Micro Focus Credit Presentation Deck

17

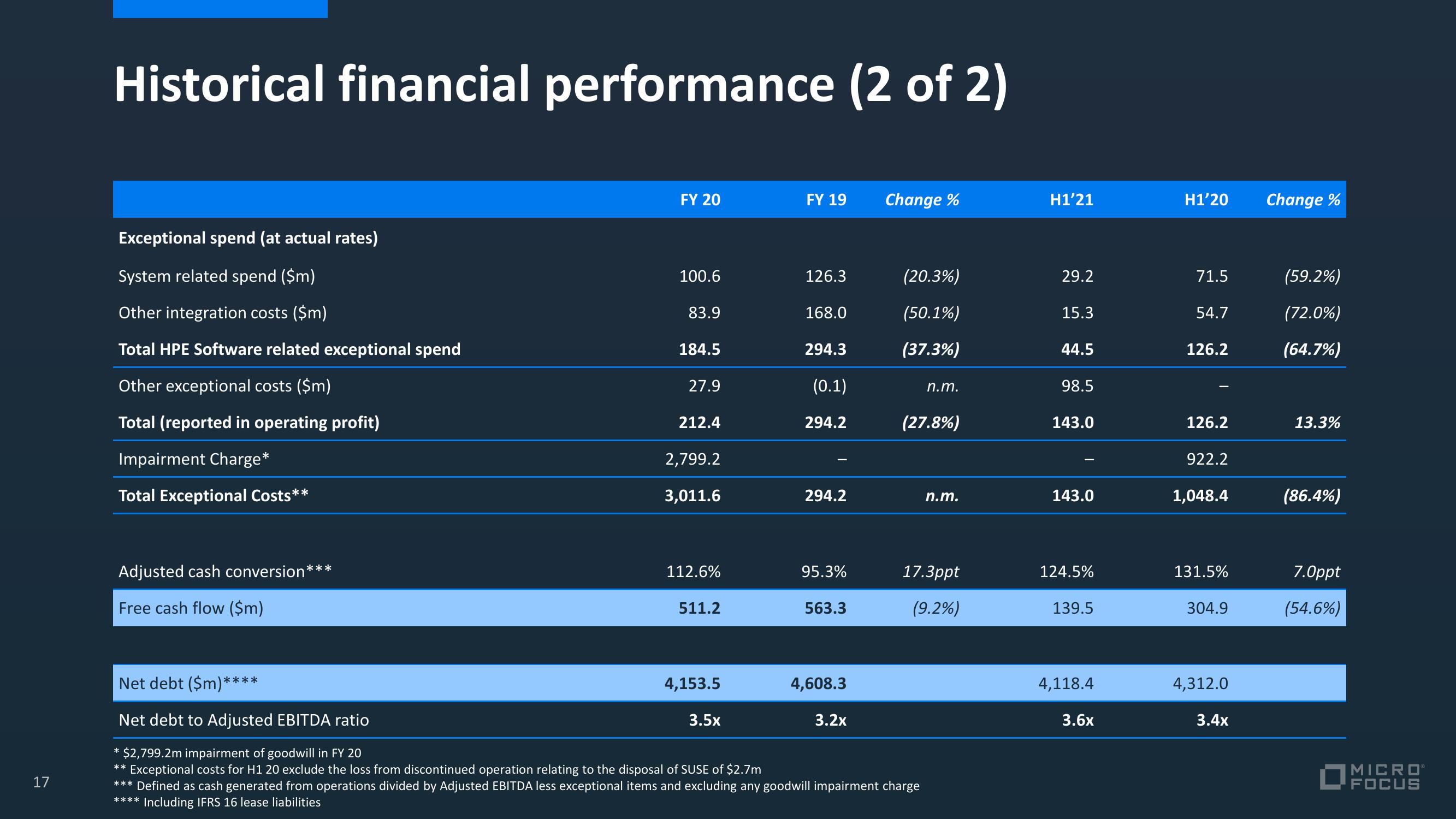

Historical financial performance (2 of 2)

Exceptional spend (at actual rates)

System related spend ($m)

Other integration costs ($m)

Total HPE Software related exceptional spend

Other exceptional costs ($m)

Total (reported in operating profit)

Impairment Charge*

Total Exceptional Costs**

Adjusted cash conversion*

Free cash flow ($m)

Net debt ($m)**

***

****

FY 20

100.6

83.9

184.5

27.9

212.4

2,799.2

3,011.6

112.6%

511.2

4,153.5

FY 19 Change %

3.5x

126.3

168.0

294.3

(0.1)

294.2

294.2

95.3%

563.3

4,608.3

3.2x

(20.3%)

(50.1%)

(37.3%)

Net debt to Adjusted EBITDA ratio

* $2,799.2m impairment of goodwill in FY 20

** Exceptional costs for H1 20 exclude the loss from discontinued operation relating to the disposal of SUSE of $2.7m

*** Defined as cash generated from operations divided by Adjusted EBITDA less exceptional items and excluding any goodwill impairment charge

**** Including IFRS 16 lease liabilities

n.m.

(27.8%)

n.m.

17.3ppt

(9.2%)

H1’21

29.2

15.3

44.5

98.5

143.0

143.0

124.5%

139.5

4,118.4

3.6x

H1’20

71.5

54.7

126.2

126.2

922.2

1,048.4

131.5%

304.9

4,312.0

3.4x

Change %

(59.2%)

(72.0%)

(64.7%)

13.3%

(86.4%)

7.Oppt

(54.6%)

MICROⓇ

FOCUSView entire presentation