Baird Investment Banking Pitch Book

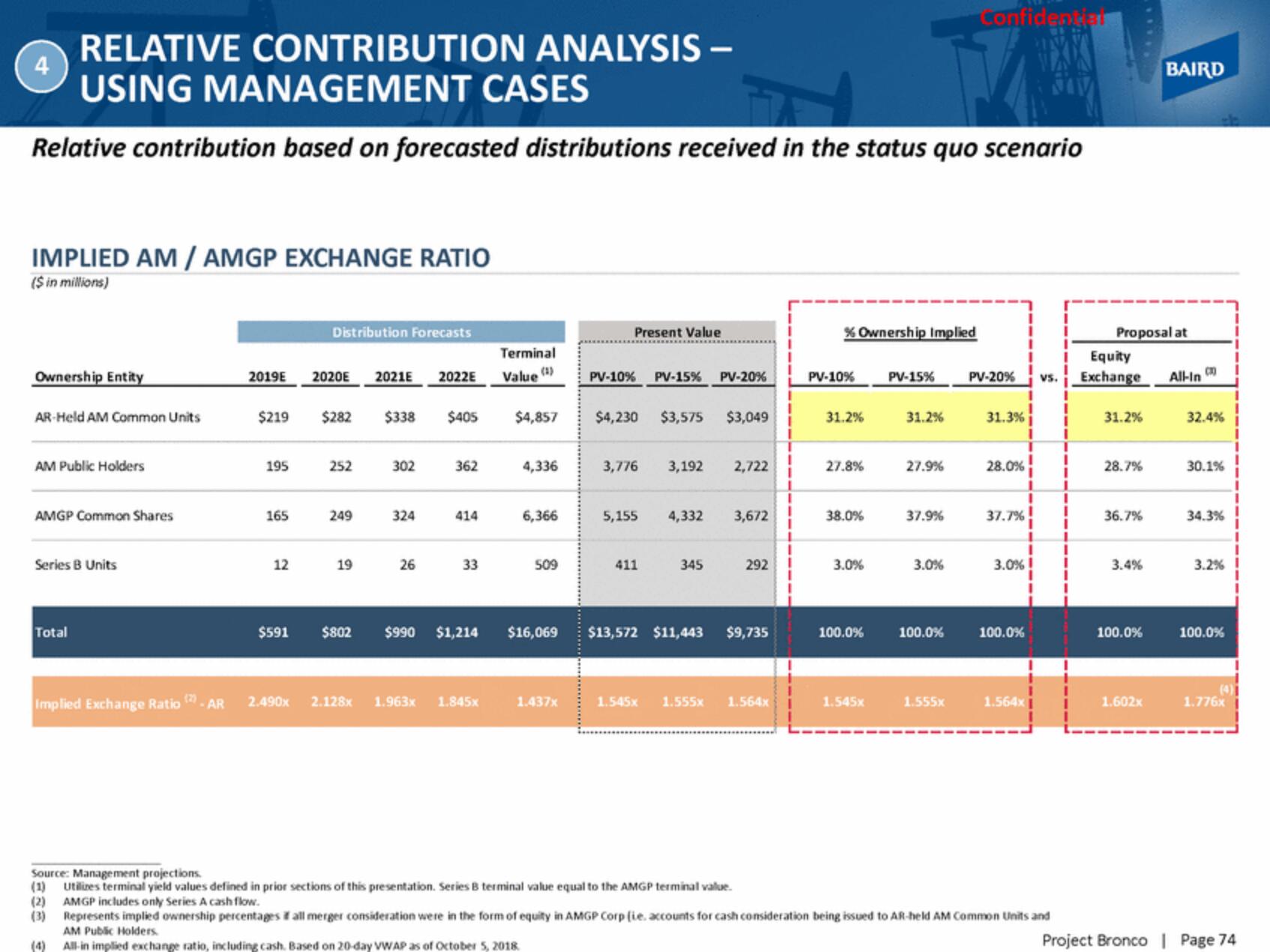

RELATIVE CONTRIBUTION ANALYSIS -

USING MANAGEMENT CASES

Relative contribution based on forecasted distributions received in the status quo scenario

4

IMPLIED AM / AMGP EXCHANGE RATIO

($ in millions)

Ownership Entity

AR-Held AM Common Units

AM Public Holders

AMGP Common Shares

Series B Units

Total

2019E

$219

(4)

195

165

12

$591

Distribution Forecasts

2020E 2021E 2022E

$282 $338 $405

252

249

19

Implied Exchange Ratio - AR 2.490x 2.128x

302

324

26

362

414

33

$802 $990 $1,214

1.963x 1.845x

Terminal

Value (1)

$4,857

4,336

6,366

509

Present Value

1.437x

PV-10% PV-15% PV-20%

$4,230 $3,575 $3,049

3,776 3,192 2,722

5,155 4,332

411

345

3,672

292

$16,069 $13,572 $11,443 $9,735

1.545x 1.555x 1.564x

1

% Ownership Implied

PV-10%

31.2%

27.8%

38.0%

3.0%

100.0%

1.545x

PV-15%

31.2%

27.9%

37.9%

3.0%

100.0%

Confidentiat

1.555x

31.3%

Equity

(3)

PV-20% VS. Exchange All-In

28.0%

37.7%

3.0%!

100.0%

1

1.564x

Source: Management projections.

(1) Utilizes terminal yield values defined in prior sections of this presentation. Series B terminal value equal to the AMGP terminal value.

(2) AMGP includes only Series A cash flow.

(3)

Represents implied ownership percentages all merger consideration were in the form of equity in AMGP Corp (ie. accounts for cash consideration being issued to AR-held AM Common Units and

AM Public Holders.

All-in implied exchange ratio, including cash. Based on 20-day VWAP as of October 5, 2018

Proposal at

31.2%

28.7%

36.7%

3.4%

BAIRD

100.0%

1.602x

32.4%

30.1%

34.3%

3.2%

100.0%

(4)

1.776x

Project Bronco | Page 74View entire presentation