DraftKings Investor Day Presentation Deck

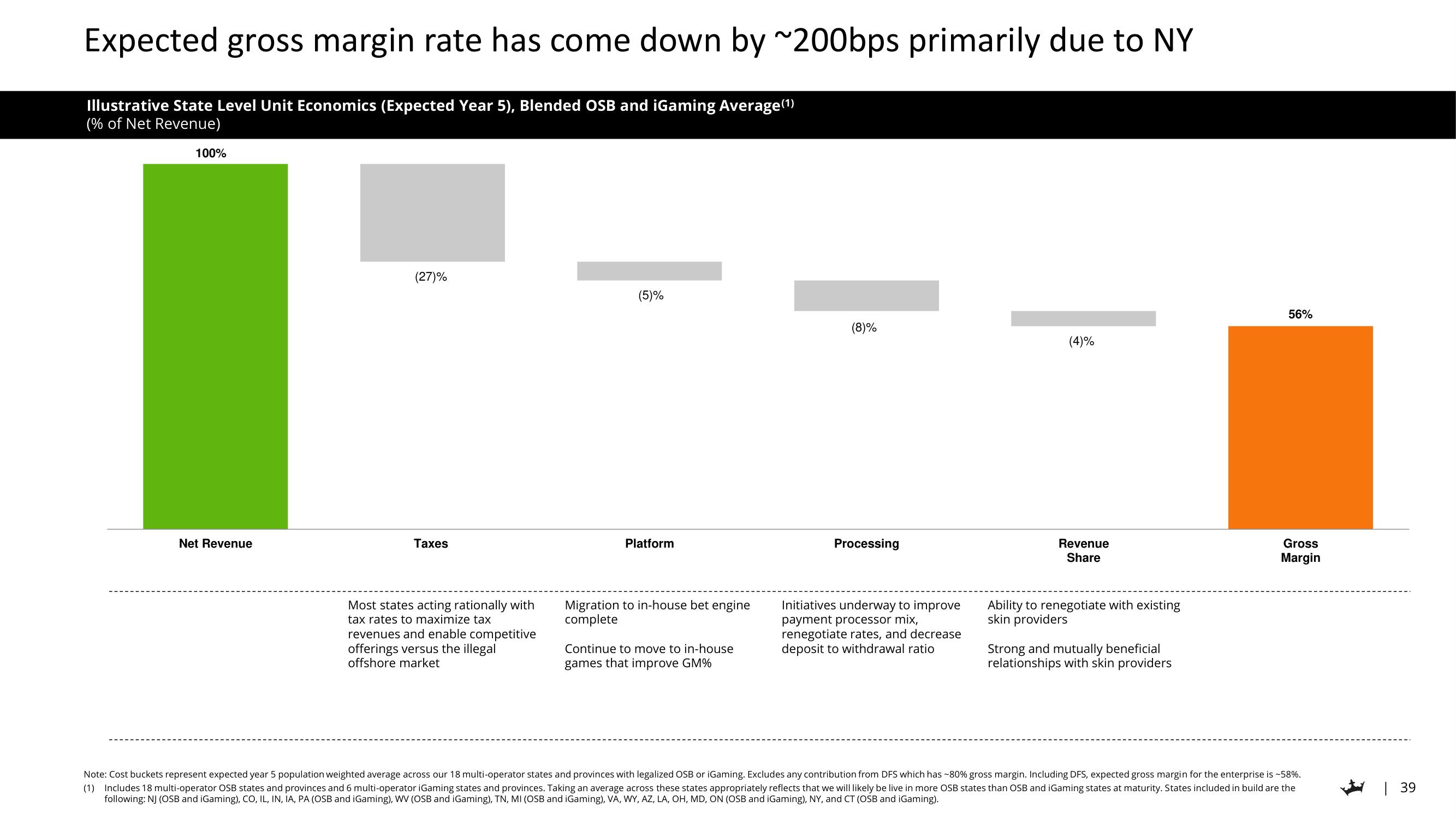

Expected gross margin rate has come down by ~200bps primarily due to NY

Illustrative State Level Unit Economics (Expected Year 5), Blended OSB and iGaming Average (1)

(% of Net Revenue)

100%

Net Revenue

(27)%

Taxes

Most states acting rationally with

tax rates to maximize tax

revenues and enable competitive

offerings versus the illegal

offshore market

(5)%

Platform

Migration to in-house bet engine

complete

Continue to move to in-house

games that improve GM%

(8)%

Processing

Initiatives underway to improve

payment processor mix,

renegotiate rates, and decrease

deposit to withdrawal ratio

(4)%

Revenue

Share

Ability to renegotiate with existing

skin providers

Strong and mutually beneficial

relationships with skin providers

56%

Gross

Margin

Note: Cost buckets represent expected year 5 population weighted average across our 18 multi-operator states and provinces with legalized OSB or iGaming. Excludes any contribution from DFS which has -80% gross margin. Including DFS, expected gross margin for the enterprise is -58%.

(1) Includes 18 multi-operator OSB states and provinces and 6 multi-operator iGaming states and provinces. Taking an average across these states appropriately reflects that we will likely be live in more OSB states than OSB and iGaming states at maturity. States included in build are the

following: NJ (OSB and iGaming), CO, IL, IN, IA, PA (OSB and iGaming), WV (OSB and iGaming), TN, MI (OSB and iGaming), VA, WY, AZ, LA, OH, MD, ON (OSB and iGaming), NY, and CT (OSB and iGaming).

| 39View entire presentation