Grove SPAC Presentation Deck

1

Investing in a

Sustainable Future

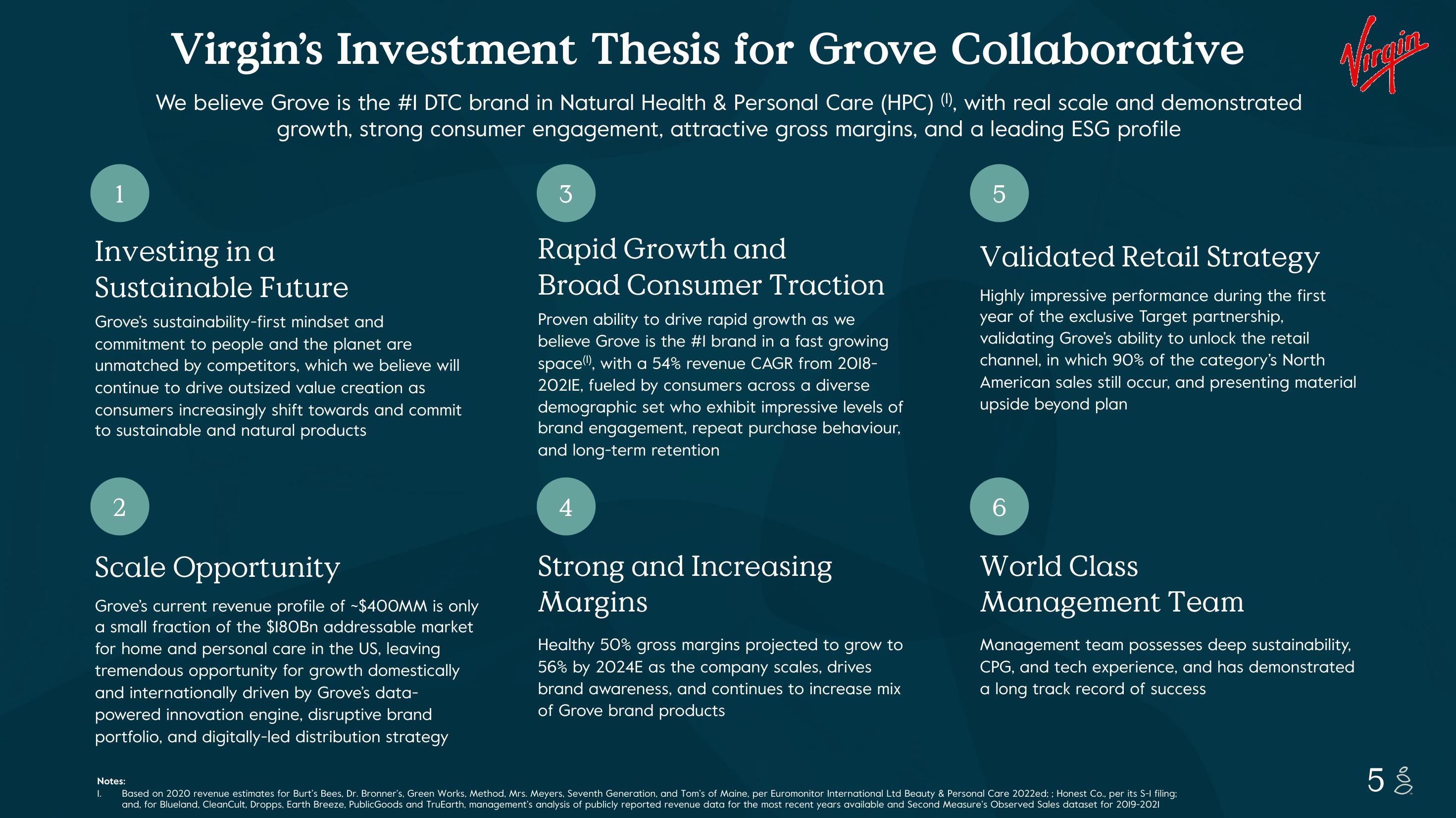

Virgin's Investment Thesis for Grove Collaborative

We believe Grove is the #1 DTC brand in Natural Health & Personal Care (HPC) (), with real scale and demonstrated

growth, strong consumer engagement, attractive gross margins, and a leading ESG profile

Grove's sustainability-first mindset and

commitment to people and the planet are

unmatched by competitors, which we believe will

continue to drive outsized value creation as

consumers increasingly shift towards and commit

to sustainable and natural products

2

Scale Opportunity

Grove's current revenue profile of ~$400MM is only

a small fraction of the $180Bn addressable market

for home and personal care in the US, leaving

tremendous opportunity for growth domestically

and internationally driven by Grove's data-

powered innovation engine, disruptive brand

portfolio, and digitally-led distribution strategy

Notes:

I.

3

Rapid Growth and

Broad Consumer Traction

Proven ability to drive rapid growth as we

believe Grove is the #1 brand in a fast growing

space), with a 54% revenue CAGR from 2018-

2021E, fueled by consumers across a diverse

demographic set who exhibit impressive levels of

brand engagement, repeat purchase behaviour,

and long-term retention

4

Strong and Increasing

Margins

Healthy 50% gross margins projected to grow to

56% by 2024E as the company scales, drives

brand awareness, and continues to increase mix

of Grove brand products

5

Validated Retail Strategy

Highly impressive performance during the first

year of the exclusive Target partnership,

validating Grove's ability to unlock the retail

channel, in which 90% of the category's North

American sales still occur, and presenting material

upside beyond plan

6

Virgin

World Class

Management Team

Management team possesses deep sustainability,

CPG, and tech experience, and has demonstrated

a long track record of success

Based on 2020 revenue estimates for Burt's Bees, Dr. Bronner's, Green Works, Method, Mrs. Meyers, Seventh Generation, and Tom's of Maine, per Euromonitor International Ltd Beauty & Personal Care 2022ed; ; Honest Co., per its S-1 filing;

and, for Blueland, CleanCult, Dropps, Earth Breeze, PublicGoods and TruEarth, management's analysis of publicly reported revenue data for the most recent years available and Second Measure's Observed Sales dataset for 2019-2021

58View entire presentation