PJT Partners Investment Banking Pitch Book

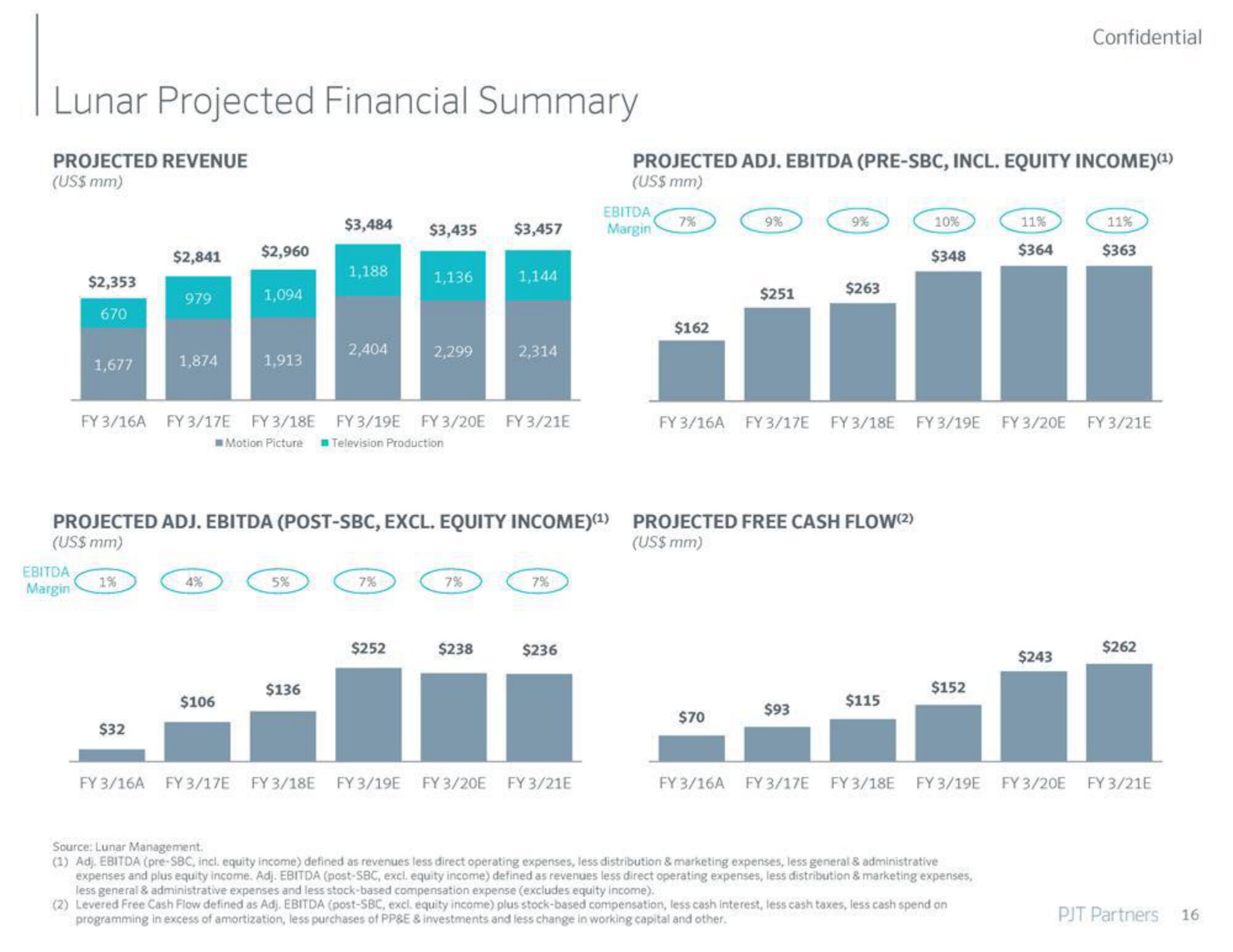

Lunar Projected Financial Summary

PROJECTED REVENUE

(US$ mm)

$2,353

670

EBITDA

Margin

1,677

$2,841

1%

979

$32

1,874

$2,960

4%

1,094

$106

1,913

$3,484

5%

1,188

$136

2,404

FY 3/16A FY 3/17E FY 3/18E FY 3/19E FY 3/20E FY3/21E

Motion Picture Television Production

$3,435 $3,457

7%

1,136

$252

2,299

1,144

7%

2,314

PROJECTED ADJ. EBITDA (POST-SBC, EXCL. EQUITY INCOME) (¹) PROJECTED FREE CASH FLOW(2)

(US$ mm)

(US$ mm)

$238

7%

$236

FY 3/16A FY 3/17E FY 3/18E FY 3/19E FY 3/20E FY 3/21E

PROJECTED ADJ. EBITDA (PRE-SBC, INCL. EQUITY INCOME)(¹)

(US$ mm)

EBITDA

Margin

7%

$162

9%

$251

$70

9%

$263

$93

10%

$348

FY 3/16A FY 3/17E FY 3/18E FY 3/19E FY 3/20E FY3/21E

$115

$152

11%

$364

Confidential

Source: Lunar Management.

(1) Adj. EBITDA (pre-S8C, incl. equity income) defined as revenues less direct operating expenses, less distribution & marketing expenses, less general & administrative

expenses and plus equity income. Adj. EBITDA (post-SBC, excl. equity income) defined as revenues less direct operating expenses, less distribution & marketing expenses,

less general & administrative expenses and less stock-based compensation expense (excludes equity income).

(2) Levered Free Cash Flow defined as Adj. EBITDA (post-SBC, excl. equity income) plus stock-based compensation, less cash interest, less cash taxes, less cash spend on

programming in excess of amortization, less purchases of PP&E & investments and less change in working capital and other.

$243

11%

$363

$262

FY 3/16A FY 3/17E FY 3/18E FY 3/19E FY 3/20E FY 3/21E

PJT Partners

16View entire presentation