Kinnevik Results Presentation Deck

Intro

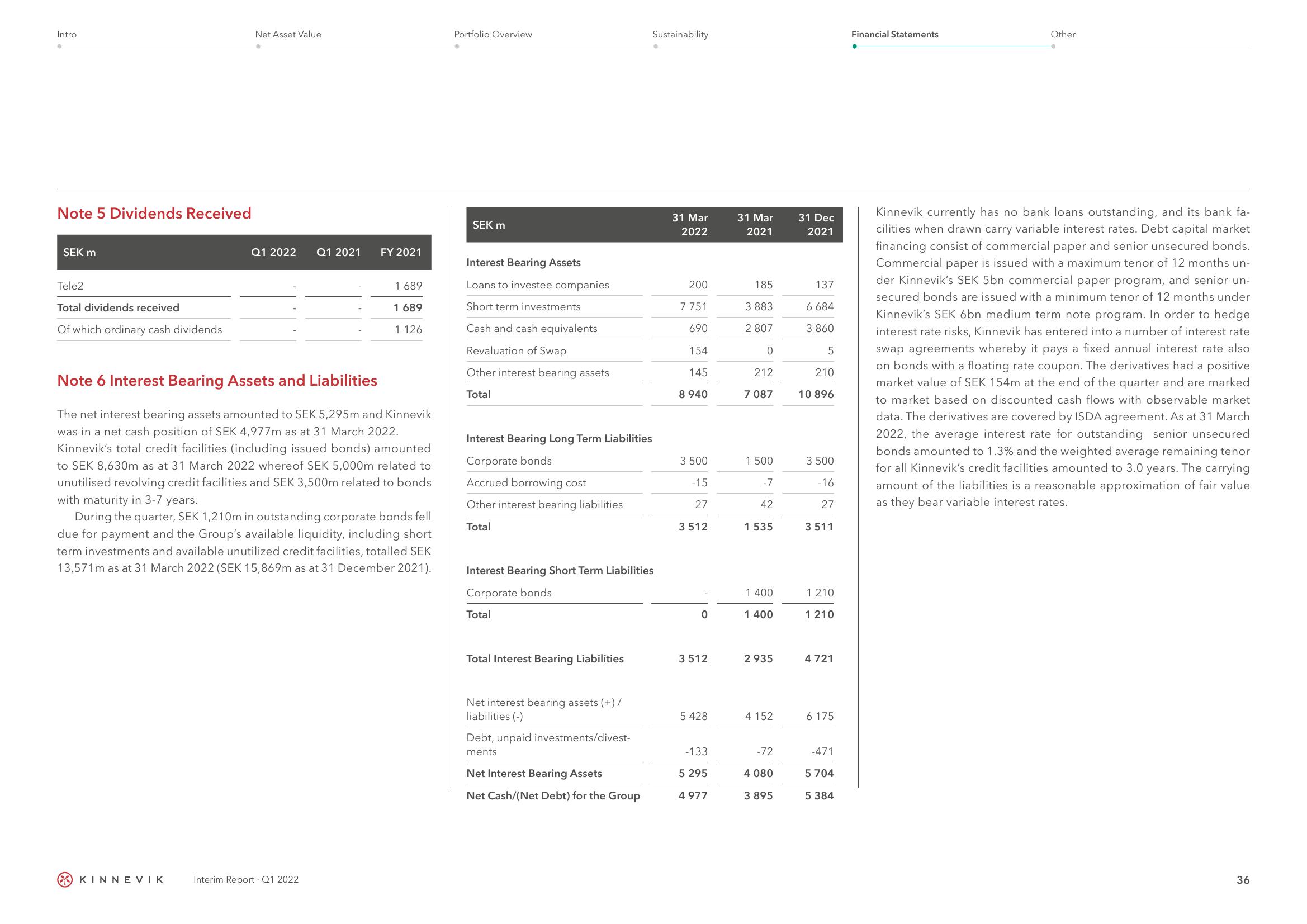

Note 5 Dividends Received

SEK m

Tele2

Total dividends received

Of which ordinary cash dividends

Net Asset Value

KINNEVIK

Q1 2022 Q1 2021

FY 2021

Note 6 Interest Bearing Assets and Liabilities

The net interest bearing assets amounted to SEK 5,295m and Kinnevik

was in a net cash position of SEK 4,977m as at 31 March 2022.

Kinnevik's total credit facilities (including issued bonds) amounted

to SEK 8,630m as at 31 March 2022 whereof SEK 5,000m related to

unutilised revolving credit facilities and SEK 3,500m related to bonds

with maturity in 3-7 years.

During the quarter, SEK 1,210m in outstanding corporate bonds fell

due for payment and the Group's available liquidity, including short

term investments and available unutilized credit facilities, totalled SEK

13,571m as at 31 March 2022 (SEK 15,869m as at 31 December 2021).

Interim Report Q1 2022

1 689

1 689

1 126

Portfolio Overview

SEK m

Interest Bearing Assets

Loans to investee companies

Short term investments

Cash and cash equivalents

Revaluation of Swap

Other interest bearing assets

Total

Interest Bearing Long Term Liabilities

Corporate bonds

Accrued borrowing cost

Other interest bearing liabilities

Total

Interest Bearing Short Term Liabilities

Corporate bonds

Total

Total Interest Bearing Liabilities

Net interest bearing assets (+)/

liabilities (-)

Sustainability

Debt, unpaid investments/divest-

ments

Net Interest Bearing Assets

Net Cash/(Net Debt) for the Group

31 Mar

2022

200

7 751

690

154

145

8 940

3 500

-15

27

3 512

0

3 512

5 428

-133

5 295

4 977

31 Mar

2021

185

3 883

2 807

0

212

7 087

1 500

-7

42

1 535

1 400

1 400

2 935

4152

-72

4 080

3 895

31 Dec

2021

137

6 684

3 860

5

210

10 896

3 500

-16

27

3 511

1 210

1 210

4 721

6 175

-471

5 704

5 384

Financial Statements

Other

Kinnevik currently has no bank loans outstanding, and its bank fa-

cilities when drawn carry variable interest rates. Debt capital market

financing consist of commercial paper and senior unsecured bonds.

Commercial paper is issued with a maximum tenor of 12 months un-

der Kinnevik's SEK 5bn commercial paper program, and senior un-

secured bonds are issued with a minimum tenor of 12 months under

Kinnevik's SEK 6bn medium term note program. In order to hedge

interest rate risks, Kinnevik has entered into a number of interest rate

swap agreements whereby it pays a fixed annual interest rate also

on bonds with a floating rate coupon. The derivatives had a positive

market value of SEK 154m at the end of the quarter and are marked

to market based on discounted cash flows with observable market

data. The derivatives are covered by ISDA agreement. As at 31 March

2022, the average interest rate for outstanding senior unsecured

bonds amounted to 1.3% and the weighted average remaining tenor

for all Kinnevik's credit facilities amounted to 3.0 years. The carrying

amount of the liabilities is a reasonable approximation of fair value

as they bear variable interest rates.

36View entire presentation