REE SPAC Presentation Deck

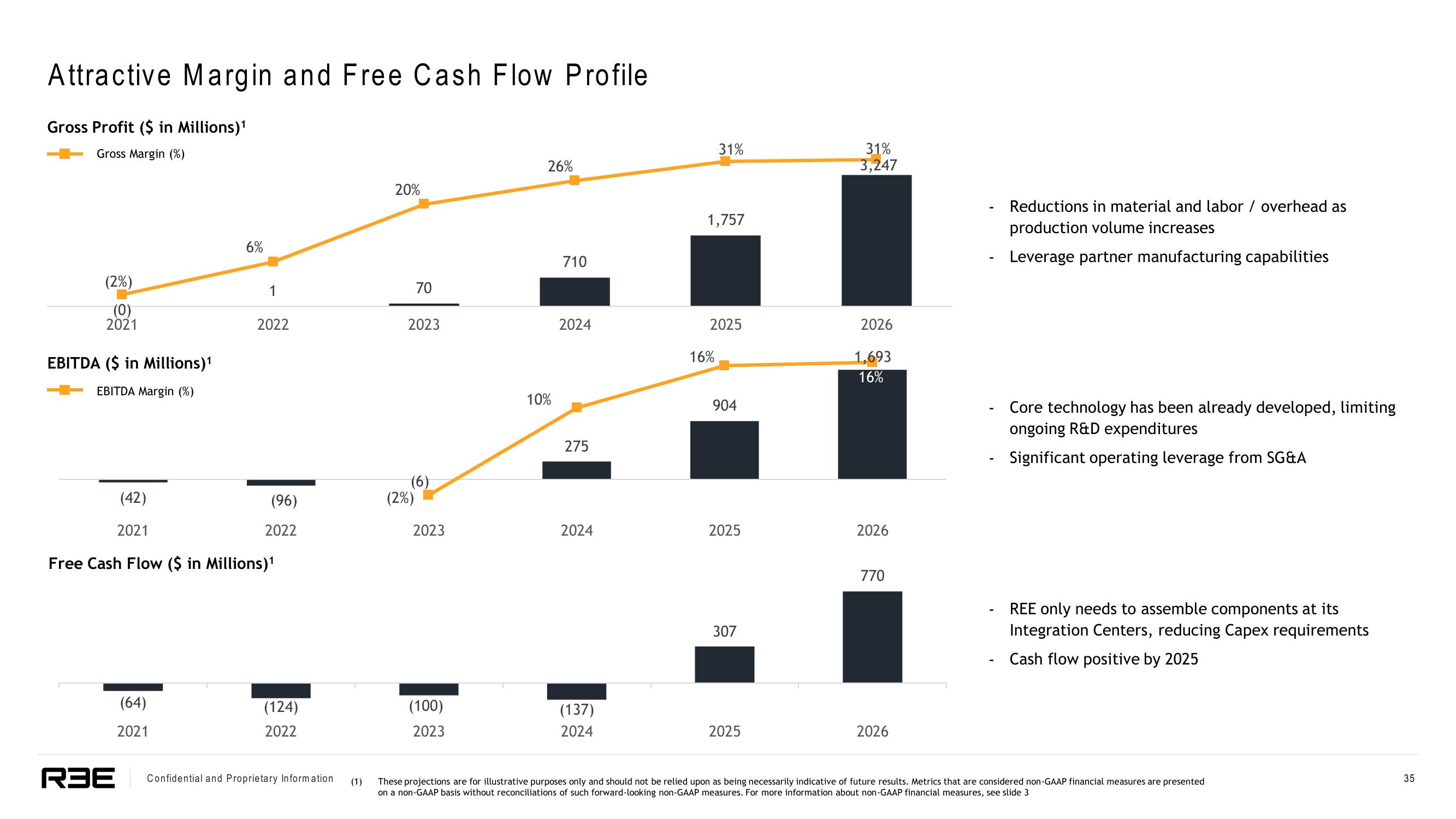

Attractive Margin and Free Cash Flow Profile

Gross Profit ($ in Millions)¹

Gross Margin (%)

(2%)

(0)

2021

EBITDA ($ in Millions) ¹

EBITDA Margin (%)

6%

(64)

2021

2022

(42)

2021

Free Cash Flow ($ in Millions) ¹

(96)

2022

(124)

2022

RBE Confidential and Proprietary Information

(1)

20%

70

2023

(6)

(2%)

2023

(100)

2023

26%

10%

710

2024

275

2024

(137)

2024

31%

1,757

2025

16%

904

2025

307

2025

31%

3,247

2026

1,693

16%

2026

770

2026

Reductions in material and labor / overhead as

production volume increases

Leverage partner manufacturing capabilities

Core technology has been already developed, limiting

ongoing R&D expenditures

Significant operating leverage from SG&A

REE only needs to assemble components at its

Integration Centers, reducing Capex requirements

Cash flow positive by 2025

These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Metrics that are considered non-GAAP financial measures are presented

on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures. For more information about non-GAAP financial measures, see slide 3

35View entire presentation