UBS Results Presentation Deck

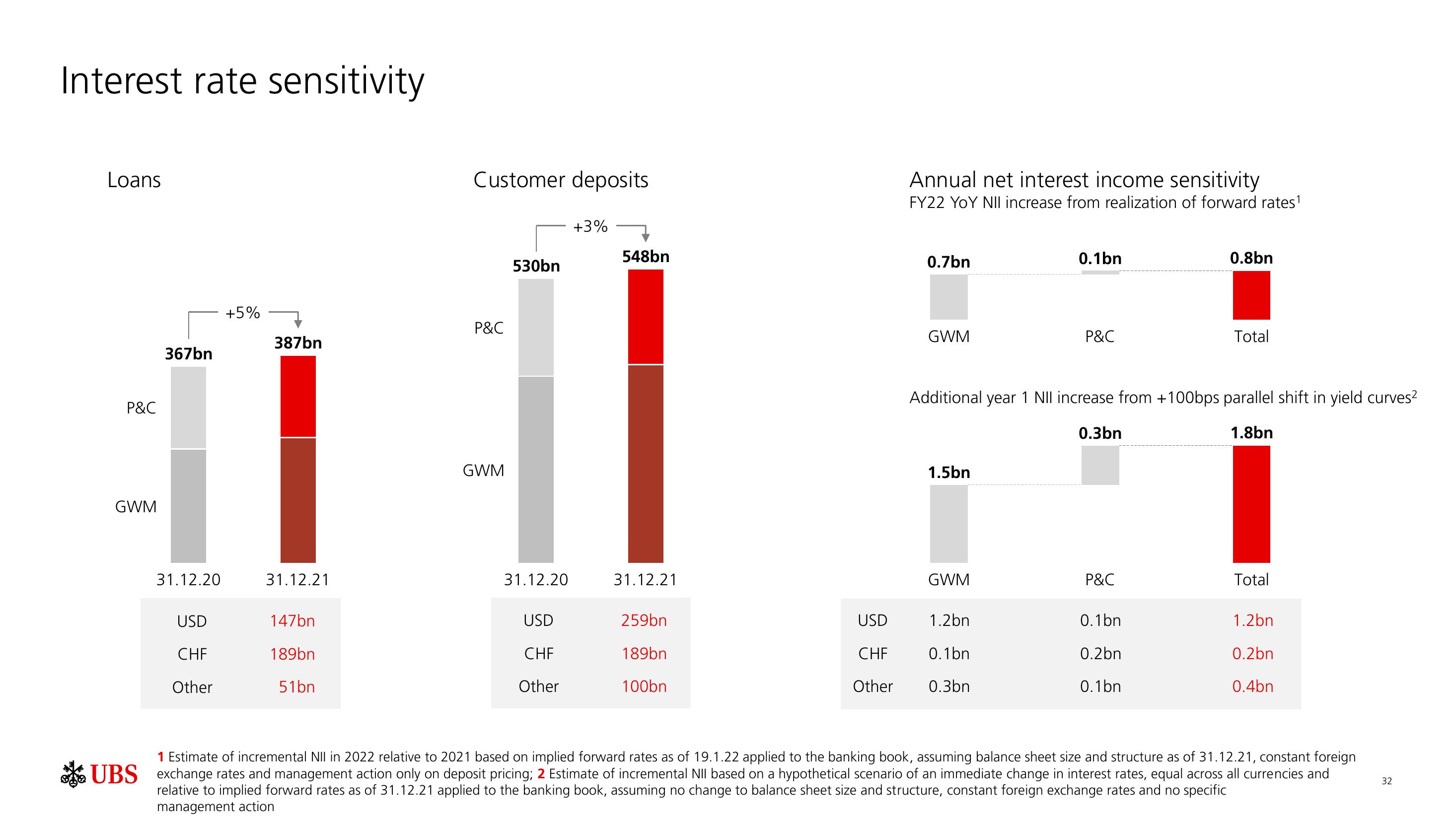

Interest rate sensitivity

Loans

P&C

GWM

367bn

31.12.20

USD

CHF

Other

+5%

387bn

31.12.21

147bn

189bn

51bn

Customer deposits

P&C

GWM

530bn

31.12.20

USD

CHF

Other

+3%

548bn

31.12.21

259bn

189bn

100bn

USD

CHF

Other

Annual net interest income sensitivity

FY22 YOY NII increase from realization of forward rates¹

0.7bn

GWM

1.5bn

GWM

0.1bn

1.2bn

0.1bn

0.3bn

P&C

Additional year 1 NII increase from +100bps parallel shift in yield curves²

0.3bn

1.8bn

P&C

0.8bn

0.1bn

0.2bn

0.1bn

Total

Total

1.2bn

0.2bn

0.4bn

1 Estimate of incremental NII in 2022 relative to 2021 based on implied forward rates as of 19.1.22 applied to the banking book, assuming balance sheet size and structure as of 31.12.21, constant foreign

UBS exchange rates and management action only on deposit pricing; 2 Estimate of incremental NII based on a hypothetical scenario of an immediate change in interest rates, equal across all currencies and

relative to implied forward rates as of 31.12.21 applied to the banking book, assuming no change to balance sheet size and structure, constant foreign exchange rates and no specific

management action

32View entire presentation