AngloAmerican Results Presentation Deck

QUELLAVECO ACCOUNTING

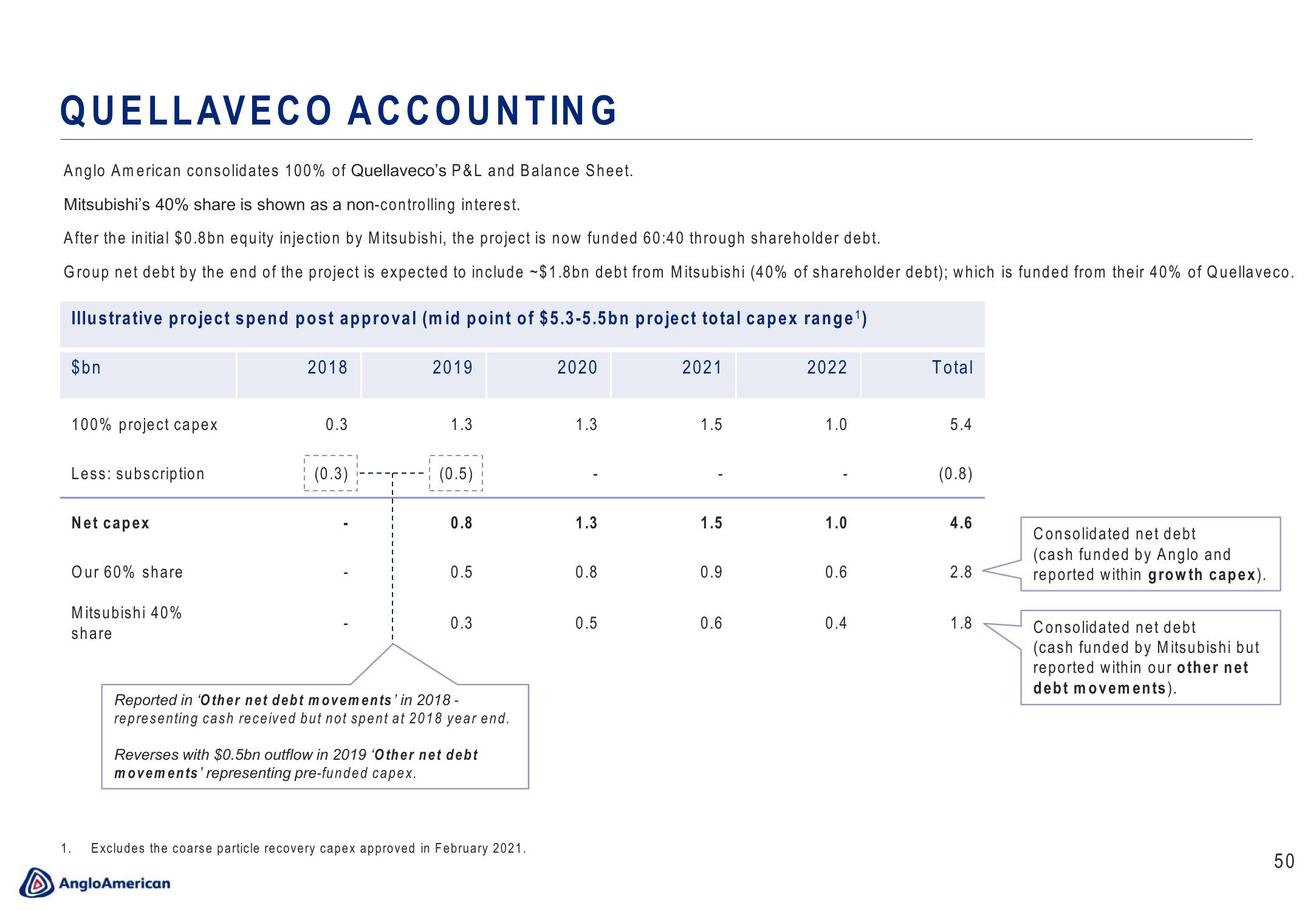

Anglo American consolidates 100% of Quellaveco's P&L and Balance Sheet.

Mitsubishi's 40% share is shown as a non-controlling interest.

After the initial $0.8bn equity injection by Mitsubishi, the project is now funded 60:40 through shareholder debt.

Group net debt by the end of the project is expected to include ~$1.8bn debt from Mitsubishi (40% of shareholder debt); which is funded from their 40% of Quellaveco.

Illustrative project spend post approval (mid point of $5.3-5.5bn project total capex range¹)

$bn

100% project capex

Less: subscription

1.

Net capex

Our 60% share

Mitsubishi 40%

share

2018

0.3

(0.3)

2019

1.3

(0.5)

0.8

0.5

0.3

Reported in 'Other net debt movements' in 2018 -

representing cash received but not spent at 2018 year end.

Reverses with $0.5bn outflow in 2019 'Other net debt

movements' representing pre-funded capex.

Excludes the coarse particle recovery capex approved in February 2021.

Anglo American

2020

1.3

1.3

0.8

0.5

2021

1.5

1.5

0.9

0.6

2022

1.0

1.0

0.6

0.4

Total

5.4

(0.8)

4.6

2.8

1.8

Consolidated net debt

(cash funded by Anglo and

reported within growth capex).

Consolidated net debt

(cash funded by Mitsubishi but

reported within our other net

debt movements).

50View entire presentation