WeWork Investor Presentation Deck

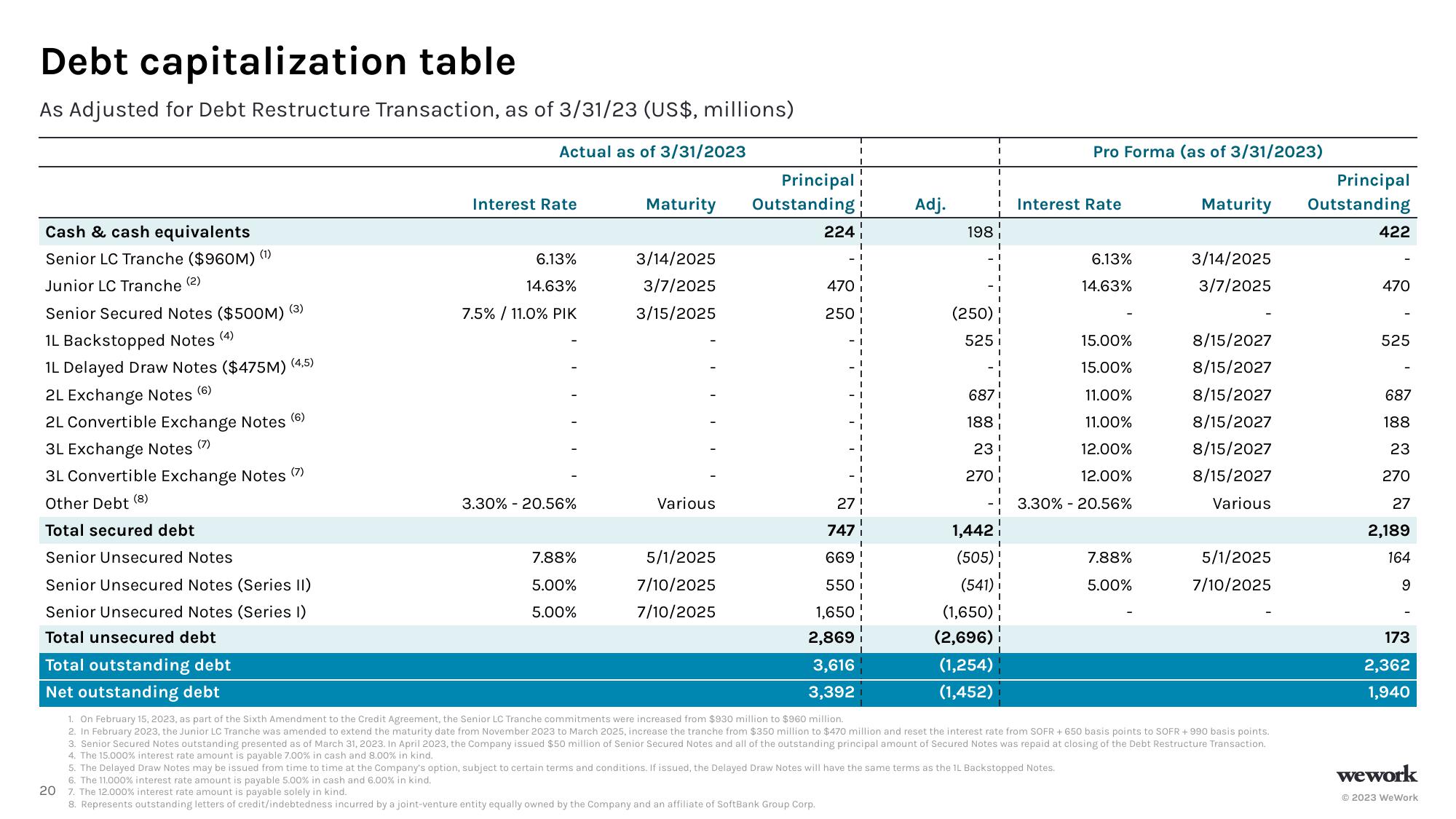

Debt capitalization table

As Adjusted for Debt Restructure Transaction, as of 3/31/23 (US$, millions)

Actual as of 3/31/2023

Cash & cash equivalents

Senior LC Tranche ($960M)

Junior LC Tranche (2)

Senior Secured Notes ($500M) (3)

1L Backstopped Notes (4)

1L Delayed Draw Notes ($475M) (4,5)

(1)

2L Exchange Notes (6)

2L Convertible Exchange Notes (6)

(7)

3L Exchange Notes

3L Convertible Exchange Notes (7)

Other Debt (8)

Total secured debt

Senior Unsecured Notes

Senior Unsecured Notes (Series II)

Senior Unsecured Notes (Series 1)

Total unsecured debt

Total outstanding debt

Net outstanding debt

Interest Rate

6.13%

14.63%

7.5% / 11.0% PIK

3.30% 20.56%

7.88%

5.00%

5.00%

Maturity

3/14/2025

3/7/2025

3/15/2025

Various

5/1/2025

7/10/2025

7/10/2025

Principal

Outstanding

224

470

250!

27

747 i

669

550

1,650

2,869 i

3,616

3,392

Adj.

198

(250)

525

687

188

23

270

1,442

(505)

(541)

(1,650)

(2,696)

(1,254)

(1,452)

Pro Forma (as of 3/31/2023)

Interest Rate

6.13%

14.63%

15.00%

15.00%

11.00%

11.00%

12.00%

12.00%

3.30% 20.56%

7.88%

5.00%

Principal

Maturity Outstanding

3/14/2025

3/7/2025

8/15/2027

8/15/2027

8/15/2027

8/15/2027

8/15/2027

8/15/2027

Various

5/1/2025

7/10/2025

1. On February 15, 2023, as part of the Sixth Amendment to the Credit Agreement, the Senior LC Tranche commitments were increased from $930 million to $960 million.

2. In February 2023, the Junior LC Tranche was amended to extend the maturity date from November 2023 to March 2025, increase the tranche from $350 million to $470 million and reset the interest rate from SOFR + 650 basis points to SOFR +990 basis points.

3. Senior Secured Notes outstanding presented as of March 31, 2023. In April 2023, the Company issued $50 million of Senior Secured Notes and all of the outstanding principal amount of Secured Notes was repaid at closing of the Debt Restructure Transaction..

4. The 15.000% interest rate amount is payable 7.00% in cash and 8.00% in kind.

5. The Delayed Draw Notes may be issued from time to time at the Company's option, subject to certain terms and conditions. If issued, the Delayed Draw Notes will have the same terms as the 1L Backstopped Notes.

6. The 11.000% interest rate amount is payable 5.00% in cash and 6.00% in kind.

20

7. The 12.000% interest rate amount is payable solely in kind.

8. Represents outstanding letters of credit/indebtedness incurred by a joint-venture entity equally owned by the Company and an affiliate of SoftBank Group Corp.

422

470

525

687

188

23

270

27

2,189

164

9

173

2,362

1,940

wework

© 2023 WeWorkView entire presentation