Taboola Investor Presentation Deck

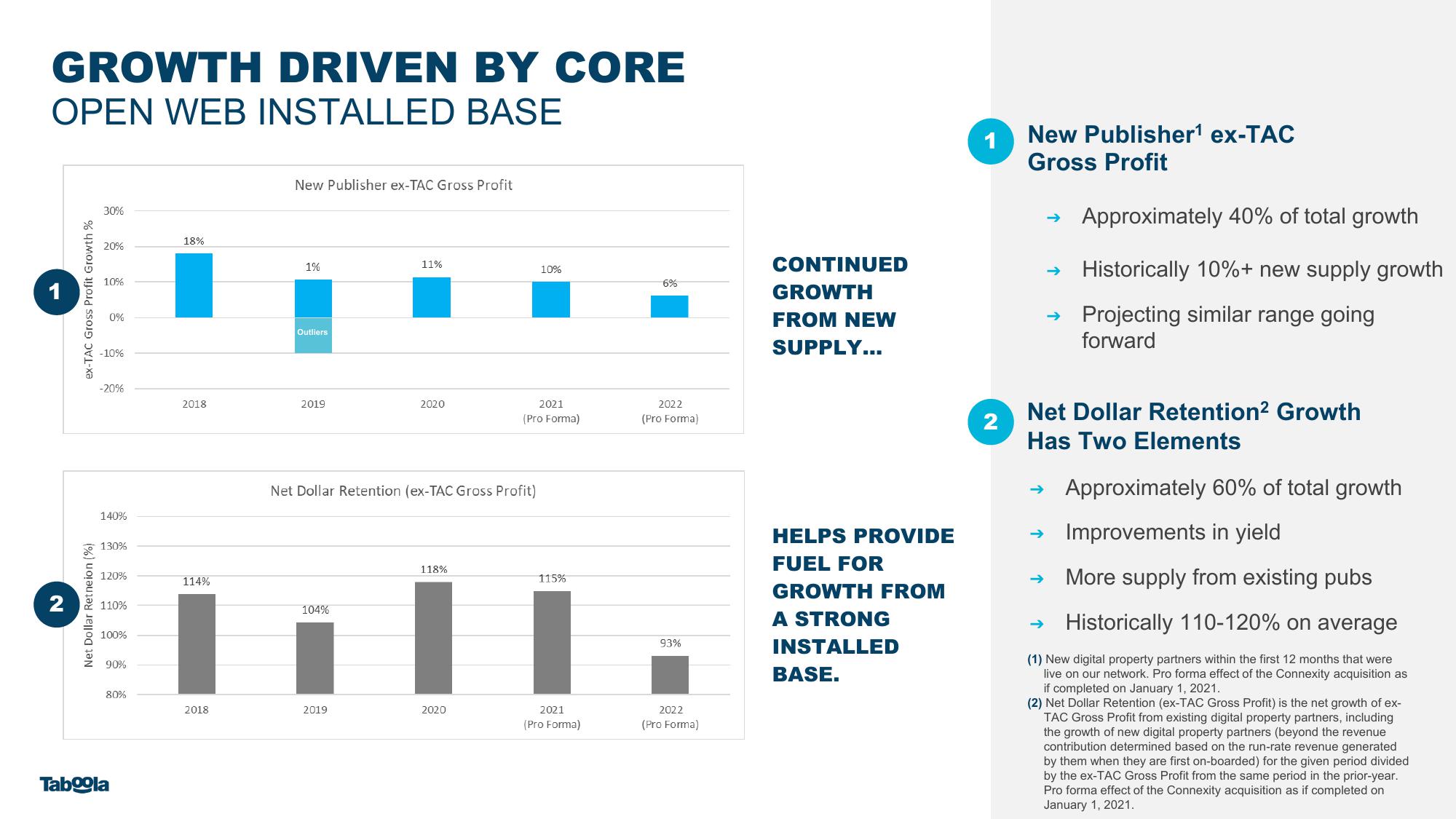

GROWTH DRIVEN BY CORE

OPEN WEB INSTALLED BASE

2

ex-TAC Gross Profit Growth %

Net Dollar Retneion (%)

30%

20%

10%

0%

-10%

-20%

140%

130%

120%

110%

100%

90%

80%

Taboola

18%

2018

114%

2018

New Publisher ex-TAC Gross Profit

1%

Outliers

2019

104%

11%

2019

2020

Net Dollar Retention (ex-TAC Gross Profit)

118%

2020

10%

2021

(Pro Forma)

115%

2021

(Pro Forma)

6%

2022

(Pro Forma)

93%

2022

(Pro Forma)

CONTINUED

GROWTH

FROM NEW

SUPPLY...

HELPS PROVIDE

FUEL FOR

GROWTH FROM

A STRONG

INSTALLED

BASE.

2

New Publisher¹ ex-TAC

Gross Profit

Approximately 40% of total growth

→ Historically 10%+ new supply growth

→ Projecting similar range going

forward

Net Dollar Retention² Growth

Has Two Elements

Approximately 60% of total growth

→ Improvements in yield

➜>> More supply from existing pubs

→ Historically 110-120% on average

(1) New digital property partners within the first 12 months that were

live on our network. Pro forma effect of the Connexity acquisition as

if completed on January 1, 2021.

(2) Net Dollar Retention (ex-TAC Gross Profit) is the net growth of ex-

TAC Gross Profit from existing digital property partners, including

the growth of new digital property partners (beyond the revenue

contribution determined based on the run-rate revenue generated

by them when they are first on-boarded) for the given period divided

by the ex-TAC Gross Profit from the same period in the prior-year.

Pro forma effect of the Connexity acquisition as if completed on

January 1, 2021.View entire presentation