J.P.Morgan Investment Banking Pitch Book

PRELIMINARY VALUATION ANALYSIS

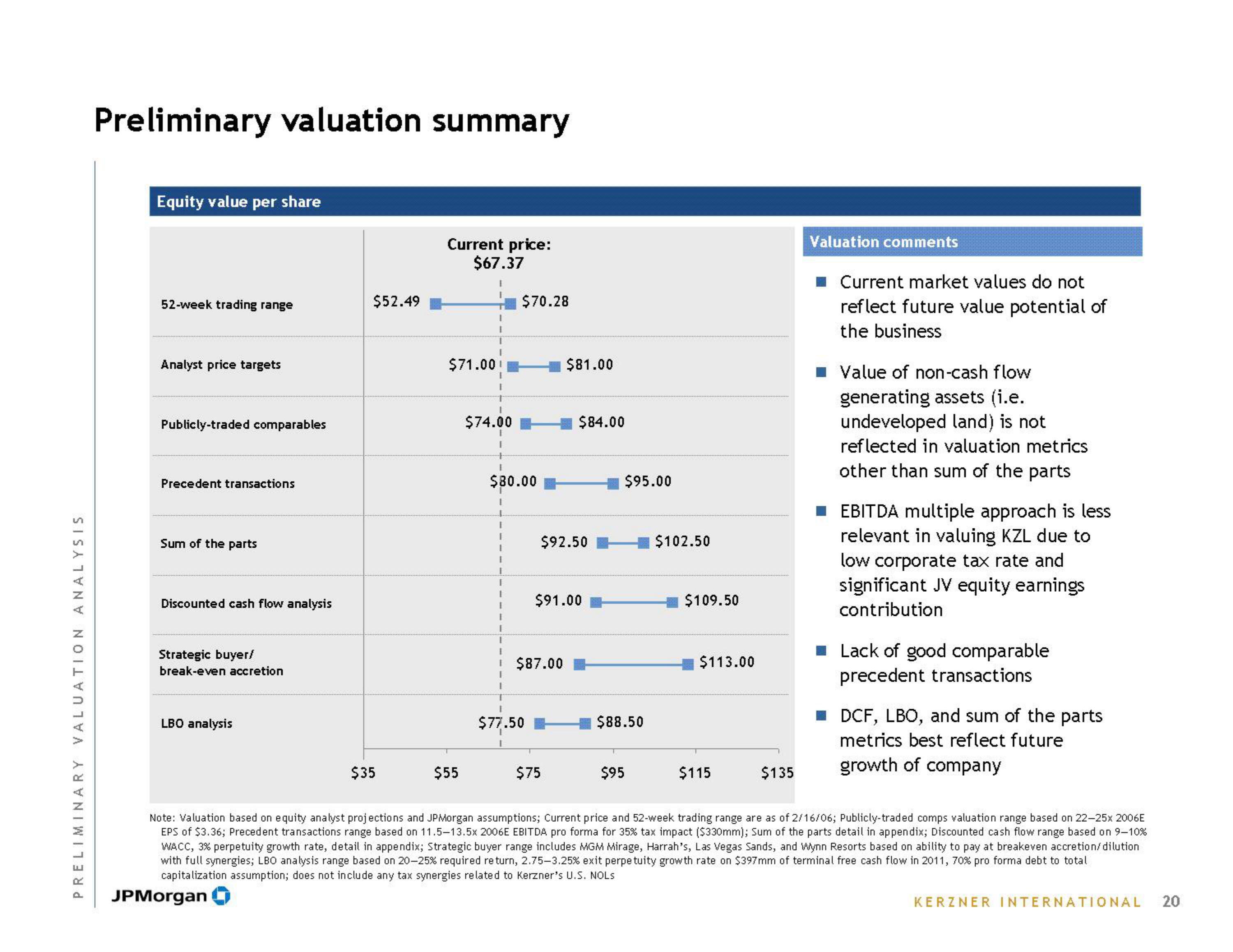

Preliminary valuation summary

Equity value per share

52-week trading range

Analyst price targets

Publicly-traded comparables

Precedent transactions

Sum of the parts

Discounted cash flow analysis

Strategic buyer/

break-even accretion

LBO analysis

$52.49

$35

Current price:

$67.37

$71.00

$55

$74.00

I

$70.28

I

$80.00

I

↓

I

1

$77.50

$87.00

$81.00

$92.50

$84.00

$91.00

$75

$95.00

$88.50

$95

$102.50

$109.50

$113.00

$115

$135

Valuation comments

■ Current market values do not

reflect future value potential of

the business

■ Value of non-cash flow

generating assets (i.e.

undeveloped land) is not

reflected in valuation metrics

other than sum of the parts

EBITDA multiple approach is less

relevant in valuing KZL due to

low corporate tax rate and

significant JV equity earnings

contribution

Lack of good comparable

precedent transactions

■ DCF, LBO, and sum of the parts

metrics best reflect future

growth of company

Note: Valuation based on equity analyst projections and JPMorgan assumptions; Current price and 52-week trading range are as of 2/16/06; Publicly-traded comps valuation range based on 22-25x 2006E

EPS of $3.36; Precedent transactions range based on 11.5-13.5x 2006E EBITDA pro forma for 35% tax impact ($330mm); Sum of the parts detail in appendix; Discounted cash flow range based on 9-10%

WACC, 3% perpetuity growth rate, detail in appendix; Strategic buyer range includes MGM Mirage, Harrah's, Las Vegas Sands, and Wynn Resorts based on ability to pay at breakeven accretion/dilution

with full synergies; LBO analysis range based on 20-25% required return, 2.75-3.25 % exit perpe tuity growth rate on $397mm of terminal free cash flow in 2011, 70% pro forma debt to total

capitalization assumption; does not include any tax synergies related to Kerzner's U.S. NOLS

JPMorgan

KERZNER INTERNATIONAL

20View entire presentation