Barclays Investment Banking Pitch Book

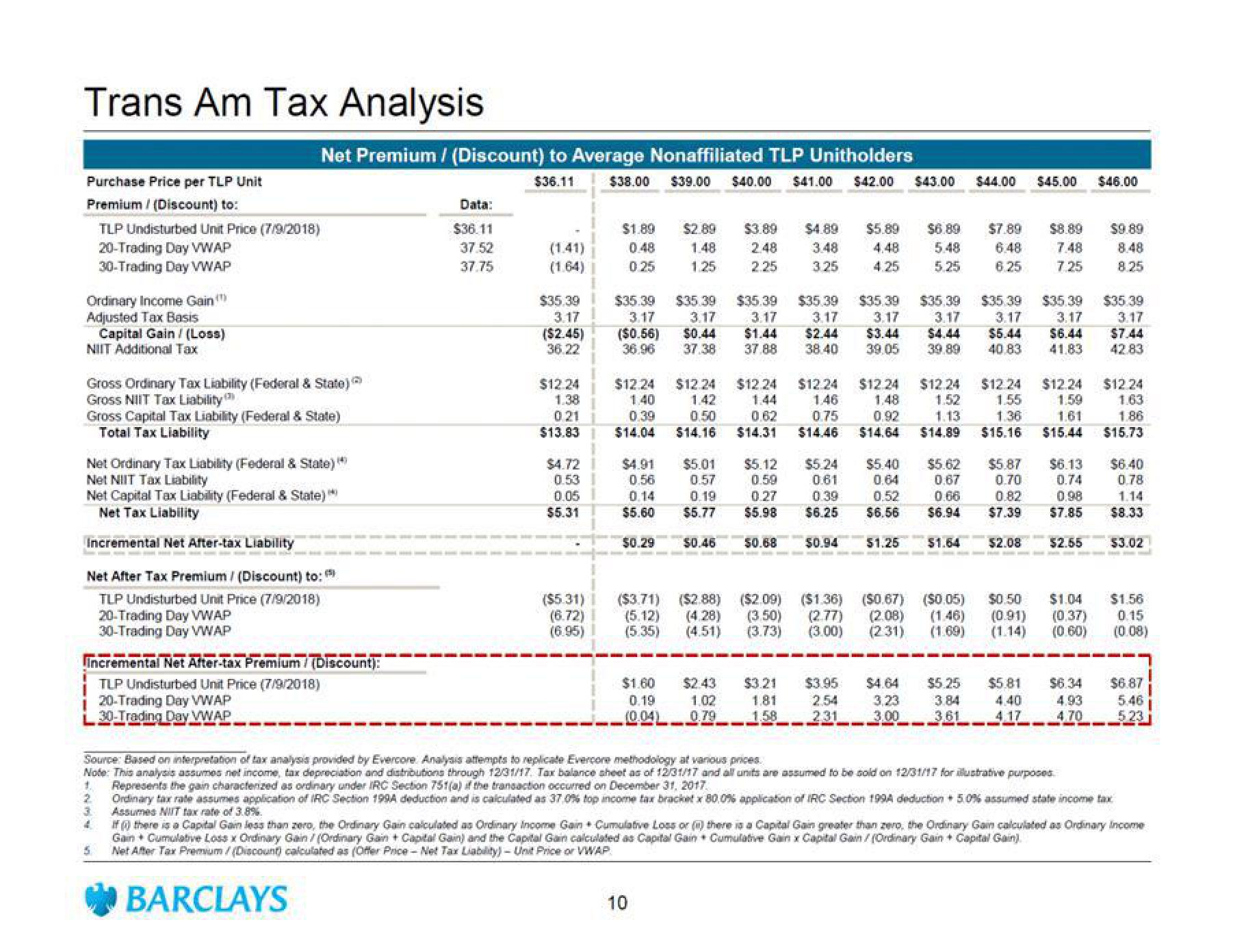

Trans Am Tax Analysis

Purchase Price per TLP Unit

Premium / (Discount) to:

TLP Undisturbed Unit Price (7/9/2018)

20-Trading Day VWAP

30-Trading Day VWAP

Ordinary Income Gain

Adjusted Tax Basis

Capital Gain/ (Loss)

NIIT Additional Tax

Gross Ordinary Tax Liability (Federal & State)

Gross NIIT Tax Liability

Gross Capital Tax Liability (Federal & State)

Total Tax Liability

Net Premium / (Discount) to Average Nonaffiliated TLP Unitholders

$36.11

Net Ordinary Tax Liability (Federal & State)"

Net NIIT Tax Liability

Net Capital Tax Liability (Federal & State) **)

Net Tax Liability

Incremental Net After-tax Liability

Net After Tax Premium / (Discount) to:

TLP Undisturbed Unit Price (7/9/2018)

20-Trading Day VWAP

30-Trading Day VWAP

incremental Net After-tax Premium / (Discount):

TLP Undisturbed Unit Price (7/9/2018)

20-Trading Day VWAP

30-Trading Day VWAP

5

Data:

$36.11

37.52

37.75

BARCLAYS

(1.41)

(1.64)

$35.39

3.17

($2.45)

36.22

$4.72

0.53

0.05

$5.31

$38.00 $39.00 $40.00 $41.00 $42.00 $43.00 $44.00 $45.00 $46.00

($5.31)

(6.72)

(6.95)

$1.80 $2.89

0.48 1.48

0.25 1.25

$35.39

3.17

($0.56)

36.96

$4.91

0.56

0.14

$5.60

$0.29

$3.89 $4.89

2.48 3.48

2.25 3.25

$35.39 $35.39 $35.39

3.17 3.17

$0.44 $1.44

37.38 37.88

$12.24

$12,24 $12.24 $12.24 $12.24 $12.24 $12,24 $12.24 $12.24

1.38

1.40 1.42

1.46 1.48 1.52 1.55 1.59

021

0.39 0.50

0.75 0.92 1.13 1.36

$13.83 1 $14.04 $14.16

$14.64 $14.89 $15.16

$14.31 $14.46

$5.01 $5.12

0.57

0.59

0.19

0.27

$5.77 $5.98

$0.46 $0.68

$1.60 $2.43

0.19 1.02

(0.04) 0.79

10

$5.89 $6.89 $7.89

4.48 5.48

4.25 5.25

6.48

6.25

$35.39 $35.39

3.17 3.1

3.17

$2.44 $3.44 $4.44

38.40 39.05 39.89

$3.21

1.81

1.58

$5.24

$5.40 $5.62

0.64

0.67

$5.87

0.70

0.61

0.39

0.52

0.66

0.82

$6.25 $6.56

$6.94

$7.39

$1.64 $2.08

$0.94 $1.25

$3.95

254

231

$35.39 $35.39

3.17

$5.44

40.83

3.17

$6.44

41.83

7.48

7.25

($3.71) ($2.88) ($2.09) ($1.36) ($0.67) ($0.05) $0.50 $1.04

(5.12) (4.28) (3.50) (2.77) (2.08) (1.46) (0.91) (0.37)

(5.35) (4.51) (3.73) (3.00) (231) (1.69) (1.14) (0.60)

$4.64

3,23

3.00

$15.44

$6.13

0.74

0.98

$7.85

Source: Based on interpretation of tax analysis provided by Evercore Analysis attempts to replicate Evercone methodology at various prices.

Note: This analysis assumes net income tax depreciation and distributions through 12/31/17. Tax balance sheet as of 12/31/17 and all units are assumed to be sold on 12/31/17 for illustrative purposes.

1. Represents the gain characterized as ordinary under IRC Section 751(a) if the transaction occurred on December 31, 2017.

$2.55

$5.25 $5.81 $6.34

3.84

4.40

4.93

3.61

4.70

$9.89

8.25

$35.39

3.17

$7.44

42.83

$12 24

1.63

1.86

$15.73

$6.40

0.78

1.14

$8.33

$3.02

2 Ordinary tax rate assumes application of IRC Section 199A deduction and is calculated as 37.0% top income tax bracket x 80.0% application of IRC Section 1994 deduction+ 5.0% assumed state income tax

3 Assumes NIT tax rate of 3.8%.

4

If there is a Capital Gain less than zero, the Ordinary Gain calculated as Ordinary Income Gan Cumulative Loss or () there is a Capital Gain greater than zero, the Ordinary Gain calculated as Ordinary Income

Gain + Cumulative Loss x Ordinary Gain/ (Ordinary Gain + Capital Gain) and the Capital Gain calculated as Capital Gain Cumulative Gain x Capital Gain/ (Ordinary Gain + Capital Gain)

Net After Tax Premium/(Discount) calculated as (Offer Price-Net Tax Liability) - Unit Price or VWAP

$1.56

0.15

(0.08)

$6.87

546

523View entire presentation