Blackwells Capital Activist Presentation Deck

BLACKWELLS IS A LEADING ACTIVIST INVESTOR¹

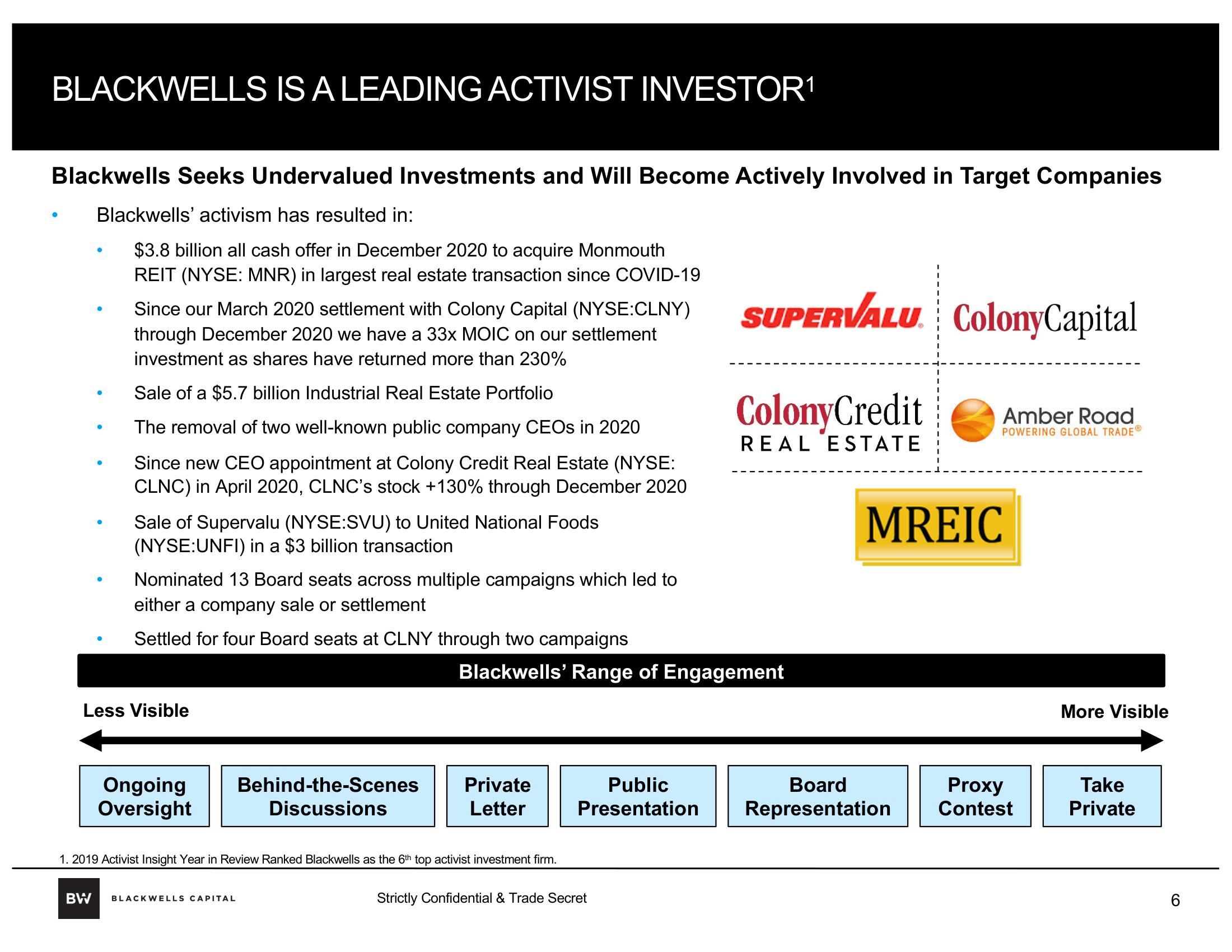

Blackwells Seeks Undervalued Investments and Will Become Actively Involved in Target Companies

Blackwells' activism has resulted in:

$3.8 billion all cash offer in December 2020 to acquire Monmouth

REIT (NYSE: MNR) in largest real estate transaction since COVID-19

Since our March 2020 settlement with Colony Capital (NYSE:CLNY)

through December 2020 we have a 33x MOIC on our settlement

investment as shares have returned more than 230%

Sale of a $5.7 billion Industrial Real Estate Portfolio

The removal of two well-known public company CEOs in 2020

Since new CEO appointment at Colony Credit Real Estate (NYSE:

CLNC) in April 2020, CLNC's stock +130% through December 2020

●

●

Sale of Supervalu (NYSE:SVU) to United National Foods

(NYSE:UNFI) in a $3 billion transaction

Nominated 13 Board seats across multiple campaigns which led to

either a company sale or settlement

Settled for four Board seats at CLNY through two campaigns

Less Visible

Ongoing

Oversight

Behind-the-Scenes

Discussions

BW BLACKWELLS CAPITAL

Private

Letter

1. 2019 Activist Insight Year in Review Ranked Blackwells as the 6th top activist investment firm.

Blackwells' Range of Engagement

Public

Presentation

SUPERVALU ColonyCapital

Strictly Confidential & Trade Secret

ColonyCredit

REAL ESTATE

Amber Road

POWERING GLOBAL TRADEⓇ

MREIC

Board

Representation

Proxy

Contest

More Visible

Take

Private

6View entire presentation