Embracer Group Mergers and Acquisitions Presentation Deck

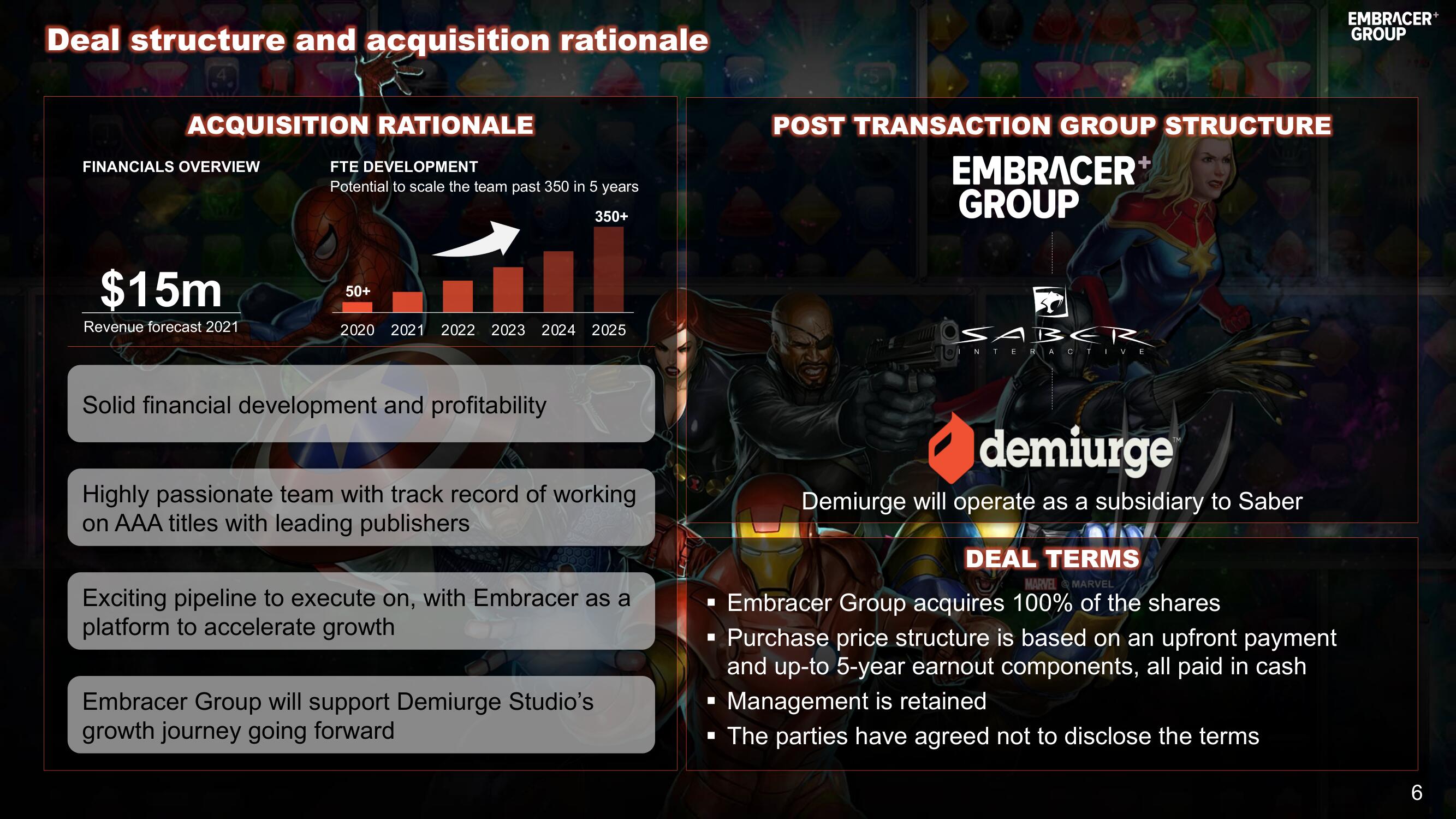

Deal structure and acquisition rationale

ACQUISITION RATIONALE

FINANCIALS OVERVIEW

$15m

Revenue forecast 2021

FTE DEVELOPMENT

Potential to scale the team past 350 in 5 years

350+

I

2020 2021 2022 2023 2024 2025

50+

Solid financial development and profitability

Highly passionate team with track record of working

on AAA titles with leading publishers

Exciting pipeline to execute on, with Embracer as a

platform to accelerate growth

Embracer Group will support Demiurge Studio's

growth journey going forward

B

■

POST TRANSACTION GROUP STRUCTURE

■

EMBRACER

GROUP

s

BER

INTERACTIVE

demiurge

Demiurge will operate as a subsidiary to Saber

Purchase price structure is based on an upfront payment

and up-to 5-year earnout components, all paid in cash

Management is retained

▪ The parties have agreed not to disclose the terms

DEAL TERMS

MARVEL MARVEL

Embracer Group acquires 100% of the shares

EMBRACER+

GROUP

6View entire presentation