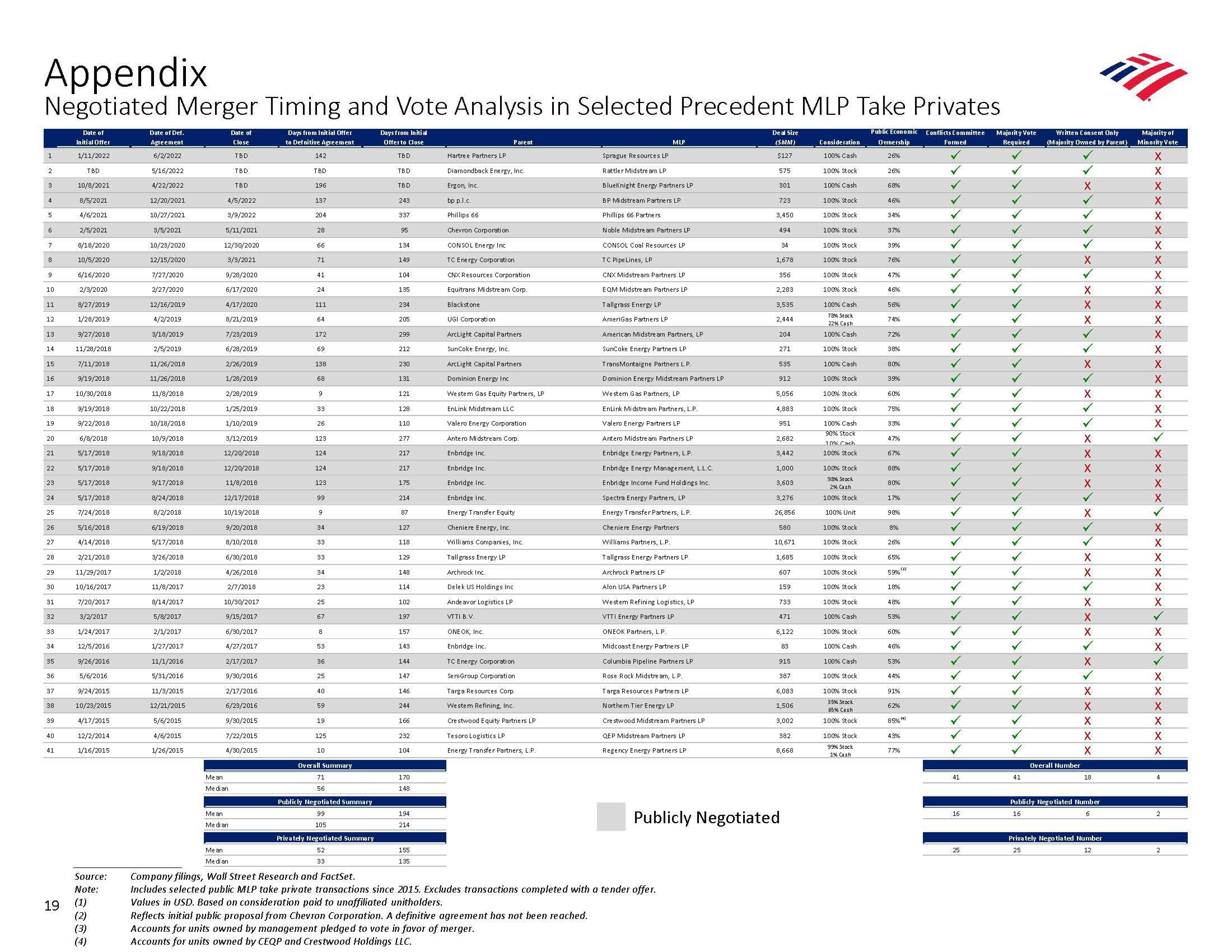

Appendix

Negotiated Merger Timing and Vote Analysis in Selected Precedent MLP Take Privates

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18.

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

19

Date of

Initial Offer

1/11/2022

TBD

10/8/2021

8/5/2021

4/6/2021

2/5/2021

8/18/2020

10/5/2020

6/16/2020

2/3/2020

8/27/2019

1/28/2019

9/27/2018

11/28/2018

7/11/2018

9/19/2018

10/30/2018

9/19/2018

9/22/2018

6/8/2018

5/17/2018

5/17/2018

5/17/2018

5/17/2018

7/24/2018

5/16/2018

4/14/2018

2/21/2018

11/29/2017

10/16/2017

7/20/2017

3/2/2017

1/24/2017

12/5/2016

9/26/2016

5/6/2016

9/24/2015

10/23/2015

4/17/2015

12/2/2014

1/16/2015

Source:

Note:

(1)

(2)

(3)

(4)

Date of Def.

Agreement

6/2/2022

5/16/2022

4/22/2022

12/20/2021

10/27/2021

3/5/2021

10/23/2020

12/15/2020

7/27/2020

2/27/2020

12/16/2019

4/2/2019

3/18/2019

2/5/2019

11/26/2018

11/26/2018.

11/8/2018

10/22/2018

10/18/2018

10/9/2018

9/18/2018

9/18/2018

9/17/2018

8/24/2018

8/2/2018

6/19/2018

5/17/2018

3/26/2018

1/2/2018

11/8/2017

8/14/2017

5/8/2017

2/1/2017

1/27/2017

11/1/2016

5/31/2016

11/3/2015

12/21/2015

5/6/2015

4/6/2015

1/26/2015

Me an

Median

TBD

4/5/2022

3/9/2022

5/11/2021

12/30/2020

3/3/2021

9/28/2020

6/17/2020

4/17/2020

8/21/2019

7/23/2019

6/28/2019

2/26/2019

1/28/2019

2/28/2019

1/25/2019

1/10/2019

3/12/2019

12/20/2018

12/20/2018

11/8/2018

12/17/2018

10/19/2018

9/20/2018

8/10/2018

6/30/2018

4/26/2018

2/7/2018

10/30/2017

9/15/2017

6/30/2017

4/27/2017

2/17/2017

9/30/2016

2/17/2016

6/23/2016

9/30/2015

7/22/2015

4/30/2015

Me an

Me di an

Date of

Close

TBD

Me an

Median

TBD

Days from Initial Offer

to Defnitive Agreement

142

TBD

196

137

204

28

66

71

41

24

111

64

172

69

138.

68

9

33

26

123

124

124

123

99

9

34

33

33

34

23

25

67

8

53

36

25

40

59

19

125

10

Overall Summary

71

56

Publicly Negotiated Summary

99

105

Privately Negotiated Summary

52

33

Days from Initial

Offer to Close

TBD

TBD

TBD

243

337

95

134

149

104

135

234

205

299

212

230

131

121

128

110

277

217

217

175

214

87

127

118

129

148

114

102

197

157

143

144

147

146

244

166

232

104

170

148

194

214

155

135.

Hartree Partners LP

Diamondback Energy, Inc.

Ergon, Inc.

bp p.l.c.

Phillips 66

Chevron Corporation.

CONSOL Energy Inc

TC Energy Corporation.

CNX Resources Corporation

Equitrans Midstream Corp.

Blackstone

UGI Corporation

ArcLight Capital Partners

SunCoke Energy, Inc.

ArcLight Capital Partners.

Dominion Energy Inc

Westem Gas Equity Partners, LP

Parent

EnLink Midstream LLC

Valero Energy Corporation

Antero Midstream Corp.

Enbridge Inc.

Enbridge Inc.

Enbridge Inc.

Enbridge Inc.

Energy Transfer Equity

Cheniere Energy, Inc.

Williams Companies, Inc.

Tallgrass Energy LP

Archrock Inc.

Delek US Holdings Inc

Andeavor Logistics LP

VTTI B.V.

ONE OK, Inc.

Enbridge Inc.

TC Energy Corporation

SemGroup Corporation

Targa Resources Corp.

Westem Refining, Inc.

Crestwood Equity Partners LP

Tesoro Logistics LP

Energy Transfer Partners, L.P.

Accounts for units owned by management pledged to vote in favor of merger.

Accounts for units owned by CEQP and Crestwood Holdings LLC.

MLP

Sprague Resources LP

Rattler Midstre am LP

BlueKnight Energy Partners LP.

BP Midstream Partners LP

Phillips 66 Partners

Noble Midstre am Partners LP

CONSOL Coal Resources LP

TC Pipe Lines, LP

CNX Midstream Partners LP

EQM Midstre am Partners LP

Tallgrass Energy LP

AmeriGas Partners LP

American Midstre am Partners, LP

SunCoke Energy Partners LP

TransMontaigne Partners L.P.

Dominion Energy Midstream Partners LP

Westem Gas Partners, LP

EnLink Midstre am Partners, L.P.

Valero Energy Partners LP

Antero Midstre am Partners LP

Enbridge Energy Partners, L.P.

Enbridge Energy Management, L.L.C.

Enbridge Income Fund Holdings Inc.

Spectra Energy Partners, LP

Energy Transfer Partners, L. P.

Cheniere Energy Partners

Williams Partners, L.P.

Tallgrass Energy Partners LP.

Archrock Partners LP

Alon USA Partners LP

Westem Refining Logistics, LP

VTTI Energy Partners LP

ONEOK Partners, L.P.

Midcoast Energy Partners LP

Columbia Pipeline Partners LP

Rose Rock Midstre am, L.P.

Targa Resources Partners LP

Northem Tier Energy LP

Crestwood Midstream Partners LP

QEP Midstream Partners LP

Regency Energy Partners LP

Company filings, Wall Street Research and FactSet.

Includes selected public MLP take private transactions since 2015. Excludes transactions completed with a tender offer.

Values in USD. Based on consideration paid to unaffiliated unitholders.

Reflects initial public proposal from Chevron Corporation. A definitive agreement has not been reached.

Deal Size

(SMM)

$127

575

301

723

3,450

494

34

1,678

356

2,283

3,535

2,444

204

271

535

912

5,056

4,883

951

2,682

3,442

1,000

3,603

3,276

26,856

580

10,671

1,685

607

159

733

471

6,122

83

915

387

6,083

1,506

3,002

382

8,668

Publicly Negotiated

Consideration

100% Cash

100% Stock

100% Cash

100% Stock

100% Stock

100% Stock

100% Stock

100% Stock

100% Stock

100% Stock

100% Cash

78% Stock

22% Cash

100% Cash

100% Stock

100% Cash

100% Stock

100% Stock

100% Stock

100% Cash

90% Stock

10% Cash

100% Stock

100% Stock

98% Stock

2% Cash

100% Stock

100% Unit

100% Stock

100% Stock

100% Stock

100% Stock

100% Stock

100% Stock

100% Cash

100% Stock

100% Cash

100% Cash

100% Stock

100% Stock

35% Stock

65% Cash

100% Stock

100% Stock

99% Stack

1% Cash

Public Economic

Ownership

26%

26%

68%

46%

34%

37%

39%

76%

47%

46%

56%

74%

72%

38%

80%

39%

60%

75%

33%

47%

67%

88%

80%

17%

98%

8%

26%

65%

5.9%)

18%

48%

53%

60%

46%

5.3%

44%

91%

62%

85%

43%

77%

Conflicts Committee

Formed

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

41

16

25

Majority Vote

Required

✓

✓

✓

✓

✓

✓

✓

41

Written consent Only

(Majority Owned by Parent)

Overall Number

X

✓

✓

X

✓

X

X

X

✓

✓

X

X

✓

✓

X

X

X

X

✓

X

✓

✓

X

X

✓

X

X

X

✓

X

✓

X

X

X

X

X

18

Publicly Negotiated Number

16

6

Privately Negotiated Number

12

25

Majority of

Minority Vote

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

✓

X

X

X

X

✓

X

X

X

X

X

X

✓

X

X

✓

X

X

X

X

X

X

4

2

2View entire presentation